Cardano (ADA) bulls continue to defend the $0.30 price support level amid sideways momentum in the broader altcoin market. Onchain data shows that holders are solidifying their positions rather than taking huge risks. What’s in store for ADA price in the coming weeks?

ADA price entered double-digit gains to reclaim $0.35 after Ripple’s heralded victory over the SEC. A closer look at the data shows that ADA trading volumes have soared to new highs in the past 3 months.

As regulatory concerns surrounding Cardano have now eased, the best crypto- exchanges Coinbase and Kraken have announced plans to relist ADA. Will H2 take ADA price to new heights in 2023?

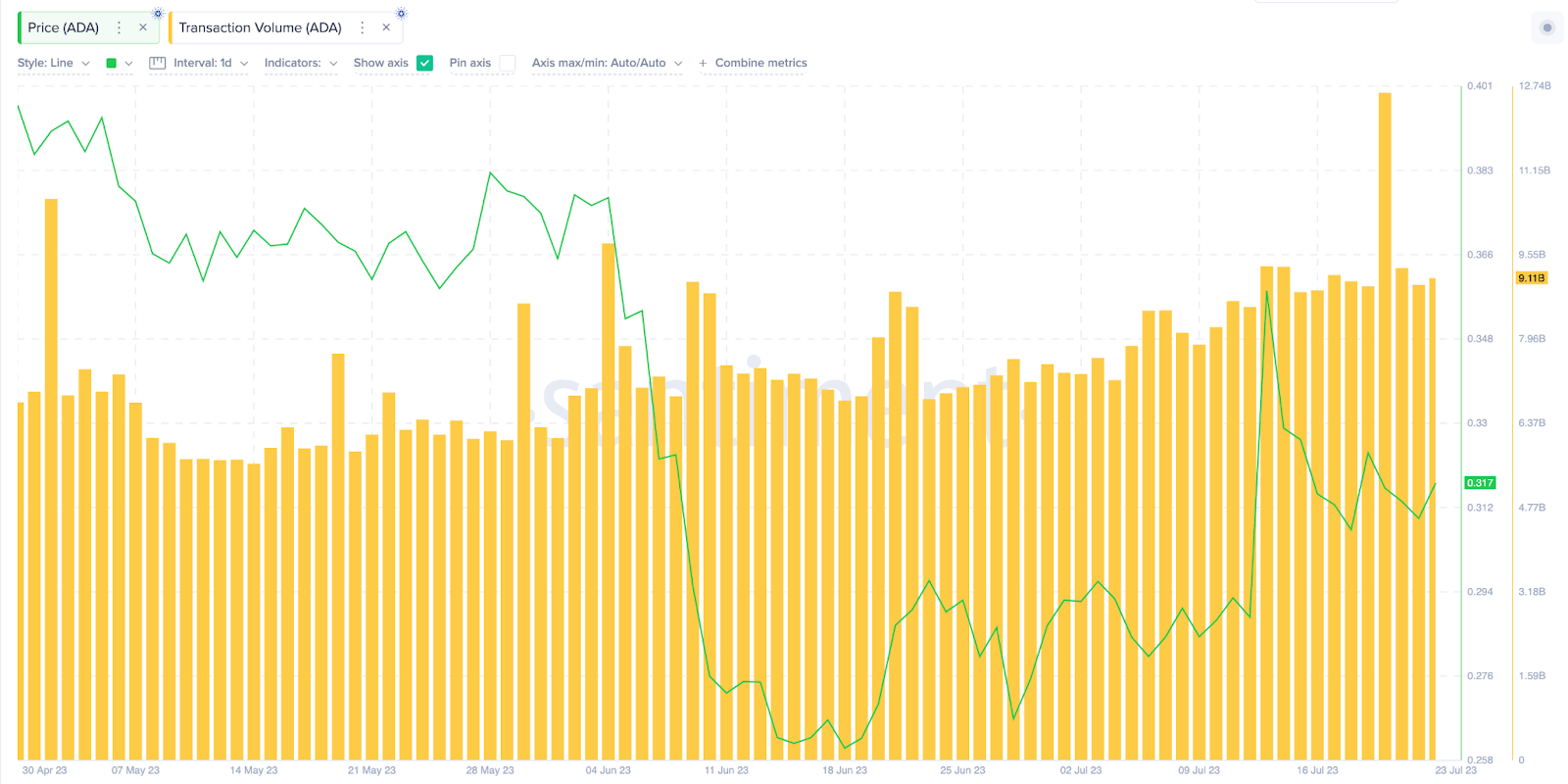

ADA Transaction Volume Reached 3-Month High

Despite the turbulent price action in recent months and widespread regulatory FUD, ADA has maintained steady growth in its trading activity, quite notably.

