While Bitcoin remains above $30,000, the altcoin market is laying the groundwork for higher levels. In this article, you can find the next technical levels for ADA, MATIC, BCH, COMP, ETH and XLM.

Cardano (ADA) struggles to keep up

Analysis of the daily chart shows that the ADA price recovered by 39% from June 10 to 25. The bounce started when the price fell to its lowest level of the year on June 10. Then, it reclaimed the $0.25 horizontal support area. Despite the rise, the ADA price failed to sustain its momentum. It has since fallen and almost reached the $0.25 region again.

Technical analysis showed that ADA price would eventually return to the horizontal support area of $0.25. If this trend continues, the bears’ first target will be the $0.17 region, according to analyst Valdrin Tahiri. After that, there is the next critical support at $0.16. A daily close below $0.25 will confirm this bearish scenario for ADA. ADA price is currently trading in this direction, in the $0.23 region.

Despite this bearish ADA price prediction, a move above $0.35 will mean the trend is still bullish. Traders need to watch the $0.25 zone in the short term, then how ADA price will react to lower supports.

MATIC price promises 40% gain after rally

MATIC has bounced off a key support area, but the long-term outlook is bearish due to a breakout from a long-term pattern. Technical analysis on a weekly basis gives a rather pessimistic outlook. There are many factors that contribute to this perspective. First, MATIC price broke below the long-term ascending parallel channel in April 2023. This indicated that the previous upward move had concluded.

Additionally, since these channels typically contain corrective patterns, it means that the previous increase is corrective in nature. As a result, the prevailing trend is likely to be downside. Currently, MATIC is trading above the $0.53 horizontal support level, which it bounced off at the beginning of June (green icon).

The most likely expectation is that the current price action for MATIC is bearish. If this becomes true, the MATIC price will drop to as low as $0.39. However, the bearish forecast will only be invalidated by a move above the base of the first wave (red line). In this case, the bulls could press for $1.30 again. This means more than 40% gain for MATIC, which is currently trading at $0.642.

What’s next for Bitcoin Cash (BCH)?

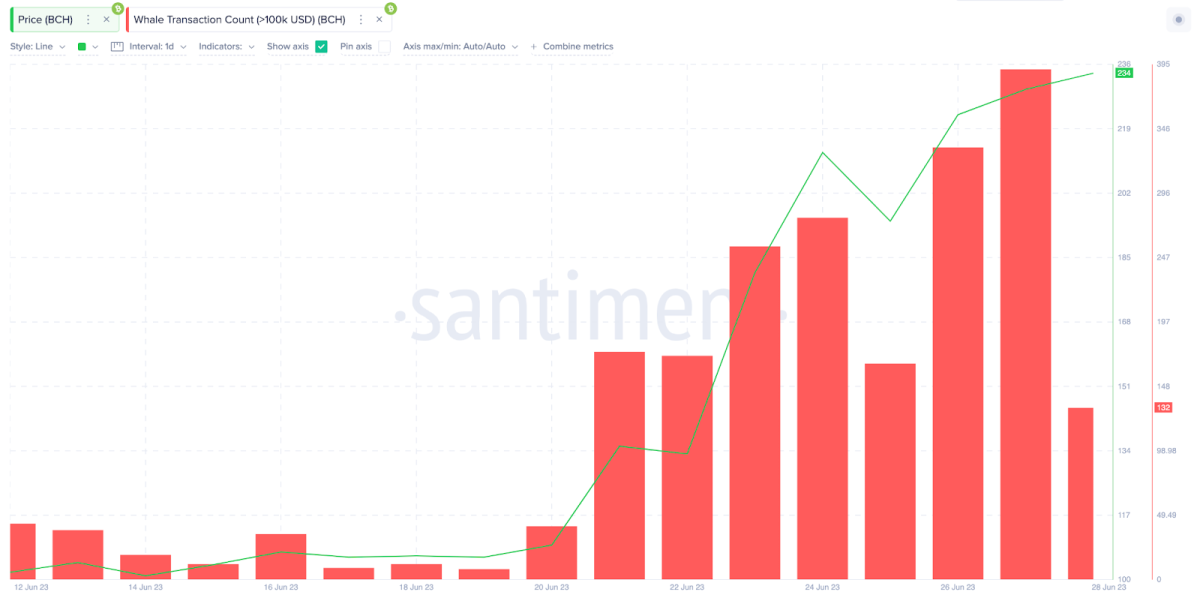

Bitcoin Cash (BCH) price hit a 13-month high of $235 on Wednesday morning. Santiment data shows that only 102 large transactions were recorded on the Bitcoin Cash network on June 20. Remarkably, however, at the close of June 27, this figure increased by 700% to 766 transactions. For the first time since March 2022, BCH whale trading activity exceeded 700 transactions in a single day.

