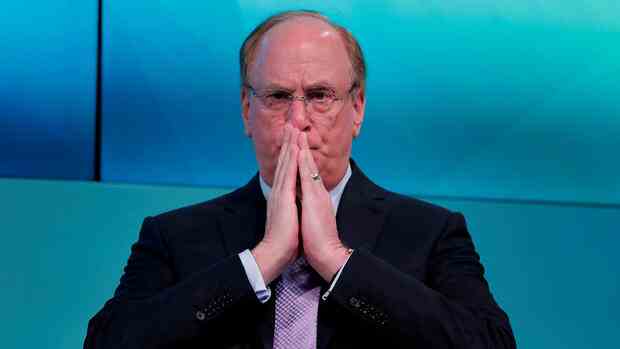

In a letter to customers and investors, Blackrock’s CEO forecasts inflation of 3.5 to 4 percent in the medium term.

(Photo: Reuters)

Frankfurt Larry Fink, CEO of the world’s largest wealth manager Blackrock, expects persistently high inflation in the future and, given the collapse of the Silicon Valley Bank (SVB), wonders whether more “dominoes” could fall. However, it is still too early to foresee the entire damage.

Many companies and states find themselves in a conflict of objectives between price and security. Some executives chose to trade efficiency and low costs for resilient supply chains and political certainties.

As a result, product prices will remain high in the medium term and will be more difficult for central banks to control. “Therefore, I assume that inflation will be closer to 3.5 or 4 percent in the next few years,” writes Fink in a letter to investors and customers.

Fink also goes into the price of the supposedly cheap money and refers to the collapse of the SVB. This is a classic case of a mismatch between assets and liabilities and a consequence of years of low interest rates.

However, it is still too early to know how widespread the damage is. Although the supervisors reacted quickly and decisively, the markets remained extremely tense.

It is also not yet known whether the SVB crisis will spill over into the regional banking sector with further receiverships and closures. Fink points to the crisis in the US savings banks in the 1980s and 1990s, which lasted for a decade.

Risks of illiquid investments

In Fink’s view, it is inevitable that some banks will lend less in order to strengthen their balance sheets. He also expects stricter capital requirements for financial institutions. This will lead to the capital markets becoming more important for financing.

>> Read here: Interview with economist Goodhart – “The new normal for inflation will be between three and a half and four percent”

The first domino that ended the years of cheap money and the ultra-loose interest rate policy was the interest rate hikes by the US Federal Reserve. In 2022, she had raised interest rates by 500 basis points. The bankruptcy of the SVB is now the second domino.

The third domino that could fall is risks related to liquidity, according to Fink. In recent years, investors have increased their funding commitments for illiquid assets in order to achieve higher returns. Fink does not name an asset class, but illiquid vehicles include private equity, certain real estate investments and private credit funds.

Now, according to Fink, there is a risk that there will be problems with liquidity management. The danger is even higher when outside capital is involved.

The Blackrock boss expects the Fed to continue fighting inflation with high interest rates. As a result, states could no longer sustain their high levels of debt.

The US government, for example, paid a record $213 billion in interest in the fourth quarter of 2022, $63 billion more than the year before. After years of record high government spending, the time has now come for the private sector to grow economies and improve people’s living standards. That is why politicians and entrepreneurs must work together now so that the potential of the private sector can be fully developed.

More: Savings banks write off almost eight billion euros on securities