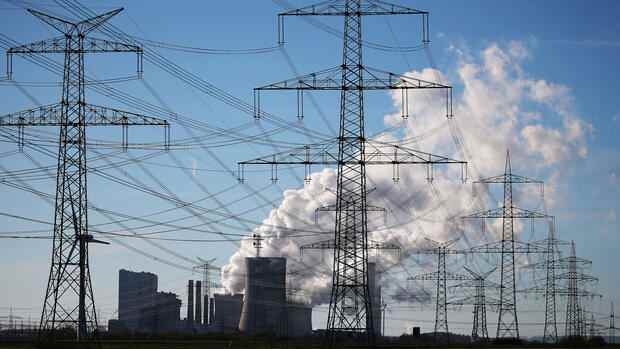

With its new strategy, RWE is focusing on renewables.

(Photo: dpa)

While the climate conference in Glasgow ended with a massive delay and some dissatisfied participants, the largest CO2 emitter is presenting a strategy that has it all.

The Essen-based energy giant RWE has now actually sealed the change from a fossil fuel company to a green global player. In the next eight years alone, 30 billion euros are to flow into the expansion of wind, sun, storage and hydrogen. By then, at the latest, RWE wants to present a renewables portfolio with a capacity of 50 gigawatts. That is almost as much as all of the wind energy currently available in Germany. RWE is making one fact more than clear: the strategic direction of a company has only one catchphrase: sustainability.

Because of course there is no activism behind this U-turn, let alone a newly discovered love for the environment. It is the pure survival instinct that makes RWE from the dirty coal company to one of the largest providers of green energies in Europe. As former CEO Rolf Martin Schmitz said: “RWE has been producing electricity for 120 years. Now the way is changing. ”

The economy has recognized what politicians sometimes still shy away from in the final analysis – turning away from fossil fuels is inevitable. Although specific exit dates are often still missing, for example the end date for the production of cars with combustion engines in Germany or the end of coal-fired power generation in China, many companies simply no longer have time to wait for final laws.

Top jobs of the day

Find the best jobs now and

be notified by email.

Like the chemical giant BASF, they secure their own access to green electricity or, like the oil companies BP and Total, are selling more and more fossil fuel capacities, although an exit from crude oil is not even rudimentarily discussed. The companies are building ahead, the ambitious climate targets in Brussels and many other regions of the world have made sure of that.

The strategic realignment is therefore logical for corporations like RWE. With a view to rising CO2 prices, emissions are becoming a business risk. Even for the Essen-based company, which has stocked up on inexpensive certificates by 2030, but will then be asked to pay just like everyone else. The more renewables and the less coal and gas in the portfolio, the better for RWE’s balance sheet.

Anyone who looks at the numbers without climate activism or idealism can now only have one logical conclusion: ecology and economy will go hand in hand in the future.

More: From a coal company to a green global player: this is how RWE wants to manage the conversion