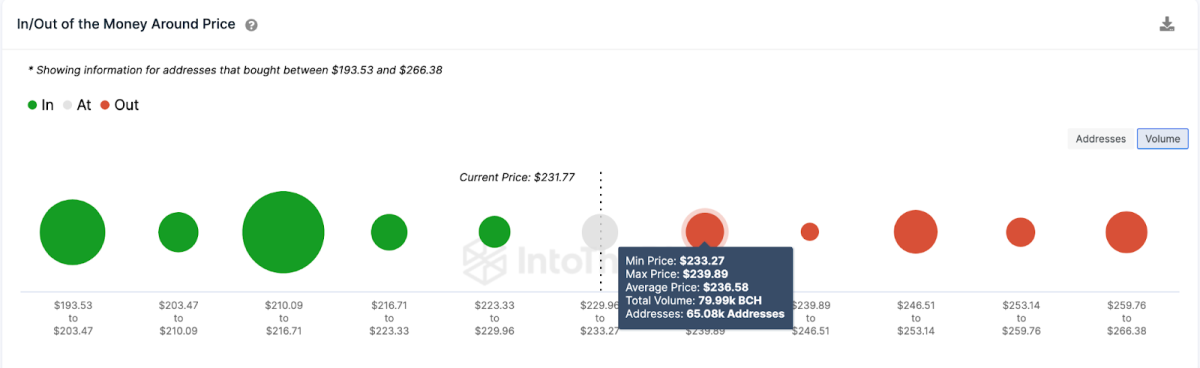

Technically speaking, it looks like BCH bulls will break the $250 resistance in the coming weeks. But first, the bulls need to break above $240 to be sure of the bullish price prediction. Analysis shows that the bulls will press for $260 after this level. $240 is the region where 65,080 investors who bought 80,000 BCH formed a strong demand wall.

Conversely, bears could take control if BCH drops below $225. However, 111,570 traders who bought 50,530 BCH coins at an average price of $225 could avert the decline if they stand firm. However, if this support level fails to hold, BCH could trail the town $200 sharply. The altcoin is currently trading around 246.96, which is a critical zone.

Compound Finance (COMP) gained 50% in 3 days: What’s next?

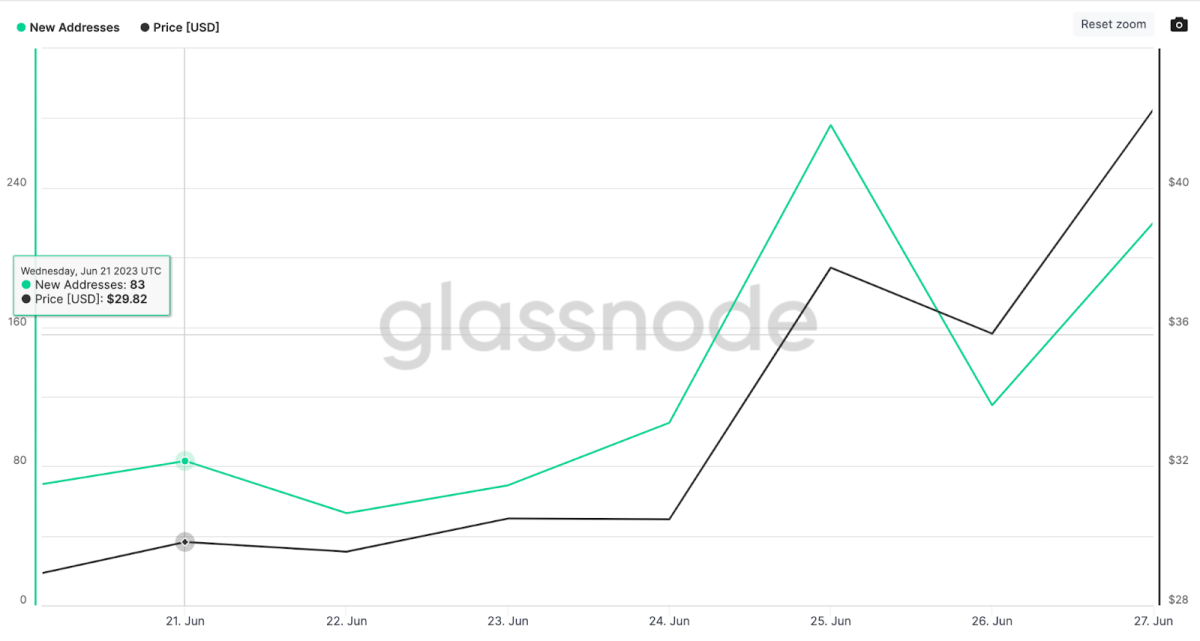

The COMP price is up 48% from last week as whale investors turn their attention to DeFi protocols after the last Fed rate pause. Meanwhile, COMP network growth also increased significantly. On June 21, only 83 new wallet addresses were created on the Compound network. At the close of June 27, this figure quickly rose to 220. This represents a 165% increase in new user acquisition rate.

