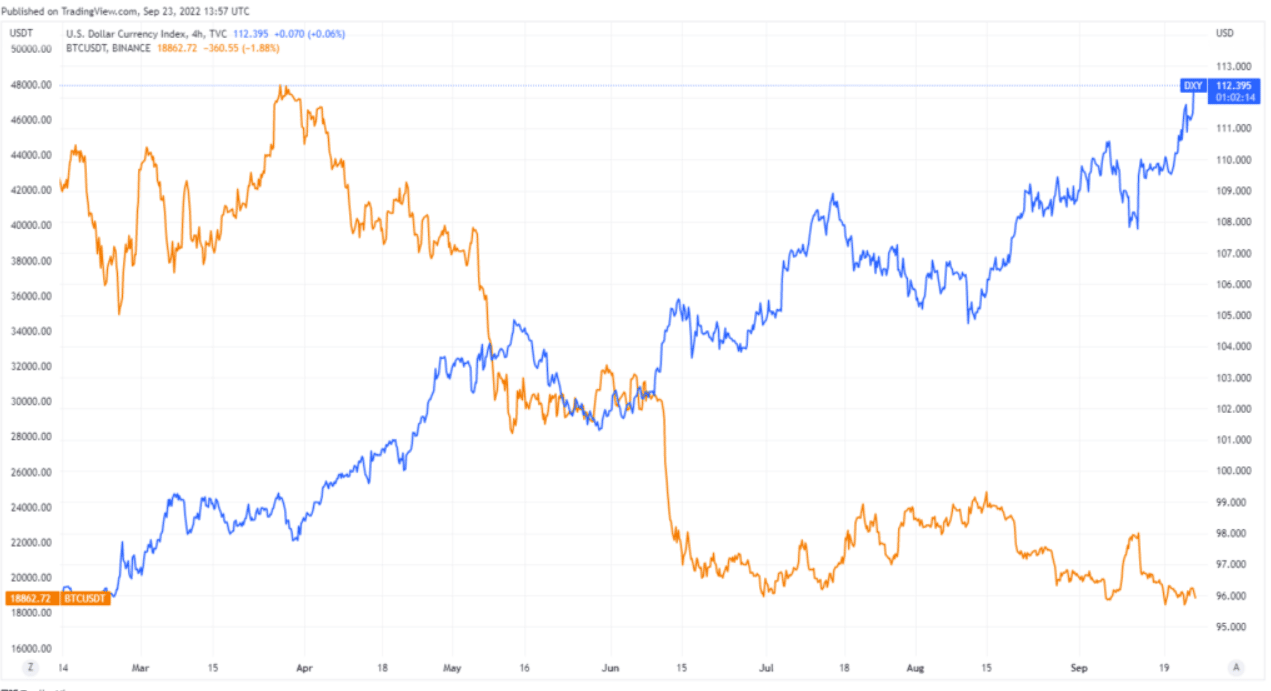

US Dollar Index (DXY)reached the highest level of the last 20 years, surpassing the level of 113. How were cryptocurrencies affected with the peak of the dollar index?

US Federal Reserve (FED)increased the interest rate by 75 basis points (0.75%) last Wednesday. Thus, the FED’s policy rate rose to the range of 3.00-3.25%.

Following the news of the rate hike, Fed Chairman Jerome Powell made a speech. Powell emphasized that inflation should decrease even if the economy slows down.

Contrary to the expectations of some of the market, the FED’s determination on inflation caused the dollar index to rise. With the dollar index exceeding the level of 113, bitcoin including cryptocurrenciesstocks, precious metals such as gold and silver were adversely affected.

While the dollar index has been rising since March, Bitcoin has moved in the opposite direction. While the dollar index rose from 95 to 113, the leading cryptocurrency Bitcoin fell from $42,000 to $19,000.

Why Are Cryptocurrencies So Affected?

DXY is an important indicator that measures the value of the US dollar against the currency of other countries. A rise in the index means that the US dollar appreciates. As the dollar appreciates, investors are shifting from risky assets to the dollar.

All risk products are adversely affected by the rise in the dollar index. However, cryptocurrencies are the most affected investment product as they are defined as the riskiest asset class.

Not only cryptocurrencies were affected by the rise in DXY. An ounce of gold fell to the level of $ 1643. The Nasdaq, one of the American stock markets, lost 2.50% of its value.

As of writing date $ITC is trading at $18,700, down 2.35% daily.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android and iOS Start live price tracking right now by downloading our apps!