TerraUSD (UST) Despite losing its pegged value against the dollar in the past few days, crypto executives said that the fate of all stablecoins is not the same. However, the tension in the community is quite high.

DeFi platform EQIFI CEO Brad Yaşar stated that he does not believe that the stablecoin market as a whole will suffer, reducing the tension in the community to some extent.

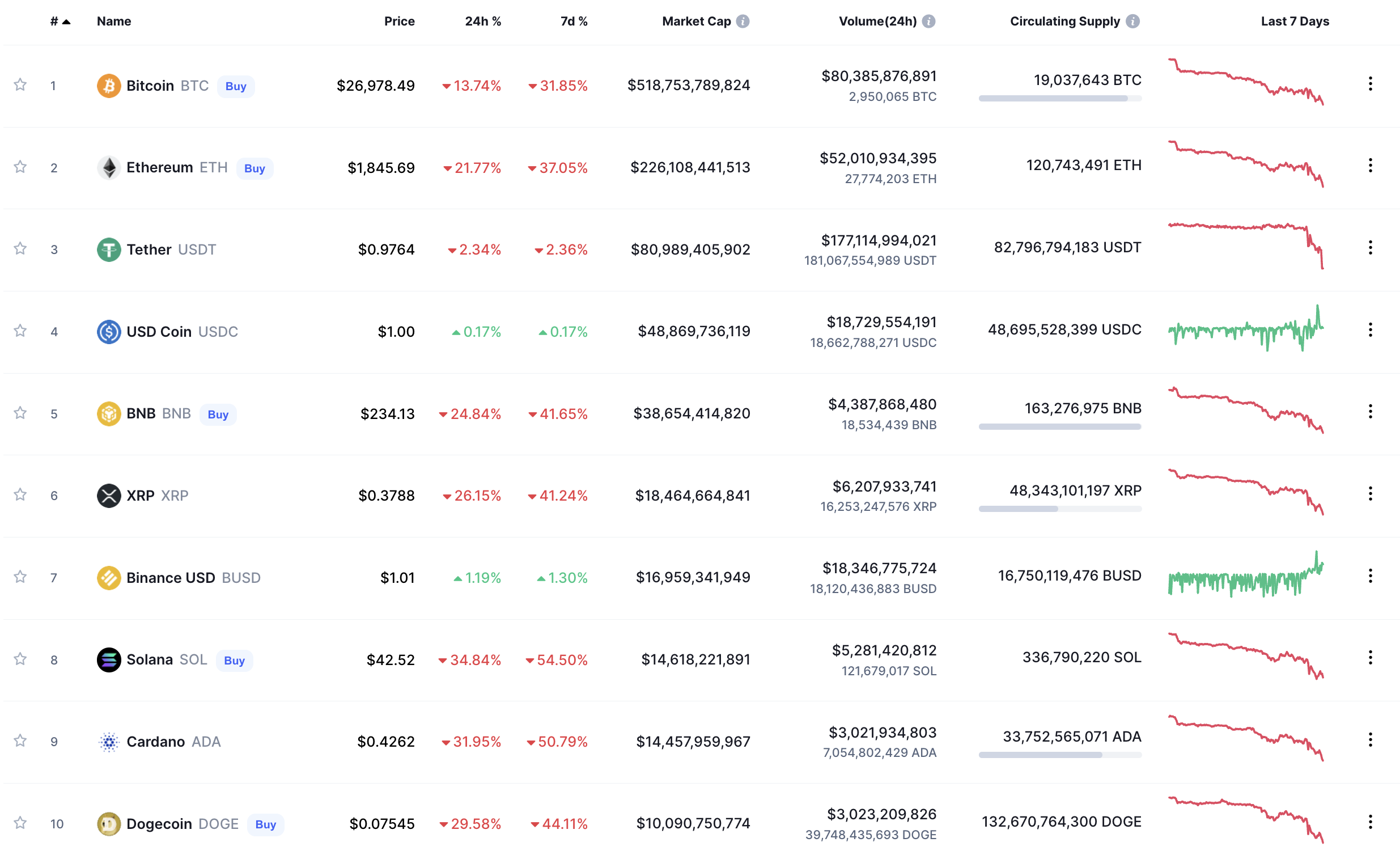

The biggest stablecoin Tether (USDT) and the second largest USD Coin (USDC) prices managed to stay around $1 on Wednesday afternoon. Both are backed by an entity, unlike UST, which seeks to maintain its stability by creating or destroying the UST supply through exchange with LUNA, the native token of the Terra blockchain.

Yaşar explained, “As long as the reserves of asset-backed stablecoins match the number of coins in circulation, they are not prone to peging with market movements.” He also added that “Algorithmic stablecoins that have not been asset-backed until now have been stabilized by violent market movements.”

According to data compiled by Terra and Flipside Crypto, UST, which currently has a market cap of approximately $13.95 billion, was priced at approximately $0.68 at 2:30 PM ET on Wednesday. LUNA was down 94% in the last 24 hours at the time.

According to a blog post by Grayscale Investments, approximately $350 million in UST, other stablecoinIt was exchanged for USDT using the Curve protocol, which reduced its value by leaving more USTs available compared to . The remainder of the UST withdrawn from the Anchor protocol was sold on centralized exchanges, causing the value in those markets to decline as well.

While Terra founder Do Kwon announced his bailout plan, it seems that the markets did not trust this explanation. We have shared the details of the recovery plan with you before.

A spokesperson for Tether stated that USDT is the most liquid stablecoin on the market, adding that the company does not believe that the status of UST does not make sense for the central stablecoin market.

“Tether has managed to withstand multiple ‘black swan’ events in cryptocurrency. The collapse on the UST side is just one of these events. We are proud to say that the 1:1 peg against the dollar has been successfully maintained in USDT and Tether has never honored a payment request from a verified user.”

Gabor Gurbacs, director of digital assets strategy at VanEck fund group, stated in a tweet that Bitcoin and USDT are the most reliable reserve assets for the crypto space.

Ryan Shea, crypto economist at crypto index trading platform Trakx, said the stablecoin market should be a “zero-sum game.” He noted that the dramatic price drop of the UST will create a shift from algorithmic stablecoins to collateralized stablecoins as the market loses faith in legacy stabilization mechanisms.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.