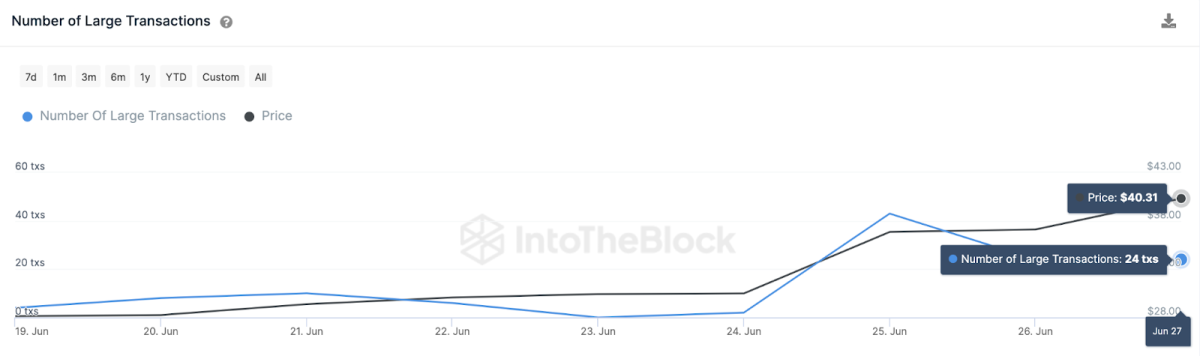

The trading activity of major institutional investors was another key driving factor that helped COMP to break above the $40 price resistance zone. Between June 20 and June 28, whale transactions containing COMP skyrocketed by 300%.

The IntoTheBlock chart below shows how COMP Major Trades rose from 8 trades to a 5-month high of 24 trades between June 20 and the close of June 27.

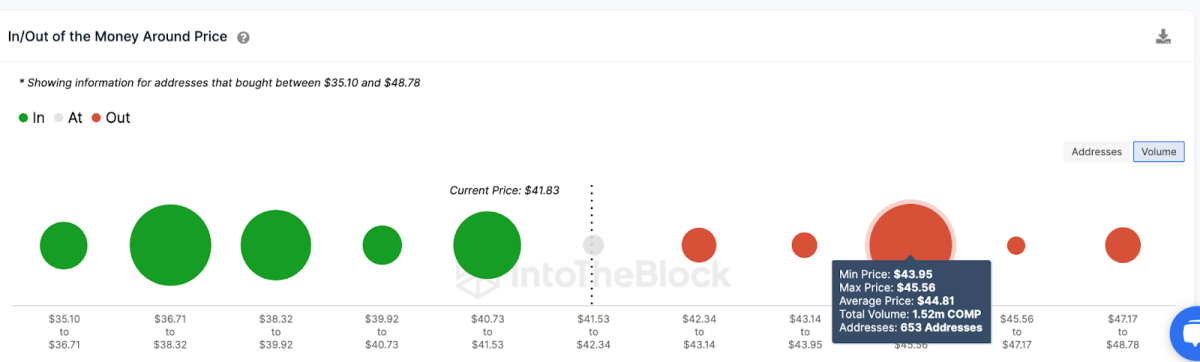

Technically speaking, the bulls are gaining momentum to rally towards $50 given that they easily pushed aside the $40 resistance. But first, they need to clear the next important resistance at $45. In this region, 653 investors who purchased 1.52 million tokens at an average price of $44.81 were able to exit their positions.

If the bullish momentum is strong enough, this will form a large accumulation zone. As a result it will drive COMP above $50.

Still, if the price drops below $38, the bears are likely to reverse the upside COMP price prediction. However, as in the chart above, the 2,940 investors who bought 1.44 million COMP at an average price of $38.58 would offer significant support. If this support level breaks down, COMP price is likely to return to $35.

Ethereum (ETH) drops due to whale sale

As Lookonchain reports, whales are dumping massive amounts of ETH. One whale pulled 16 million USDT, according to on-chain data.

However, ETH bulls continue to show strength. Looking at the 1-hour chart of Ethereum, it can be seen that the price has formed a bull flag. In technical analysis, a flag is a short-term consolidation pattern that appears after a strong price move and indicates a temporary break in the trend.

A bullish flag is formed during an uptrend with the flagpole pointing up. Then comes a consolidation phase before a possible continuation of the upward move. For now, the pattern has held, with ETH bouncing at $1,825. In this respect, the bulls are in control for now (despite the whale).

There are basically two scenarios. Especially if the lower side of the flag breaks down, Ethereum will drop to $1,750. Conversely, a break to the upside (around $1,900) triggers the price to rally to $2,000. However, the price will hit Ethereum’s main supply wall in the $2,000 to $2,060 range, according to analyst Ali Martinez. This is where 832,640 addresses bought over 26 million ETH. “If ETH can break through this resistance barrier, we can expect a rise to $2,330 or even $2,750,” Martinez says.

Stellar (XLM) surpassed its competitors with these developments

Finally, XLM has experienced a notable surge lately, eclipsing various altcoins in the market. This surge comes as a breath of fresh air for the crypto community, which has been plagued by volatility and uncertainty for the past few weeks.

According to a post on Twitter by Timer Weller, one of the core developers of the Stellar protocol, developers now have the opportunity to use the recently introduced layer protocol. This protocol provides significant scalability enhancements for Stellar and enables efficient launch of Soroban smart contracts.

The latest announcement represents an important milestone for XLM. It will show how effective it will be in terms of price in the coming days.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.