Munich Hundreds of phone calls and dozens of personal conversations lie behind the bosses of the German Football League (DFL). They advertised a billion-dollar deal with a financial investor so that digitization and internationalization can be advanced. And yet one anxious question hung over the extraordinary meeting of the 36 DFL members this Wednesday until the end: Is there the necessary two-thirds majority among the professional clubs in the first and second Bundesliga? It should be very close, every vote counts.

That makes Wednesday’s session in Frankfurt a showdown at a nervous time. Because the opponents of the planned deal have also mobilized. There is a lot at stake, after all, 12.5 percent of all DFL media revenues should go to a private equity company over 20 years. According to the current status, the highest bid in the remaining group of four interested parties is 1.85 billion euros.

At this level, Blackstone and CVC should be ahead, followed by Advent. The Swedish company EQT, on the other hand, was probably told by the transaction banks Deutsche Bank and Nomura that it was around ten percent behind the best offers. KKR is eliminated: the Axel Springer shareholder is said to have only offered 1.33 billion.

A heated debate on the lure of money is to be expected. The DFL Presidium is submitting the application to achieve “binding offers” with the remaining four bidders in “phase two” of the investor project. Later, the DFL members should decide again on “phase three”, the final negotiations with the partner then selected.

According to the DFL application, the planned transaction involving the new subsidiary “DFL MediaCo GmbH & Co. KGaA” represents “a legal transaction of considerable importance”. The first division clubs are “clearly predominantly affected”, they bring in almost all of the money in international marketing. Therefore, at the decisive DFL meeting, they should first agree to the fundraising in a “partial meeting” with a two-thirds majority.

Lure for the undecided

Such a vote in this circle is considered likely. A maximum of five of the 18 first division clubs – for example Cologne and Augsburg – are considered opponents of the investor model. A positive outcome would then radiate to the following general meeting of all 36 DFL clubs, hope the supporters around DFL supervisory board chairman Hans-Joachim Watzke from Dortmund.

So perhaps one or the other in the ranks of those nine second division teams who have appeared as opponents to date should be changed. A lure is an additional 36 million euros, which the second division clubs are allowed to have at their disposal beyond the usual distribution key according to the DFL plans.

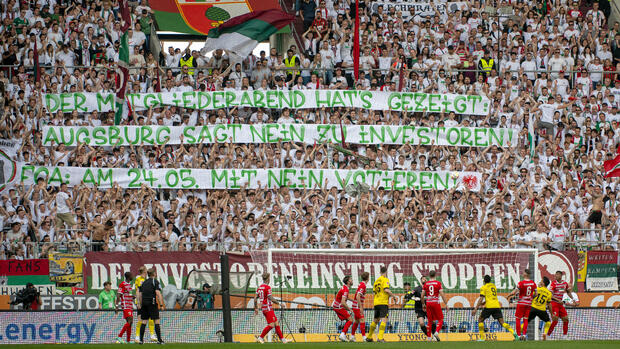

Fans of the first division are taking a stand against the investors’ plans.

(Photo: IMAGO/Matthias Koch)

The clubs will discuss many important details that are only now becoming public. The investor money urgently needed by some clubs will not flow en bloc immediately, but in five annual tranches. In contrast, 12.5 percent of the DFL revenues are lost immediately in the first year. A kind of reserve fund should help with any financial gaps, provided that the clubs concerned have managed properly. There is also a “strategic reserve” if the planned fan platform should actually be expanded into a streaming platform with videos.

Veto rights are also likely to be an issue. In this way, the DFL can prevent an unwelcome new investor from whom the courted private equity partner could resell its stake after eight years at the earliest. The DFL also has a right of first refusal in this case. Conversely, the selected investor has certain blocking rights on the supervisory board and the advisory board of the new DFL MediaCo, which he will join with his own representatives.

And the management team should also represent the donor: he has the right to co-determine the “Chief Commercial Officer”, i.e. one of the managing directors, confirms the DFL management on request. In this context, the circle of investors pointed out the very ambitious goals of the DFL: Media revenues should increase within a decade from 1.4 billion to 2.6 billion euros in 2031. Perfect marketing is necessary, and people are happy to get involved.

Debates about the deal shake clubs and associations

Possible veto rights of a partner would, as is usual with such agreements, primarily affect significant changes to the basic agreement on which a partnership is based, according to the DFL. According to the current concept, the partner has a right of veto against any termination of the license agreement by DFL eV for the duration of the minority holding.

The sovereign rights of the DFL relating to the organization of game operations and the licensing of clubs and players are explicitly not affected. “Neither competitive games abroad nor new kick-off times or any co-determination rights of a partner in the area of game planning are part of the considerations,” explains a spokesman.

Even such debates about the deal shake the clubs and associations. Last weekend, 15 of the 18 third division clubs under the auspices of the German Football Association (DFB) reported. They feel directly affected, after all, the relegated from the second division – their future rivals – should be considered with around 25 million euros in investor money.

In a long paper, the third division clubs ask all sorts of questions – for example whether the planned distribution of the financial resources could lead to the “identity feature” of German football, an open, permeable league system, being undermined by “economic market entry barriers”. The question is whether there could be antitrust proceedings. Those responsible for football should “focus on promoting clubs beyond the DFL,” says the fire letter.

For the second division club FC St. Pauli, the planned investor deal is definitely not yet ready for a decision. The popular neighborhood club submitted its own motion for the DFL general meeting: The upcoming decision on the second project phase, the “detailed due diligence”, should be postponed to the ordinary general meeting in August.

implementation issues

It is a groundbreaking project for two decades, but many crucial and complex questions are still open. The DFL members should therefore be allowed to send written questions to the DFL committees in the next four weeks, which should be answered in another four weeks. They want to “place the decision on a stable basis in terms of content”.

The FC St. Pauli managers also discuss how a deal “by a new DFL management that has not yet been determined” should be implemented. The interim bosses Axel Hellmann and Oliver Leki will return to the management of their regular clubs Eintracht Frankfurt and SC Freiburg at the beginning of July with significantly better endowed contracts. It is not yet clear who will succeed them. FC Bayern Munich CFO Jan-Christian Dreesen, who has already been presented to the DFL Supervisory Board, may not come after all – the leadership crisis at the German record champions could make his continued presence there necessary.

Time is of the essence, also when it comes to the boss question. A new candidate is already being traded, who once celebrated success as the private broadcaster boss of Vox and RTL Germany: Bernd Reichart. The manager is currently working as head of the Spanish sports project developer A22 on a “Super League” of top European clubs, with little chance of success. He has already named a role model for his current work: the DFL.

More: DFL investor deal is on the brink