Ethereum (ETH) price is still in a position to recover around 22% and erase the losses of the last few trading days.

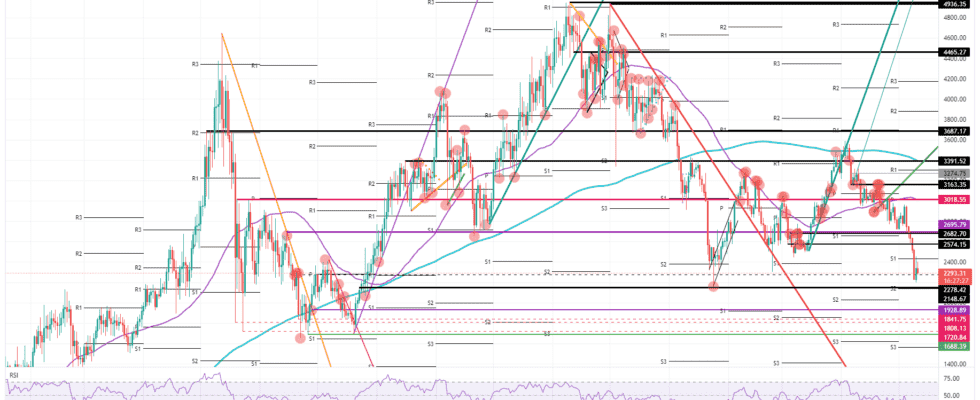

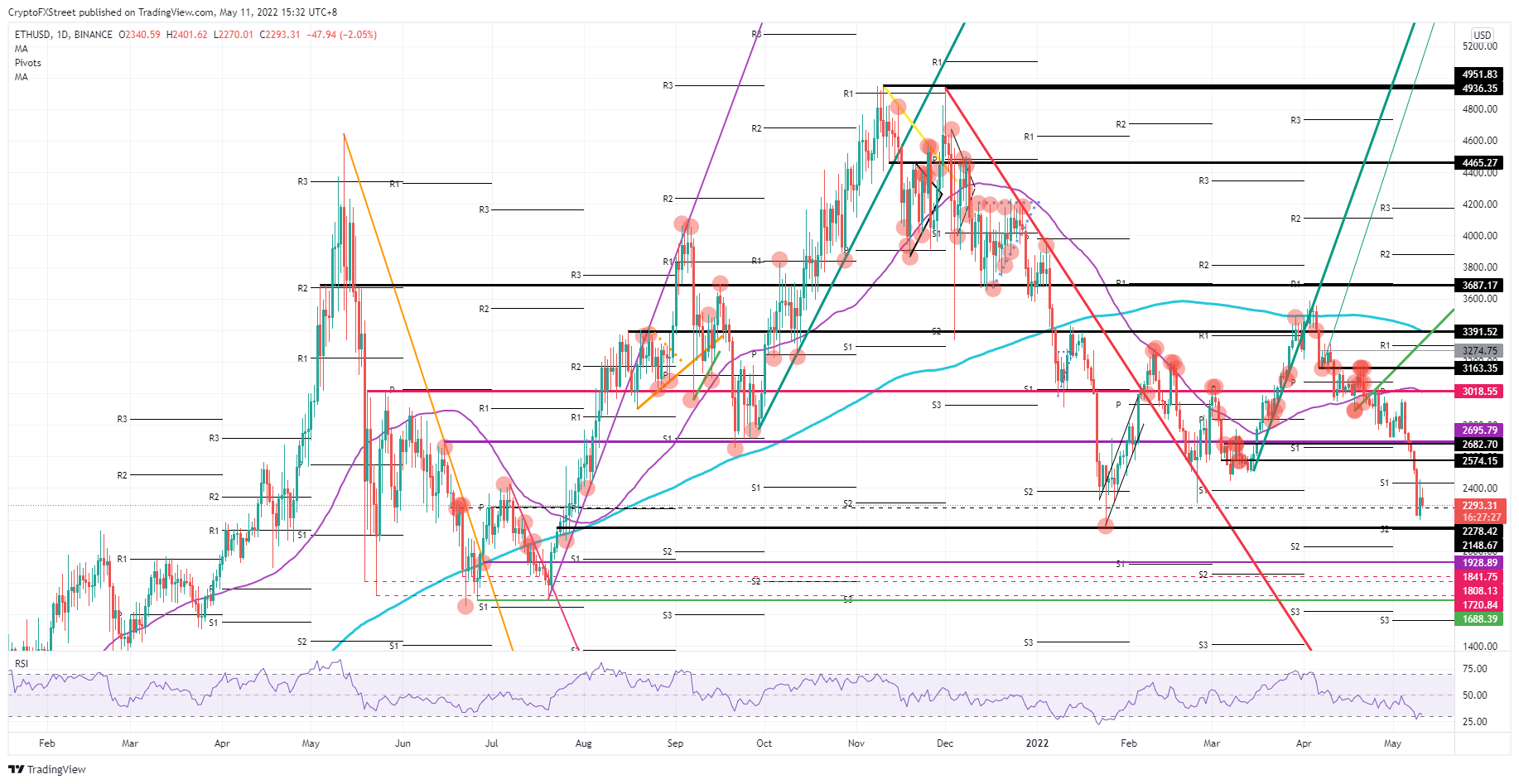

Price action during the ASIA PAC and European session this morning continued to consolidate with lower highs and higher dips as the bears and bulls squeezed together. It would be prudent to expect to see a bounce higher immediately after consolidation or with a bullish break after a minor decline and bounce back at $2,278 while the pair is at the technical bottom.

Ethereum is Backed by Dual Technical Base

Ethereum price, continues to keep investors and bulls nervous after a complete technical reversal of losses in the US trading session on Tuesday. Today, ETH price seems to be under consolidation, with lower highs and higher lows signaling a confluence of bulls and bears.

Usually, as the Relative Strength Index (RSI) is unable to recover from oversold, this means that sellers do not have a suitable downside area to gain, which could result in an expected breakout to the upside.

In light of all these developments, Ethereum price could reach $2,685 or $2,695 levels by escaping this consolidation. Another important scenario is a bearish dip to test the double fold with monthly S2 and the historical base at $2,278. A test and subsequent bounce from this level will result in price action as high as $2,695 and open the door to a rally above $2,700.

Not only the Ethereum price, but also the Euro/Dollar parity is consolidating with lower and higher drops on the fourth trading day. A downside break here would reflect more dollar strength, which would weigh heavily on Ethereum price, which eventually appreciates in dollar terms. In such a scenario, ETH price will drop below $2,278, resulting in a drop below $2,000 towards the first notable level of decline to $1,928.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.