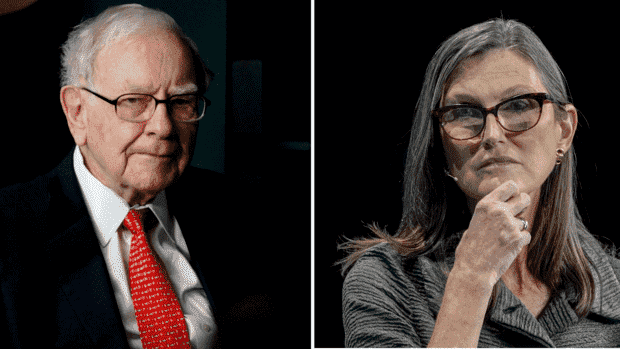

The two star investors represent two extreme positions with their two investment approaches.

(Photo: Reuters)

New York, Dusseldorf Warren Buffett was almost written off: The investment strategy of the 91-year-old star investor seemed outdated, and he was mocked in trading forums for missing important future trends. But now his focus on value-oriented securities is more in demand than ever. Last Friday alone, he earned almost ten billion dollars with Apple’s price jump.

It marks a remarkable turnaround in the world of celebrity investing: his company’s stock, Berkshire Hathaway, has overtaken the flagship fund of Cathie Wood, Ark Invest’s CEO.

Since the beginning of 2020, the Berkshire paper has gained almost 38 percent. Wood, known for her focus on disruptive companies and the star of the pandemic, returned 36 percent on her exchange-traded fund (ETF) ARKK.

Read on now

Get access to this and every other article in the

Web and in our app free of charge for 4 weeks.

Continue

Read on now

Get access to this and every other article in the

Web and in our app free of charge for 4 weeks.

Continue