Ethereum price It seemed to be handling the FOMC crash on May 5 well, but in the last 24 hours, this situation has reversed a bit and a very undesirable picture has emerged. Things are getting worse for ETH at the moment and the break of a key support level indicates that further declines are likely.

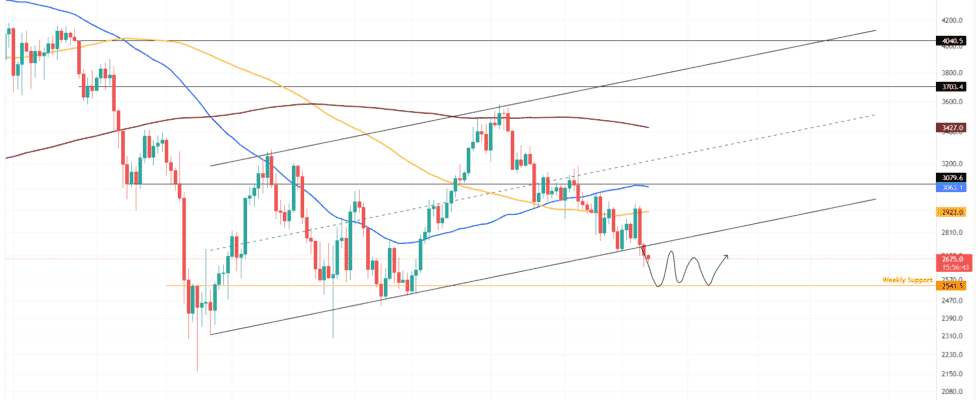

Analysts had previously stated that the next bullish reaction is happening as the Ethereum price tags the lower trendline of the ascending parallel channel. This channel had recorded a 40% price increase as a result.

With this, bitcoin priceThe third retest of the channel’s lower trendline on May 2 was weak due to the lack of bullish volatility on the coin. The FOMC crash on May 5 showed that sellers can easily outwit buyers and do so for a long time.

As a result, Ethereum price broke this setup and triggered the downtrend. $2,541 is the immediate and final support line for Ethereum. Turning this support into a hurdle would be fatal and could trigger a 21% drop to $2,000.

While things are looking for Ethereum price, a daily candlestick above $3,000 would break the 100-day SMA at $2,922, ultimately invalidating the bearish thesis for ETH. After that, Ethereum bulls need to peak higher than the April 21 high of $3,186 before it can go higher.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.