- Ethereum (ETH) As the downward pressure in the price increases, it seems that it will be difficult to hold the $ 2000 level.

- ETH, which could not take advantage of the important opportunity as the dollar protected its value in the global market, could not start a relief rally.

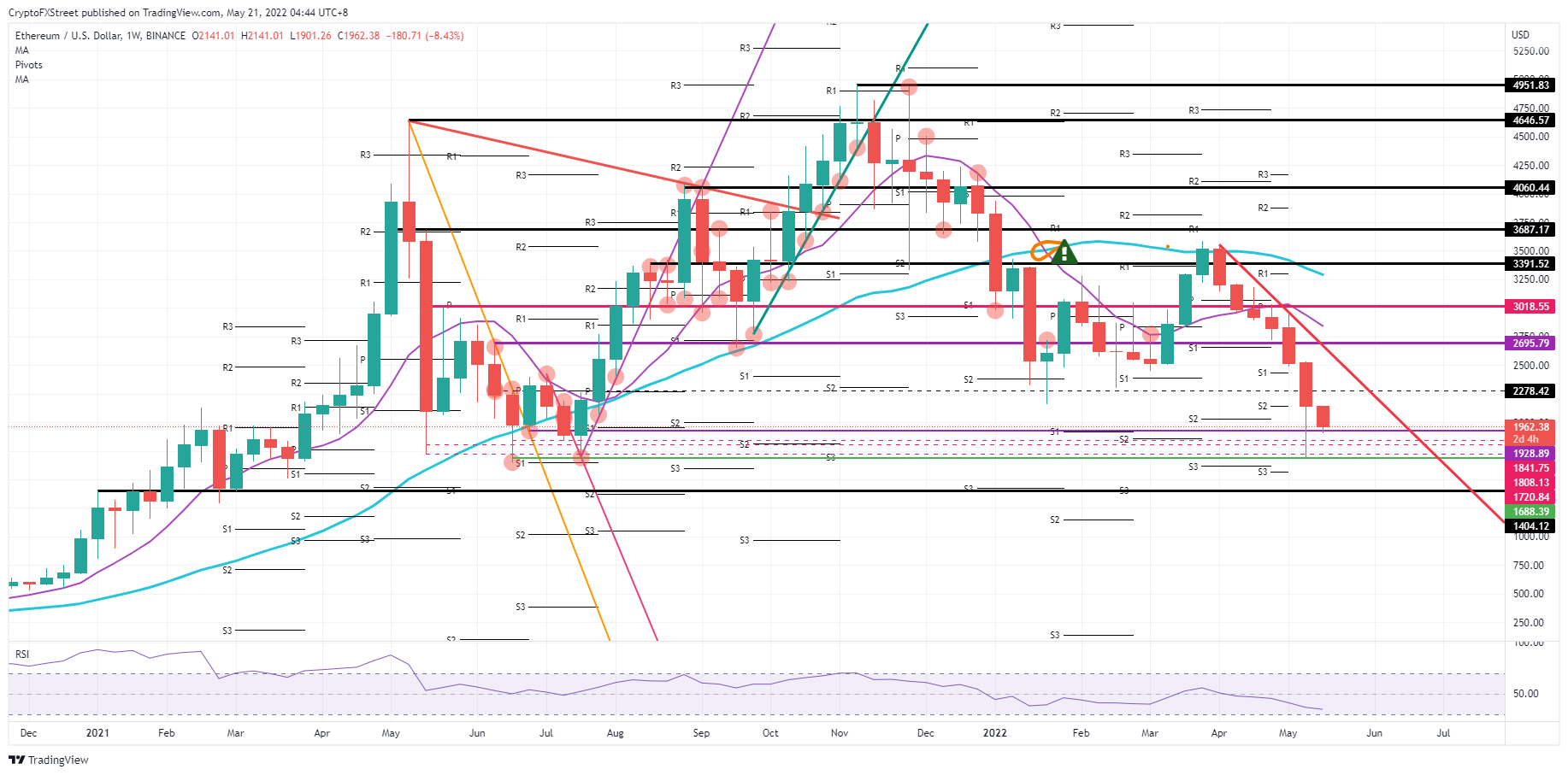

- It wouldn’t be surprising to see new dips around $1,404 in the coming weeks as the downside pressure still holds its own.

With another consecutive negative close, pressure is building for price action to close below $2,000 and there is more room to open on the downside towards $1,404.

Ethereum Price Could Drop 35%

While many different institutional funds and banks continue to issue price alerts for the top three cryptoassets, Ethereum price also joined the caravan of assets with a decline risk. ETH price is also being hit hard by the general negative in the markets around various technical pressures on the chart, making it more susceptible to amplifying a bearish bias. The current pressure on the chart seems difficult to clear at the moment and the price could drop 35% as a result of the pressure.

ETH price is under scrutiny of several factors to consider before the markets can start focusing on a reversal and uptrend. First of all, the death cross represents an important sentiment indicator pushing ETH price from $1,841 to $1,720, secondly the red descending trendline almost goes side by side with the 55-day Simple Moving Average making it a double corridor, which is for the bulls to rebound. conditions make it almost impossible. At least these two elements are nice enough to reprice Ethereum around $1,688, and if the dollar adds another round of strength soon, the range will test March 2021 lows, creating space for a pullback to $1,404.

Although the extreme negative on the technical chart still scares investors, things can suddenly turn in the opposite direction as a result of the extreme activity in the crypto markets. The global inflation problem, supply problems, monetary tightening policies, geopolitical tensions and many other similar factors are directly related to the strengthening of the dollar.

If the downtrend stops, there are still chances of a further upward move towards the $2,695 level.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.