It started trading on the stock exchange for the first time on September 7. ebebekwhile going public Opening a store in the UK in 2024 And E-commerce to Europe via Germany He set out with the aim of starting a

Not forgetting their employees, they participated in the public offering of 800,000 shares. It was distributed to 1,107 employees. Thus, an average of 722 shares were distributed per person. We can calculate its value with the public offering price of 46.50 TL. In this situation The total cost is 33,573 TL.

Individual investors “due to record participation” maximum 6 pieces i.e. 279 TL They were able to own ebebek shares worth

So, how much profit/loss did an ebebek employee and an individual investor make by purchasing 722 shares and holding them at a cost of 33,573 TL?

On the stock exchange on September 7 ebebek, which started trading for the first time, until September 14 It reached the peak price by seeing a ceiling. If we look at the latest version when this content was written, this price is 66.45 TL. Closing prices on Friday, October 20. Agendas such as the Israel-Palestine events are cited as many reasons for this decline, but that is not our topic today. So let’s continue our content.

Source: Midas

An employee who participates in an IPO and buys average lots based on the peak price Reached a portfolio value of 59,385 TL When we deduct our costs from this value, we reach the net profit and this exactly 25.811 TL! In other words, this stock started its public offering on September 1 and started trading on September 7; Our investor, who is a company employee, After 14 days, he was able to reach 25,811 net earnings.

Some of them may have existed before and some may have continued until today. And while the stock market index has fallen so much during this turbulent period, Let’s look at its earnings according to current prices and talk accordingly:

The most current share value is 66.45 TL according to the closing prices of October 20, at this point the total Our portfolio value decreased to 49,976 TL. However, we should point out that when we deduct the cost, what remains is net income 14.403 TL. In other words, according to the current prices on October 20, our investor He was able to earn 14,403 TL from the public offering.

Although there is a significant difference compared to the peak price, “compared to individual investors” in this period when the index fell so much and wars broke out. Not a bad profit. Of course, we cannot know what it will do in the long run, but this is the situation according to the peak price and current price.

Let’s also look at the individual investor;

At the beginning of our content, the individual investor maximum 6 lots We said you could get it and The cost of this is 279 TLwas. Had it sold at the peak price 214 TL net gain According to current figures, small investors The net profit is exactly 120 TL!

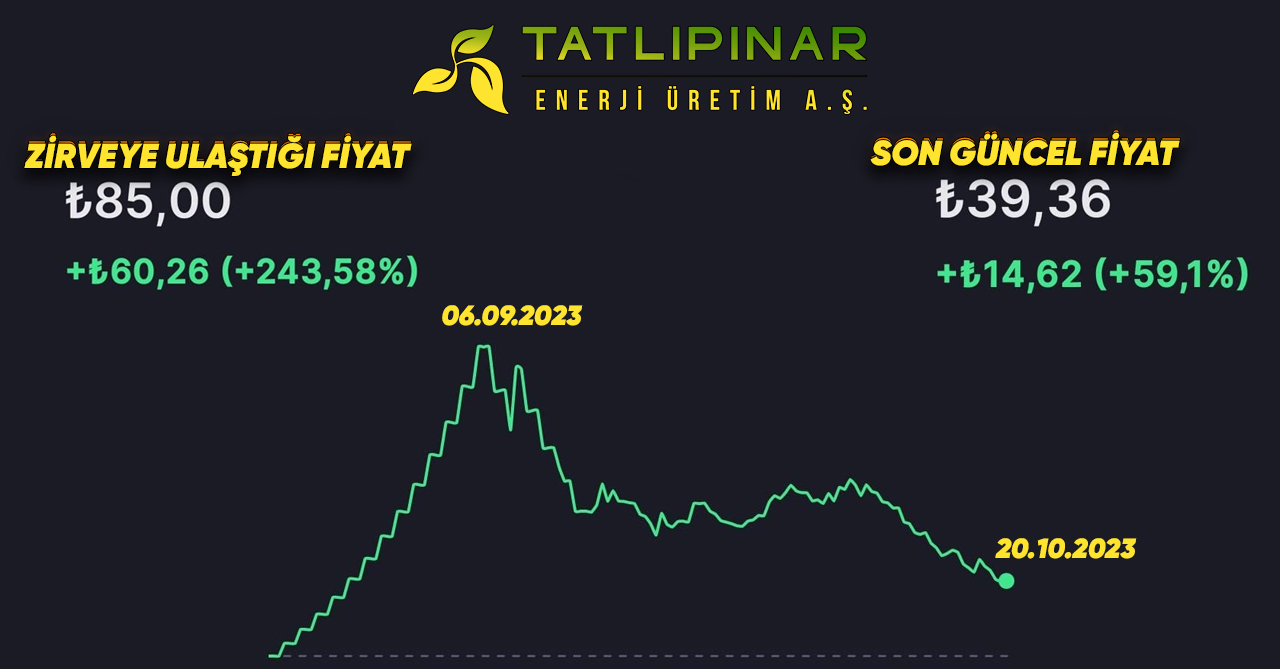

Let’s consider the situation with the energy company “Tatlipınar Enerji”:

One of Turkey’s richest businessmen Ali AğaoğluOwned by and offered to the public in August Tatlıpınar Energy Production to its employees at a total price of 22.50 TL, which is the public offering price. Distribution of 682,126 shares He had done it.

According to the results of the public offering In the public offering attended by 237 company employeesa maximum of 2,878 shares were distributed per person. For individual investors maximum 23 lots shares were given, the cost of which was exactly 517 TL.

Source: Midas

In other words, the companies that started collecting demand for the public offering on August 10-11 Tatlıpınar Energy, On the stock exchange on August 17 It started trading for the first time. It seems to have reached its peak price at this point, having seen a ceiling repeatedly until September 6. If we look at the most current share value while writing this content, this price is 39.36 TL. Closing prices on Friday, October 20.

An employee who participated in the public offering according to the peak price and bought the maximum lot, this time exactly Reached a portfolio value of 244,630 TL. When we subtract the cost from this portfolio (22.50 TL x 2878 shares), we get the net gain: 179.875 TL

Latest share value Based on October 20 closing prices 39.36 TL, at this point Our total portfolio value decreased to 113,278 TL and we subtract our cost again to look at our current net profit: 48.522 TL (current net income)

So our investor will benefit from this #TATEN IPO based on October 20 weekly closing prices. He was able to earn 48,522 TL. Although there is a significant difference compared to the peak price, it is obvious that it is not an insignificant amount in an environment where the index has fallen so much.

So, let’s see if the same situation applies to individual investors?

Maximum 23 shares distributed per person In case of individual distribution plan If the individual investor sold at the peak price with a cost of 517 TL 1437 TL net profit He could get it. When we look at current statistics, The small investor’s gain from this public offering is only 387 TL.

Perhaps the profits of institutional investors will be the subject of another content. Because that is a completely different topic. However, it is obvious how the profits of investors who can buy more lots increase. Especially in this period when the companies that have been offered to the public since the beginning of the year have not yet fallen below the “public offering price” for some.support for home economy” for some “allowanceIt would not be wrong to say that this trend is a serious investment source for large investors.

RELATED NEWS

Those who are entering or thinking of entering into a public offering in the stock market, here: It would be beneficial for you to listen to these recommendations given by experts.

RELATED NEWS