The Ethereum (ETH) network has become more deflationary with the emergence of validators and increased transactions.

With The Merge update Proof of Stake (PoS) The Ethereum network, which has been transferred to the system, has started to reap its fruits in the light of the latest developments.

On-chain data platform glassnode According to data provided by , the number of validators on the network increased noticeably in October. While slowing down the issuance of Ethereum The increase in network activity is By increasing the amount of ETH burned It gave birth to a deflationary structure. Analysts predicted that if the trend continues this way, the upward wave may continue.

Especially in the past months, on the Ethereum network The Surge With the activation of the protocol validators leaving the network average per day in October and November when the road is clear. 1018 validators Exited from staking pools.

Glassnode analysts predict the increasing deflationary structure in line with these outcomes. Parallel to the rise of Ethereum price He stated that he was moving.

Data on the Ethereum network NFT And DeFi transactions in the last four months respectively. -3% And -57% Accordingly, altcoin transfers and stablecoin transactions decreased by +8.2% And +19% showed that it increased.

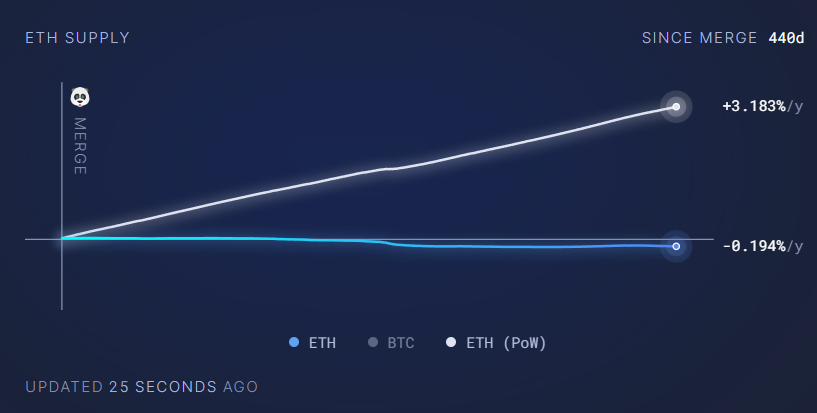

on the other hand ultrasound Money Annual inflation of Ethereum since The Merge, according to data cited by 0.194% decreased by . If the Merge transition was not made, Ethereum inflation would increase on an annual basis during this period. increased by 3.18% it would happen.