Cryptocurrency markets present both opportunities and significant risks for crypto investors. In other words, it has a highly variable structure. The ability to discern which cryptocurrencies to stay away from, based on rigorous fundamental and technical analysis, can make the difference between profit and loss. Crypto expert Vinicius Barbosa explains 3 altcoins that investors and traders should stay away from next week.

dYdX (DYDX) comes first on the list

Tokenomics and overbought or oversold conditions that affect supply dynamics are very important indicators for cryptocurrencies. dYdX (DYDX) is the first altcoin to avoid trading next week due to fundamental economic considerations. Notably, a major token unlock started on November 24. This process will continue until December 1. Over the next seven days, the dYdX team will unlock 152.16 million DYDX. This will account for 84.41% of the circulating supply. This unprecedented supply inflation could create massive selling pressure that could greatly impact the token’s performance. Meanwhile, DYDX was trading at $3.50, down 2.5% in the last 24 hours, according to CoinMarketCaps.

Second ranked altcoin: Sei Network (SEI)

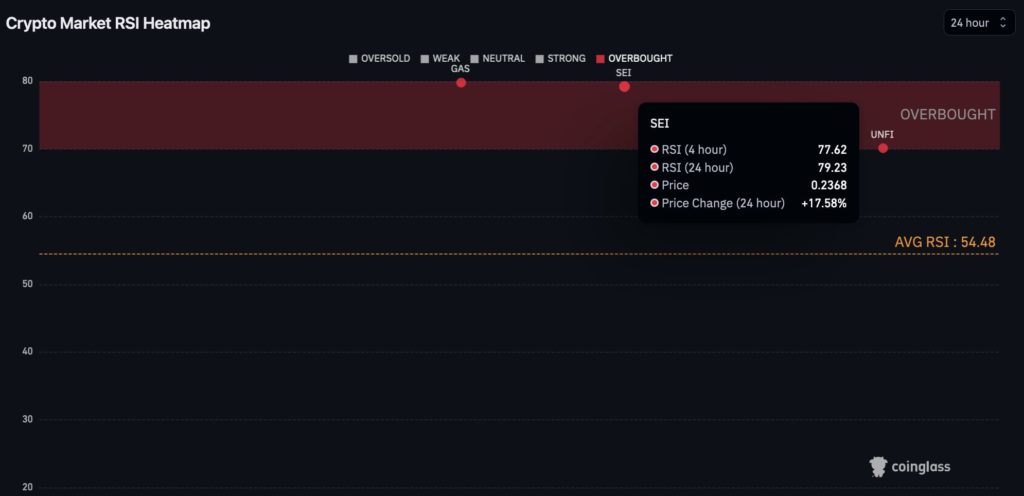

Interestingly, looking at the RSI, Sei Network (SEI) stands out as one of the most “overbought” cryptocurrencies to avoid trading in the coming week. CoinGlass’ Relative Strength Index heat map provides the data. The native token of this layer-1 Blockchain, launched in 2023, is showing 77.62 points for its indicator on the 4-hour chart and 79.23 points on the daily time frame. At the time of writing, the altcoin was trading at $0.2316, losing 4.4% in the last 24 hours.

Last on the list is Gas (GAS).

Similar to SEI, Gas (GAS) is also showing overbought signals with an RSI of 79.83 on the daily chart. However, the 4-hour RSI reveals strength and some momentum that traders should consider for short-term price movement through daily trading. GAS is in demand as the token used to pay NEO Blockchain transaction gas fees. Moreover, its fundamental success is directly tied to the adoption of NEO. At the time of writing, the altcoin was changing hands at $8.70, losing 1% on the day.

Although the cryptocurrency market is unpredictable, caution and strategic analysis are key. According to current data and analysis, the 3 altcoins mentioned above have a higher risk next week.

The opinions and predictions in the article belong to the expert and are definitely not investment advice. cryptokoin.com We strongly recommend that you do your own research before investing.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!