Just before the election, foreign investors, who like risk and do not want to miss a possible positive scenario, entered the stock market with strong purchases with the first surveys after Muharrem İnce’s announcement that he was withdrawing from his candidacy. With the surveys showing the possibility of the elections ending in the first round, even the smallest foreign purchases made on bank shares increased the index by 8 percent in one day. Long-term funds are expected to begin to appear after the election.

The king’s rule of the stock market worked again, rise when no one expected!

2 sessions before the election, all the stones played in the stock market. It’s always the rule, if everyone expects the stock market to drop, you should sell. So even if everyone says the stock market won’t go up until the election, you should have bought it. This rule has been confirmed by the most famous investors of this market throughout the history of the stock market for more than 100 years and has been the subject of their books. And this rule worked again. Just a few days before the election, right after the warnings in foreign investor reports that “We don’t come right away, you can wait”, the determined purchases of a very small part of foreign investors took the bist100 index from the critical 4,400 line and increased by 8 percent to 4 thousand in one day. Made it jump up to 800 levels. Moreover, incoming foreign purchases, it seems, camel ear.

Are foreigners really buying in the stock market?

According to most analysts, we have seen the purchases of venture funds in the market. So how do we know that the incoming purchases are from real foreigners? This is the easiest part. Because the incoming purchases came first from banks and without any target. Moreover, in the event of a possible change in power, if there is a rapid rise in interest rates, the banks will be the ones who will suffer the most because of the low-interest bonds in their hands. In other words, foreign investors started to return and buy what they sold the most while fleeing from the stock market.

Again, among the most bought, there are the shares that went through a bad sectoral conjuncture like EREGL. There is FROTO, there is THYAO at the peak in transaction volume, there is ISCTR, there is SISE, there is KCHOL. For example, as we have seen for months, there is no ASTOR, no SASA, which is one of the new public offering shares.

There are real estate investment trusts in those sold in foreign exchanges, banks and holdings when they buy.

What if long-term funds return?

