Dogecoin (DOGE) Price action is trading lower and reaching the lower trendline of a falling wedge pattern. Significant evidence suggests that a major bear trap and short-term entrapment will soon begin. On the other hand, “Point and Shape chart” supports “Japanese Candlestick” analysis in determining a possible bottom.

Dogecoin price action has definitely been on a decline lately. Fears that a capitulation movement is about to begin are of course quite consistent, but it doesn’t look like it’s been followed by the bears yet. Dogecoin price is developing strong bullish trend patterns in the candlestick chart and the Point and Figure chart.

Dogecoin priceis overwhelmingly bearish on the daily Ichimoku chart. However, this trend will likely end with a strong reversal or serious corrective move very soon. The primary reason for this reversal in the candlestick chart is the presence of a falling wedge pattern.

Of all the standard geometric patterns in technical analysis (especially Japanese candlesticks or American bar charts), wedge patterns have the highest rate of positive expectation to turn into profitable trade setups.

Wedge patterns define an overbought/oversold market (market) and represent excess. A rising wedge is a bearish reversal pattern and a falling wedge is a bullish reversal pattern.

Dogecoin is located just opposite the lower trendline of a falling wedge. DOGE, creating maximum average levels between the daily close and Kijun-Sen, while these are trading at the extremes and warning of a bullish average return move.

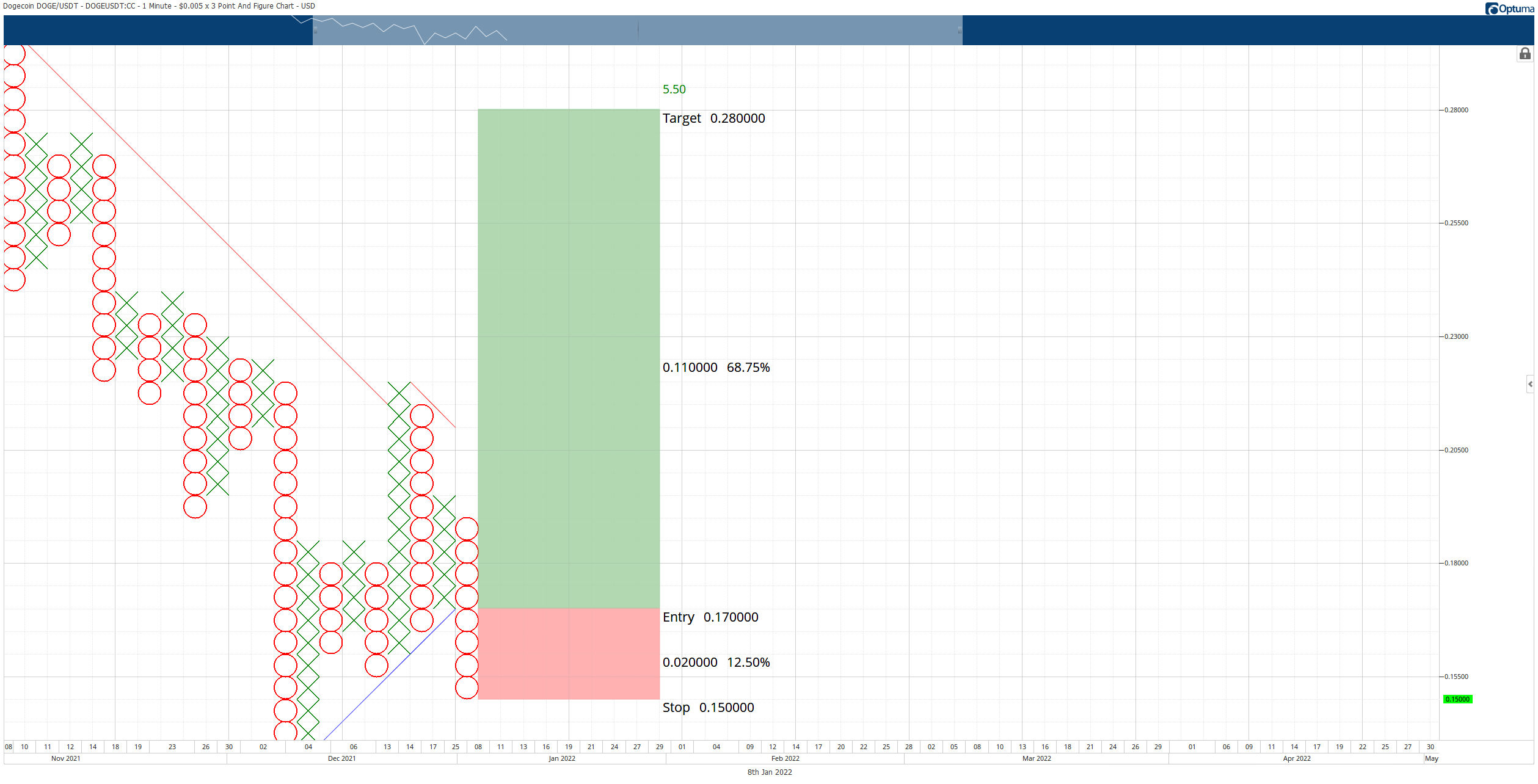

Dogecoin developed a Bullish Shakeout pattern on the Point and Figure chart with $0.005/3 box reversal. This pattern is valid only if an instrument is in a wider uptrend and is at the bottom of a corrective move (both of these situations apply to Dogecoin price). The combination of the falling wedge and the Bullish Shake pattern theoretically offers a low-risk, high-reward trading pattern.

The theoretical long trade setup for Dogecoin price is a $0.17 buy stop, a $0.15 stop loss and a $0.28 profit target.

This possible trade pattern represents a 5.5:1 reward/risk setup with a profit target of approximately 69% from entry. Additionally, a two to three box end stop will help protect any profits made after entry.

Traders, a pullback below the lower trendline of the falling wedge could create a move that will result in at least a three-day close. This will ultimately invalidate the theoretical long setup and bullish view of this analysis.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.