A DeFi investor, who took the opportunity to lose Tether (USDT) dollar stability, made a significant profit in a short time by trading millions of dollars in USD Coin (USDC) parity.

An anonymous trader, who took advantage of the depreciation of Tether against USD Coin, which was subject to heavy sales with the decline of Bitcoin, attracted attention with its decentralized finance (DeFi) transactions. Average against USDT, USDC, and DAI departing from the $1 constant After 0.03% depreciation The user took a series of large debts and trade for profit he did.

“czsamsun.ethThis user named ”, in the first step 17 thousand ETHand 14 thousand stETHDecentralized finance protocol by showing . aave v2 over 31.5 million USDT borrowed money. Then you can exchange all these USDTs on the decentralized exchange (DEX). 1inch converted to USDC. Immediately after Aave v2 and v3to respectively 10 million USDC And 21 million USDC he laid. Later from v3 12 million USDT borrower czsamsun.eth invested these assets in v2.

The main purpose of these seemingly complex transactions is USDT And From the price difference between USDC through decentralized platforms arbitrage was to make a profit.

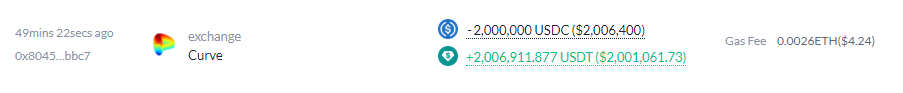

End 12 million USDTabout borrowing 20 minutes later anonymous investor in action, 52,200 stETHas collateral and taking advantage of the current USDC-USDT de-peg 50 million USDC borrowed money. Then these assets Curve by converting from USDC to USDT several times on hundreds of thousands of dollars profit in minutes has achieved.

Although the amount of profit obtained shows volatility according to the current exchange rates, the trader’s Average profit of $1,000-8,000 per trade is assumed to have. The trader, who is still in the process of converting USDC to USDT, TSI today at 12.10 performed.