Long awaited “The Merge” or “Merge” update finally seems to be fully ready for the Ethereum network. After this update, the Ethereum network will now transition to proof-of-stake (PoS) consensus. This development seems to affect the course of many different altcoins in addition to the mainnet.

Ethereum Prepares to Merge

The leading smart contract platform Ethereum, successfully completed the last of three public testnets called “Goerli” on 11 August. This is one of the most important developments with the conclusion that there will be no delays for Ethereum’s “Merge” update, which is expected to be released on September 19.

Ethereum price surged 5% to around $1,950 after the Goerli update, hitting its highest level in more than two months. Altcoins, whose benefits will increase with the merger, are trying to outperform ETH.

Will these altcoins continue to outperform ETH price until September? If you wish, let’s discuss this issue in the rest of the article.

Lido DAO (LDO)

The merger will replace Ethereum’s army of miners with validators who should have 32 ETH as an economic stake.

A relatively large staking requirement of 32 ETH, on the other hand, created many opportunities for brokers, Lido DAO on the other hand, brought together those who do not have this much ETH but want to be a validator.

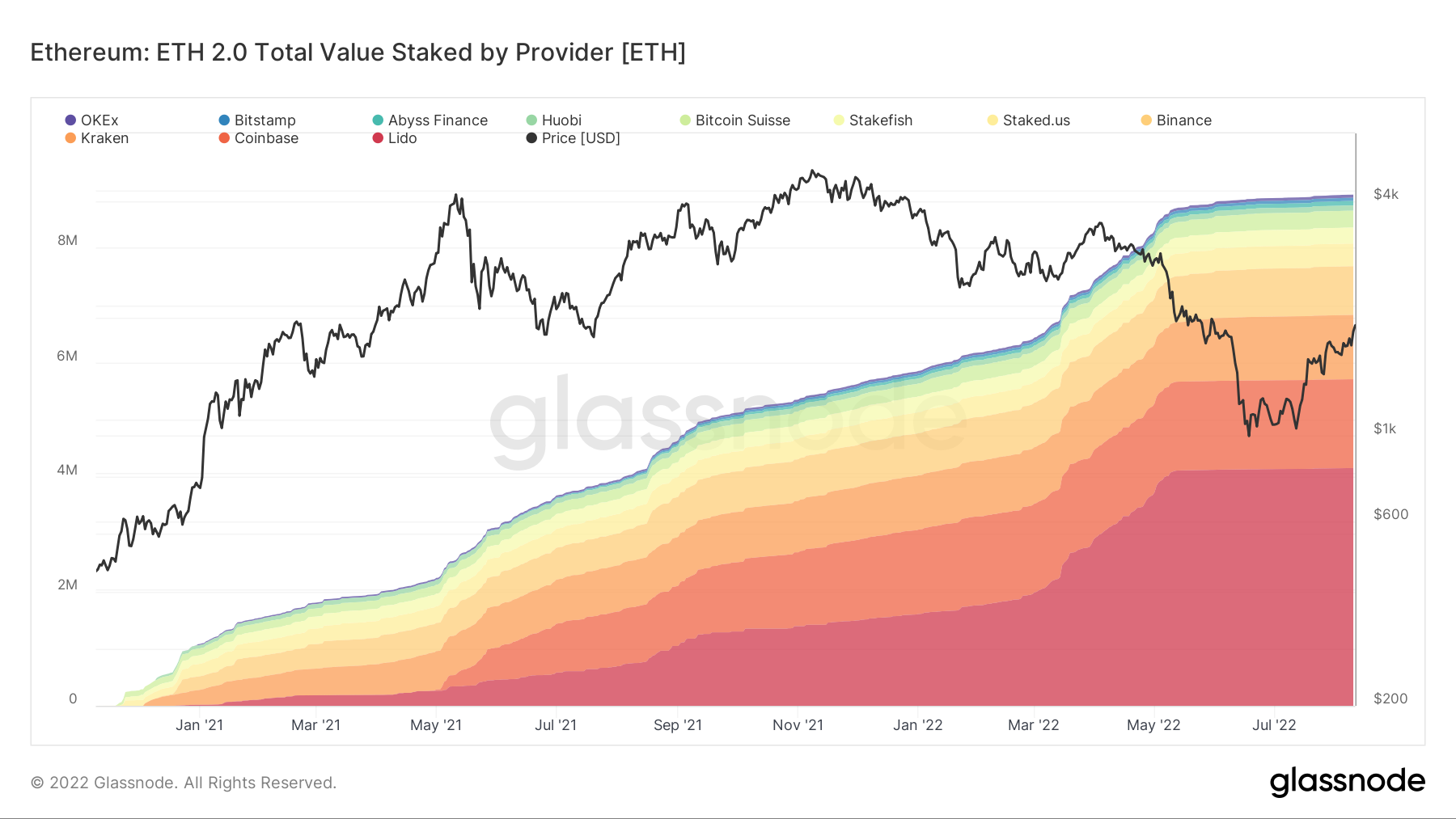

Lido DAO is the leading staking service in terms of locked value in Merge’s official smart contract. Notably, he has 4.15 million ETH on the ETH 2.0 contract leading Coinbase staking approximately. It holds 1.55 million ETH on behalf of its clients.

A successful Consolidation can increase demand for Lido DAO services.

Conversely, it could prove bullish for LDO, the platform’s official management token, whose value has already risen more than 200% since July 14, when Ethereum first announced the possibility of a PoS chain in September.

Therefore, LDO stands out as one of the crypto assets that can benefit most from the successful transition of Ethereum to POS.

Ethereum Classic (ETC)

Ethereum Classic (ETC) is another asset that has caught the attention of the bulls in recent weeks. This is primarily due to its potential to provide a haven for miners exiting the ETH network.

Since Ethereum Classic is the split chain of a contentious hard fork in 2016, it showcases almost all the technical features of the current PoW ETH network, making it a natural haven for ETH miners.

Like LDO, ETC has rallied over 200% since Ethereum’s Merge launch announcement on July 14. Therefore, the probability of resuming the uptrend is high before and after the Consolidation.

Optimism (OP)

Optimism is another Ethereum aggregation service. In other words, it collects off-chain batch data in batches and sends the results back to the ETH mainnet when a consensus is reached.

The solution, called Layer-2, can leverage Ethereum’s “Aggregation Centric Roadmap” after Consolidation. Interestingly, Optimism’s management token OP has increased by nearly 250% since the Merge release date announcement.

After the merge, Ethereum’s prospects to deploy Optimism across its network could act as a bullish catalyst for the OP price.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.