Some experts expect a market crash after Bitcoin’s halving event. They put forward 6 reasons for this. For example, giant options on Bitcoin and Ethereum will expire on Friday. The Bitcoin historical model shows the Bitcoin price below $60,000 at the end of April. Tensions between Iran and Israel continue to escalate. And others…

Bitcoin options expiry

cryptokoin.comAs you follow from , Bitcoin halving will take place on Saturday, April 20, according to predictions. However, over $2 billion worth of Bitcoin and Ethereum options will expire on Friday. A total of 21 thousand Bitcoin options will expire with a nominal value of $ 1.35 billion. The Put-Call ratio will be 0.64 and the maximum pain point is set at $66,000. Additionally, 27,785 Ethereum options will expire with a put-call ratio of 0.49. The maximum pain point will be $3,150.

Both Bitcoin and Ethereum are trading below their maximum points. This causes high volatility in the crypto market. On April 26, 88 thousand Bitcoin options with a face value of $5.5 billion will expire. Additionally, calls are expected to be significantly higher than open interest. There is a high probability that BTC price will trade below $60,000 after Bitcoin halving. Ethereum, on the other hand, can be traded below $3,100 with 860 thousand ETH options with a nominal value of $2.6 billion. In this case, the market will gain more than $8 billion from Bitcoin and Ethereum options.

Bitcoin historical model

As Bitcoin’s halving event approached, Bitcoin and the crypto market experienced sales before the halving. Elja Boom from Forbes states that Bitcoin is trending downwards and believes this trend will continue. Boom expects sideways movements for several months.

Fed interest rate cut delay and macro uncertainty

In the USA, CPI, PPI and PCE inflation figures were high. Therefore, the Federal Reserve will likely delay interest rate cuts. Fed Chairman Jerome Powell and Vice Chairman Philip Jefferson have already signaled this. BTC price also fell with CPI data. JPMorgan and other Wall Street banks predict that high inflation will continue for some time. Moreover, analysts predict that BTC price will drop below $60,000. Markus Thielen says that the price may drop to $ 52,000 before a rally.

Increasing Iran-Israel tension

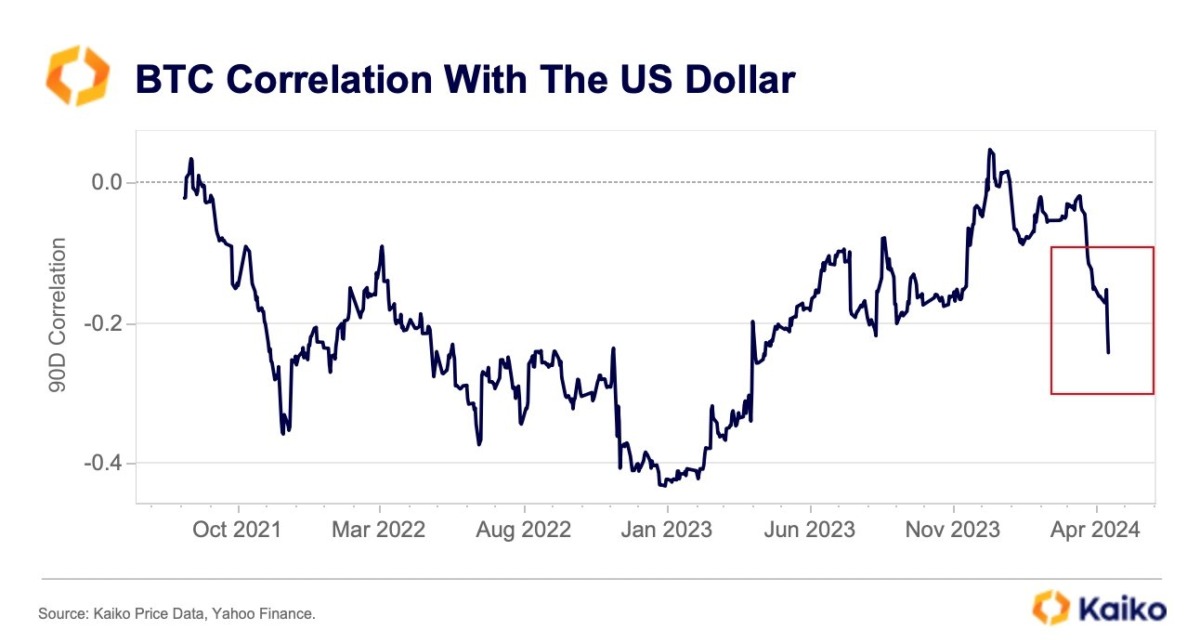

Tensions between Iran and Israel led to a loss of $500 billion in crypto liquidations. The meetings held in Israel in response to Iran’s air attack were not enough to reduce tension. These events caused the US dollar index to rise above 106, the highest level since early November. After the developments, BTC price dropped to 60 thousand dollars. According to data from Kaiko, Bitcoin’s 90-day correlation with DXY dropped to negative 0.24. Thus, it fell to its lowest level in years.

Outflows from Bitcoin ETFs continue!

Spot Bitcoin ETFs saw net outflows of $165 million on Wednesday. Thus, this week witnessed his fourth consecutive exit. Bitcoin ETF buying activity has fallen significantly over the past few days, likely due to falling institutional interest and tax filings in the US.

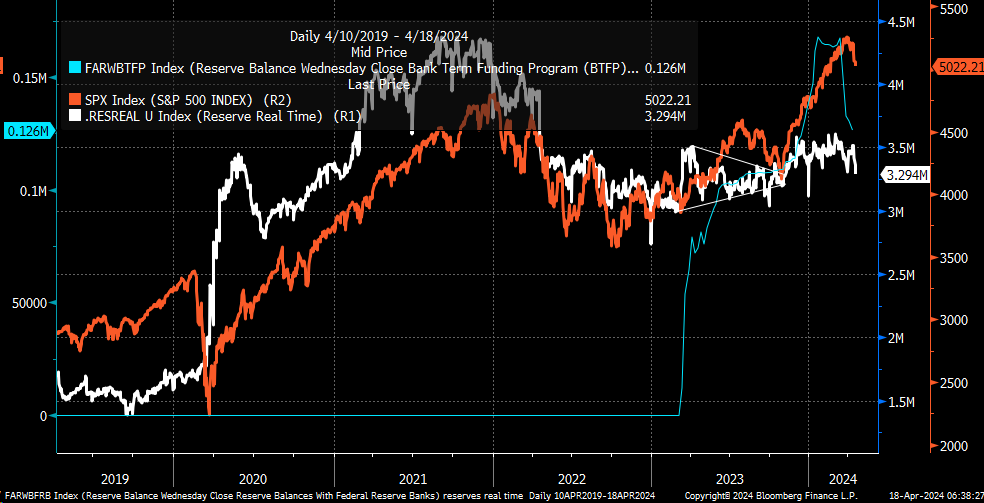

‘Bank-run’ due to BTFP ending

With NPL and BFTB falling, Treasury Reserve balances are decreasing rapidly. Without BFTP, banks are more likely to be in trouble as the Fed delays interest rate cuts. BFTP was created by the Federal Reserve as an emergency loan program to banks. With the bankruptcy of some banks in March 2023, the Fed and the Treasury Department increased BFTP support to provide support to banks. Experts state that with the suspension of BFTP, a large part of the liquidity was withdrawn.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!