On-chain data provided by Santiment reveals that it reached its 3-month peak of transaction volume with 12.16 billion ADA on July 20.

This is 19% and 30% higher than the previous monthly peaks of 10.61 billion and 9.77 billion ADA recorded in May and June 2023, respectively.

If ADA continues to rise, it could create stronger momentum for the next bullish altcoin season.

Whales Consolidate Positions Ahead of Next Rally

Also, whale investors continued to HODL, even though ADA failed to make big gains in the past week. Santiment reports that crypto whales banking 10 million to 100 million ADA have kept their balances relatively stable since June 20.

The chart below highlights that they kept their balance at 12.21 billion coins between July 20 and July 24.

Whales’ Wallet Balances monitors the trading activity of large institutional investors and high net worth holders within a blockchain ecosystem. The whale’s HODL firm, as seen above, reflects its neutral tendencies as it awaits future changes in market conditions.

With the upcoming launch of the Hydra Pay product and potential relisting by several top exchanges, cardano trading volumes could reach new highs in the coming months.

So it’s only a matter of time before bull whale traders get out of the current consolidation mode and start taking Long positions on ADA again.

ADA Price Forecast

Recent price movements and whale trading activity suggest that the short-term market sentiment surrounding ADA is largely neutral.

However, critical on-chain signals such as trading volume growth, upcoming stock market relistings and product launches are also giving medium and long-term bullish signals.

Because, AltcoinsIt looks more likely to hold the $0.30 support level and push the $0.35 price target.

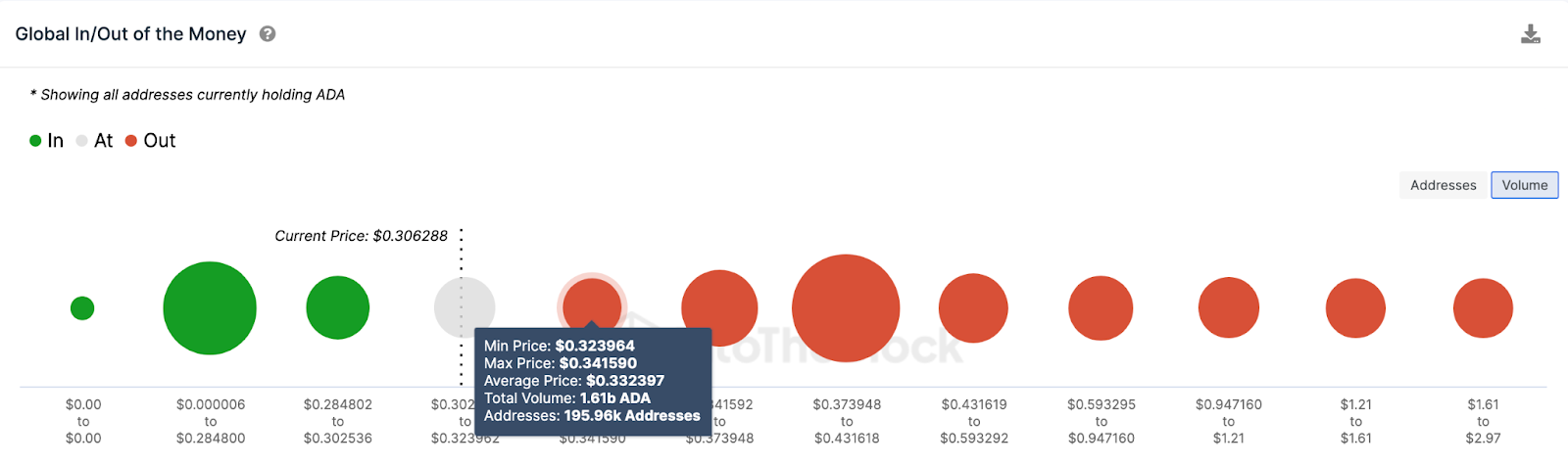

However, strategic bulls will be wary of the $0.33 resistance level. As shown below, 196,000 investors purchased 1.61 billion ADA coins at an average price of $0.33. ADA could enter a mid-retracement if traders choose to exit their positions once they are even leveled.

However, if ADA trading volume growth feeds the bullish momentum as predicted, ADA could regain its $0.35 target.

Although unlikely, the bears have little chance to thwart their bullish rhetoric if ADA drops below $0.25. However, the $0.29 support level is currently looking pretty tough.

As shown above, 64,000 investors purchased 2.1 billion ADA coins at an average price of $0.29. They may show bullish support to avoid falling into a net loss position.

However, if this support level fails to hold, ADA could decline towards $0.25