As we all know, there have been two important expectations and risks in the markets recently. The most important of these was primarily the Fed’s decisions on economic policy. However, in the last 1-1.5 months, the tension between Russia and Ukraine got ahead of the Fed. Now the markets have started to wait for the Fed’s meeting that will take place this week, and the events on the Russia-Ukraine side are also in reserve.

We had a similar period in the Gulf War in 1990. On August 2, Iraqi forces crossed the Kuwaiti border and launched an invasion. During these dates, the S&P index lost 18% and oil prices had doubled. This increase in oil prices was the concern of Iraqi Leader Saddam Hussein that he might enter Saudi Arabia after Iraq and cause great problems in oil resources in the Middle East.

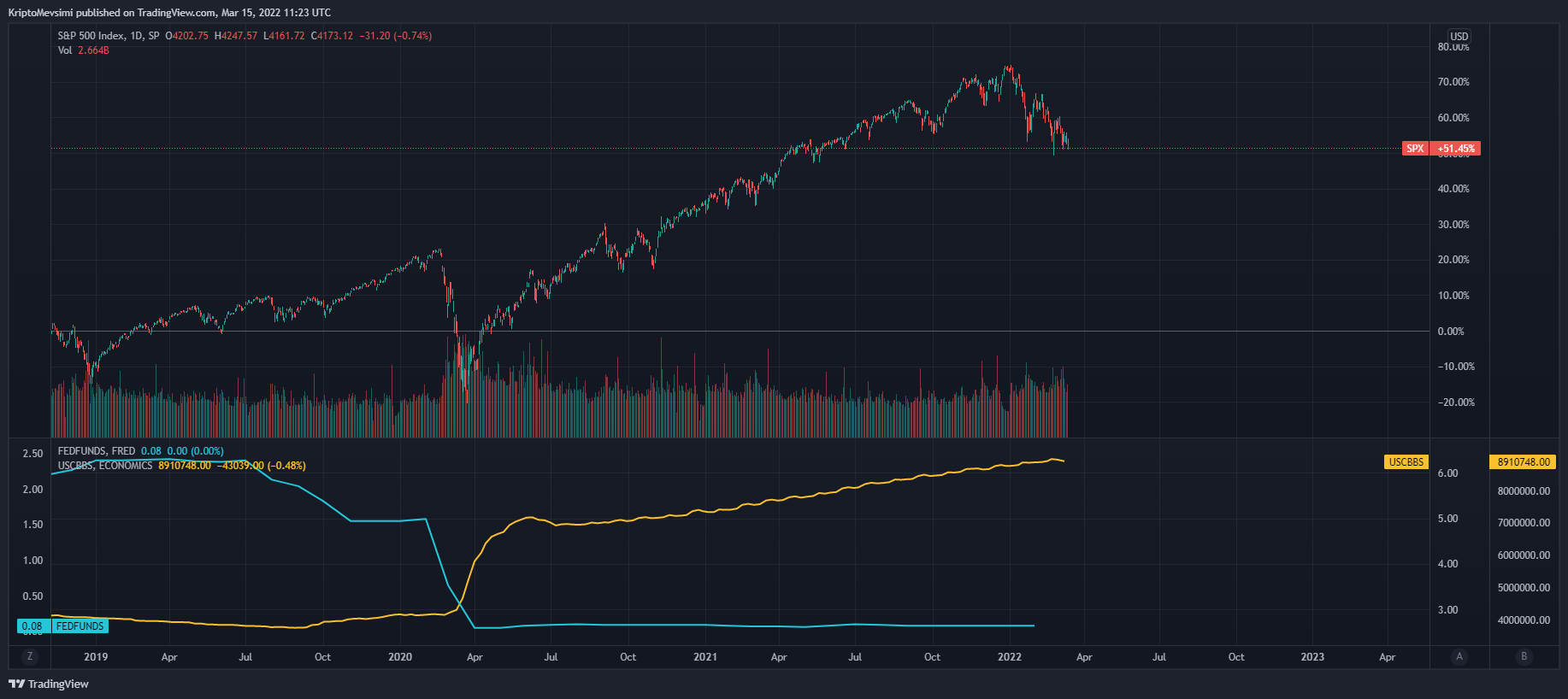

On January 17, 1991, the United States began to send its military forces to the region and launched an operation. However, during this period, the Fed cut interest rates 6 times and lowered the interest rates from 8.25% to 6.75%. It continued to lower the interest rates until 1992 and brought it up to 3%. During this period, oil prices also normalized because the risks were gone. In the chart below, you can see the Fed’s intervention in interest rates with the blue indicator.

Six weeks after the start of the war, the conflict was resolved and Saddam Hussein was forced into peace. The Fed did not stop during this period because in the 1980s, there was an economic infrastructure that got used to the 15% inflation level and was improving, and when the war started, inflation was only 4.5%. When you look at it today, you may say it is too much, but if you think that it went down from 15% to 4.5% in 1980, you can understand how comfortable the Fed is.

When we look at the current situation, we can see that the aggressive war position pursued by Russia geopolitically can go further than the Gulf war crisis. If we compare Putin today with Saddam Hussein in the 1990s; It is a much greater threat than the threat Iraq could pose to Europe and the United States. It has the potential to go much further.

At the same time, the Fed is not in the same position. The Fed is not in a position to bring the markets to their senses by reducing interest rates today. As you can see from the chart below, we are in a period where the Fed’s balance sheet is at the highest levels in history, that is, it has poured a lot of money into the market and as you can see in the blue, the policy rate is 0.

In other words, the argument that the markets react negatively in case of war by only looking at the chart while making historical comparisons, and that everyone will fall is not correct.

Each historical condition must be evaluated in its own context, it has its own conditions and these conditions may be singular, so it is necessary to avoid making general statements or inferences.

The period we are in is unique and will be a period in which many investors, even Bitcoin, will experience it for the first time. For the first time, it will try to survive in a period of serious monetary tightening, face an aggressive Fed rate hike for the first time, while geopolitical risks and recession possibilities will be on the table.

For these reasons, of course, the bull is always hopeful, let’s accept the reality of the crab market, but I would say it is essential to prioritize the risks by planning according to the bear market.