Gold prices climbed to a two-month high on Wednesday and the precious metal finished in positive territory for the first time in four sessions. Analysts’ market assessments and forecasts for the gold price cryptocoin.com compiled for our readers.

“These developments could turbocharge the price of gold to $2,000 or more”

The modest rise for bullion comes as the US dollar weakens, Treasury yields fall after a sharp rise, helping to boost investment interest in the precious metal. Michael Armbruster, managing partner of Altavest, said in a statement:

Gold couldn’t be more bullish over the next six months as the US economy began to slow. The price action of gold is particularly bullish, given that Treasury rates are on the rise. We think Treasury yields will peak soon, and if we’re right, that could turbocharge gold prices to $2,000 or more.

Marketwatch strategists say that the decline in equity markets and gold are often priced in, and the weakness in the dollar has helped mitigate some of gold’s decline.

Naeem Aslam: Rising interest rates reduce gold’s appeal

In his daily note, AvaTrade chief market analyst Naeem Aslam comments:

The high volatility and decline in the equity markets helped the precious metal to cover its losses to some extent.

The expectation of a series of rate hikes by the US Federal Reserve has had the biggest negative impact on gold, as higher interest rates blunt the appeal of non-yielding gold. The Federal Open Market Committee (FOMC) will meet on January 25-26 and will announce its interest rate decision. Naeem Aslam says:

Investors should understand that higher interest rates increase the opportunity cost of holding interest-free assets, making gold less attractive to investors.

Gold was often used as a hedge against inflation. “Still, given the projections of more rate hikes this year than the markets are pricing in, not to mention the larger individual increases than we’ve seen in years,” said Craig Erlam, senior market analyst at OANDA.

We’re seeing hedging buying from traders who think that perhaps central banks aren’t doing enough to take down price pressures.

Gold price continues to target $1,877, according to Pablo Piovano

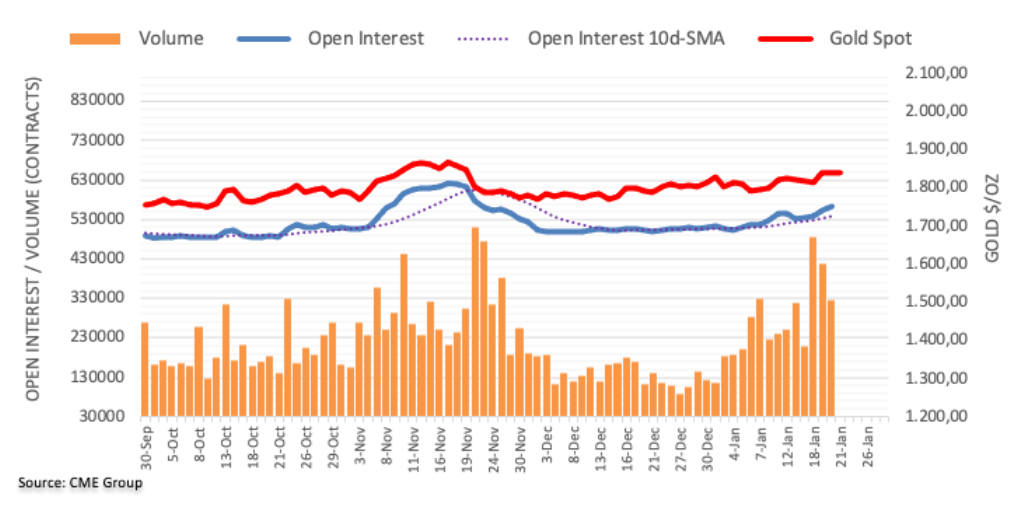

Open interest on gold futures markets rose for the fourth consecutive session on Thursday, this time with around 9.2k contracts, according to preliminary figures from CME Group. Instead, volume clinched the second consecutive daily pullback, now with around 91.3k contracts.

Gold broke new highs near the $1,850 level on Thursday before ending the session marginally lower. According to market analyst Pablo Piovano, the slight decline was in the midst of rising open interest, which could signal further downside in the very near term. Looking at the broader picture, the analyst states that the precious metal continues to target the November high of $1,877 (November 16).

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Disclaimer: The articles and articles on Kriptokoin.com do not constitute investment advice. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, asset or service in this article.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.