On-chain analyst Willy Woo said Bitcoin The price is predicted to retest the $39,000 level before a potential rally. does.

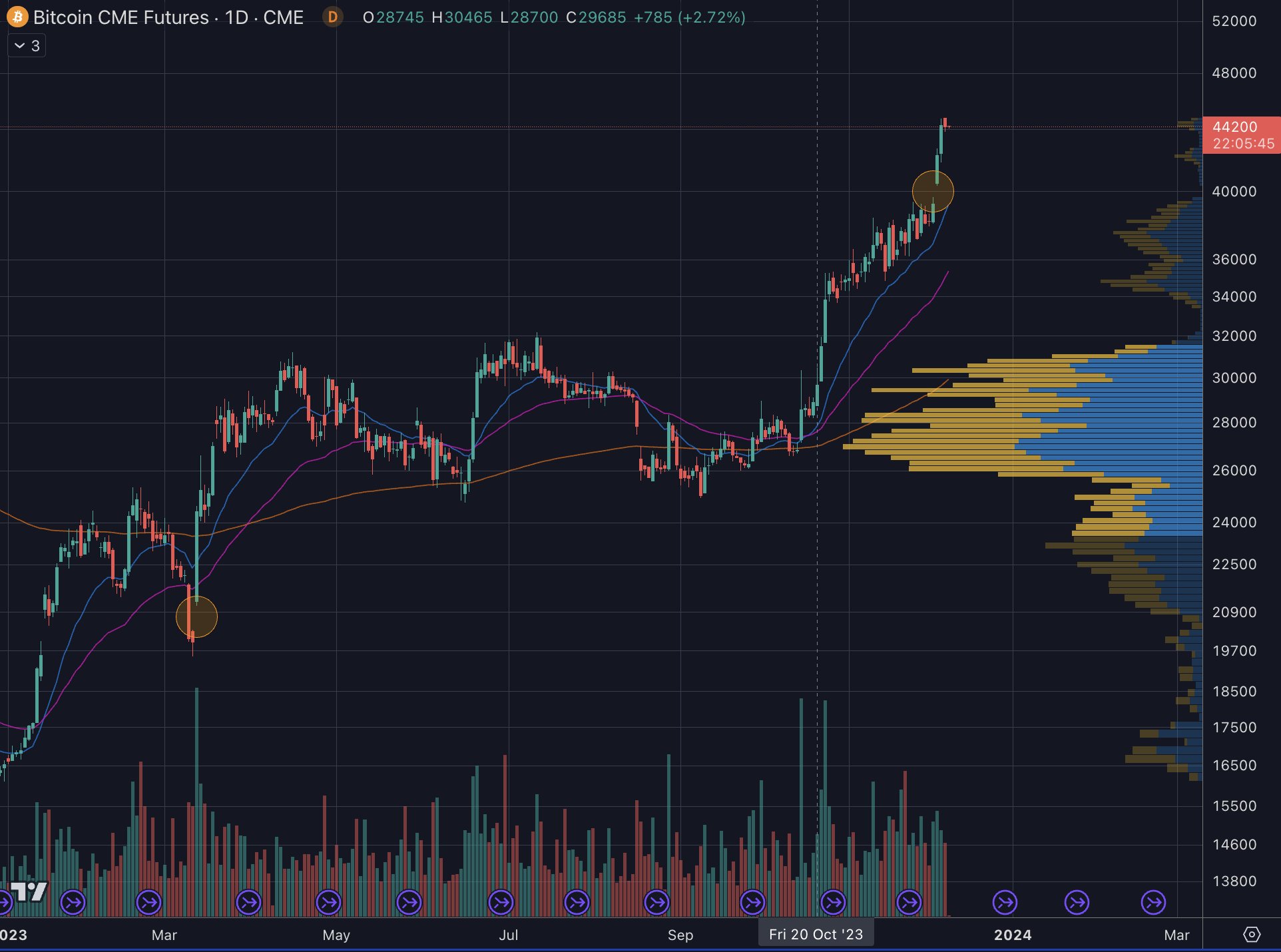

Woo says BTC has a gap near $39,700 in the Chicago Mercantile Exchange (CME) futures market.

“Trading gaps” typically occur over the weekend in traditional financial markets when the price of an asset opens significantly higher than the last closing price. Generally, gaps are expected to be filled due to lack of liquidity in that price zone, but this is not certain.

Woo also found that there was an unfilled gap of around $20,000.

Bitcoin CME Gap is located at $39,700. By my count, 28 out of 30 gaps in CME daily candles have been filled (93%). The other unfilled gap is shown at the bottom left of this graph.

Woo also discusses both bull cases and bear scenarios for Bitcoin. The analyst’s list of bullish catalysts for BTC includes lower interest rates, a peak in the dollar index, and the possibility of a turnaround in global liquidity.

BULLISH case for Bitcoin:

- Rates are falling.

- Global liquidity is returning.

- DXY [ABD dolar endeksi] is peaking.

- Spot ETF (exchange traded fund) is nearby.

- MSTR [MicroStrategy] Impressive public company treasury demand for BTC indicated by buying appetite.

- Peter Schiff stated that gold is at an all-time high but BTC is not.

In his list of reasons to be bearish on Bitcoin, Woo cited the $39,000 CME gap, as well as a net influx of coins into exchanges, a technically bearish trend, and a weakening demand for BTC in the futures market.

BEARISH situation for BTC:

- Fall techniques are improving.

- Spot flows are returning to exchanges.

- CME gap is $39,000.

- Futures demand is decreasing.