Gains for Bitcoin (BTC) and crypto continue to come in for the second day as the US dollar falls. Bitcoin is back at $21,000 for the first time since September as buyers solidify gains. Famous Bitcoin analysts shared their predictions.

Bitcoin bulls want liquidity

Bitcoin hit local highs of $21,012 on Bitstamp, according to TradingView data. At press time, BTC continues to explore inaccessible regions for more than six weeks. According to data from Coinglass, $750 million in liquidity has flowed in Bitcoin alone in the past 24 hours. Cross crypto purges totaled $1.43 billion in 2022, the highest ever figure.

Meanwhile, Material Indicators, the analytics platform that tracks the order book of Binance, the largest global exchange, noted that demand liquidity has risen. In this context, he shared the following on his Twitter account:

In the last 24 hours, a large amount of demand liquidity has been defeated and some replenished. But there is no doubt that BTC bulls are getting some help as bid blocks and demand liquidity are adjusted upwards.

$21,000 is a key level for some analysts, including Crypto Capo, who previously predicted the market would pull back at this point to retarget macro lows.

Is $33,000 in sight for Bitcoin?

Until recently, BTC stalled around the psychological $19k mark. He finally broke through the $20.5k barrier. The next few days will be crucial for Bitcoin. Since it was retested and the descending downtrend line [kırmızı diyagonal] Since breaking above, the asset already has a slope of about 10%. As shown below, this is slowly approaching the next spike in resistance, where it was rejected at the beginning of September.

The 200 and 300 MAs were quite significant for Bitcoin. Over the years, the leading crypto has bottomed out around these averages. But at the moment, the price is still consolidating weekly between these two MAs.

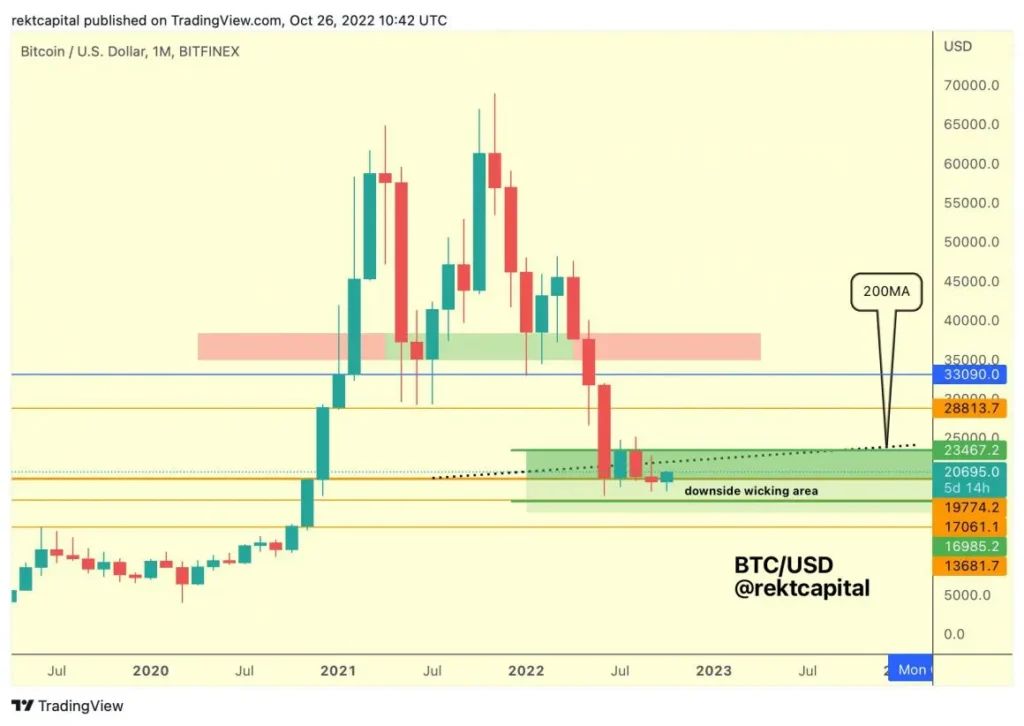

Zoomed out further, it seems that Bitcoin has yet to register a clear breakout. The analyst, nicknamed Rekt Capital, recently shared the following:

It’s easy to get excited about this recent spike in BTC’s price action. However, macro-wise, BTC is still in the historic bottom. Hence, it has not registered a major breakout yet.

Regarding the level to be considered, Rekt Capital said:

BTC will need to surpass ~$23,450 first to see stronger trend momentum.

However, when the said hurdle is overcome, it will open the doors to $28.8k and $33,000. However, these goals are long-term in nature. So it won’t be achieved overnight.

Analyst explains how Bitcoin will reach $24,000

Analyst Ali Martinez shared a chart showing how Bitcoin will move from the current $20,658 level to the $24,000 price line. Martinez says that Bitcoin is currently strengthening on a BTC chart as the weekly BTC RSI climbs above 37. The analyst notes that when a ‘continuous move’ occurs above the 21-week moving average, it will likely lead to an increase of the 200-week MA at $24,000.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.