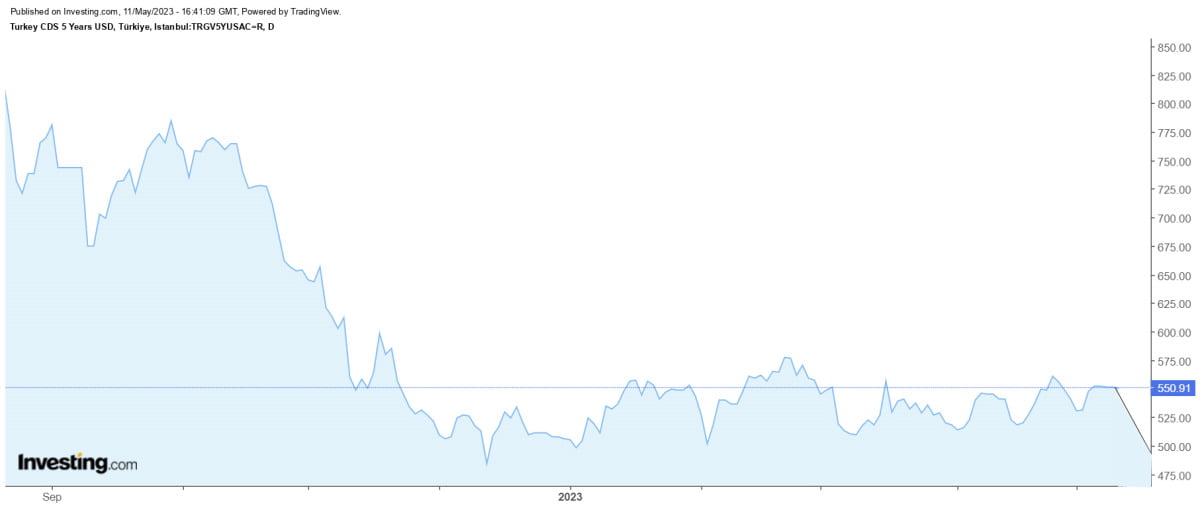

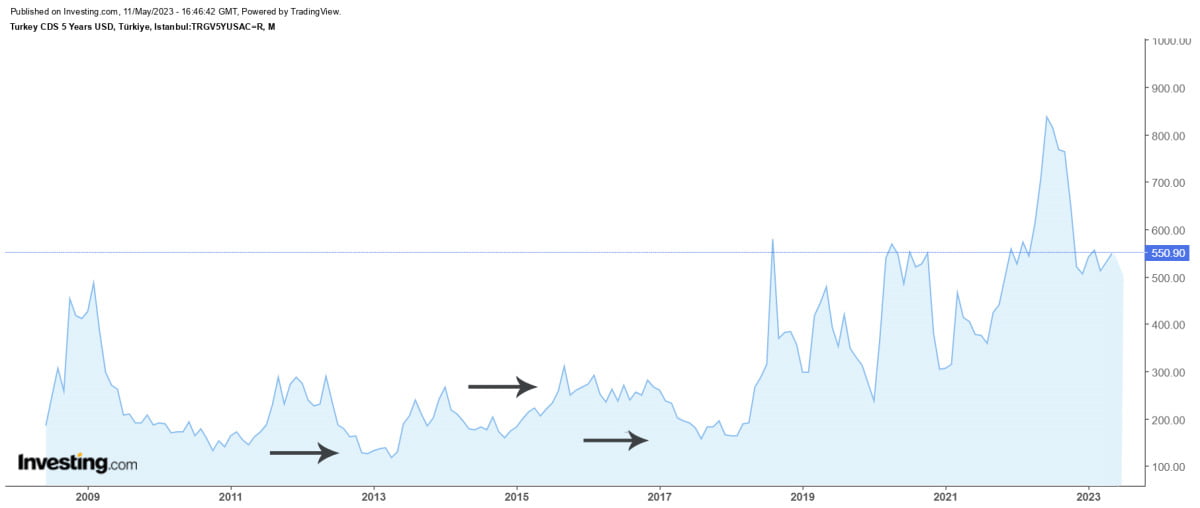

Now let’s get to the real issue. In other words, what does the stock market, which slams into the ceiling with the slightest purchases of foreigners, as if it has come out of famine, what does it do with the inflow of long-term foreign funds. At this point, it is useful to put the hat forward and think. Because, when the possibility of the Nation Alliance to win the presidency in the first round appeared in the latest poll results and the candidacy of Muharrem İnce, which is one of the most critical issues in this respect, disappeared, Turkey’s risk premium, namely CDS’s, decreased significantly as well as the incoming purchases. The CDS of 5-year bonds fell 50 points in one day and fell below 500 points for the first time since December 2022.

CDS must drop to 250 points

But the bad news is that some critical conditions are necessary for a resounding return of long-term funds to Turkey. The first of these is that Turkey’s credit risk premium confirms that Turkey has entered the investment grade status. Which means that CDS’s need to go below 250 points again. It is rare for this to happen only with market movement. In other words, there is a need for credit rating agencies to raise Turkey’s rating again. That Turkey’s rating rises, TL assets are reinvested from global funds, and Turkey’s weight in fund baskets such as S&P increases, so that long-term funds that have to invest in parallel with the basket of these funds (For example, the famous Japanese housewives fund, Texan fund) Like the Teachers’ Fund), it may be possible to increase its weight.

The good news is this: If the conservative investment strategies of these funds, at least until now, change, even if these funds repurchase Turkish shares, at least up to the current limit, the sluggish course of Borsa Istanbul may be reversed in an instant.

Is the stock market down?

However, according to experts, it is useful to be a little more careful at this stage. Because there is only one session left until the election. In the elections to be held on Sunday after the closing of Friday, there is a possibility that the destruction will be caused by the results contrary to the forecasts. That’s why experts recommend that those who want to take an election risk in tomorrow’s session do so with a small portion of their portfolio.

Because it should not be forgotten that even though the BIST-100 index has increased by nearly 8 percent today, it is still below the 5 thousand points level. In other words, 5 thousand 500 points, which is stated to be seen as confirmation of the rise, still has a difference of close to 600 points. This leads to comments that the stock market’s exit from the decline has not been confirmed yet, and that the risk factor is still ongoing.

For the continuation of the article Crazy foreigners were seen in the stock market İnce İnce: Bist-100 went crazy!