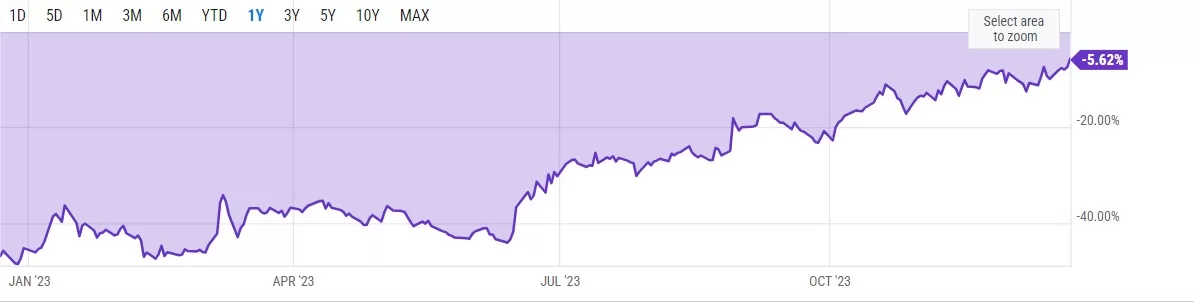

The discount rate for Grayscale Bitcoin Trust (GBTC) has fallen below 6%. This is a spotlight from BlackRock Bitcoin It’s a significant reduction from the 43% discount observed in mid-June, when it filed for its ETF.

In simple terms, the term “discount” refers to the difference between the market price of GBTC shares and the actual value of the Bitcoin they represent. For a while, the discount rate of GBTC compared to the BTC price had increased to almost 50%.

The decline in GBTC’s discount rate appears to be closely linked to the increased likelihood of Bitcoin Spot ETFs being approved. According to ETF expert Nate Geraci, the market is clearly optimistic that GBTC will be in the first wave of approvals to become a Bitcoin Spot ETF. This optimism was also reflected in GBTC’s decreasing discount. As the chances of approval increase, the discount decreases, indicating positive market sentiment towards GBTC’s future.

Similarly, Grayscale, another product of Grayscale Ethereum Trust (ETHE) is also trading at a discount of around 11% at the time of writing, compared to a 60% discount at the beginning of the year. It is thought that if the SEC approves BTC Spot ETFs, the possibility of approval of Ethereum Spot ETFs will be strengthened in the next stage.

*This is not investment advice.

For exclusive news, analysis and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android And iOS Start live price monitoring now by downloading our applications!