BitcoinWhile the main source of the rising trend in BTC is its limited supply, the continuing increase in demand for BTC, combined with its limit supply, allows us to watch a constantly rising Bitcoin chart over the years.

Although Bitcoin fell to $ 15,000 levels after the bankruptcy of FTX in a difficult bear market conditions BTC’The demand for continues to increase day by day.

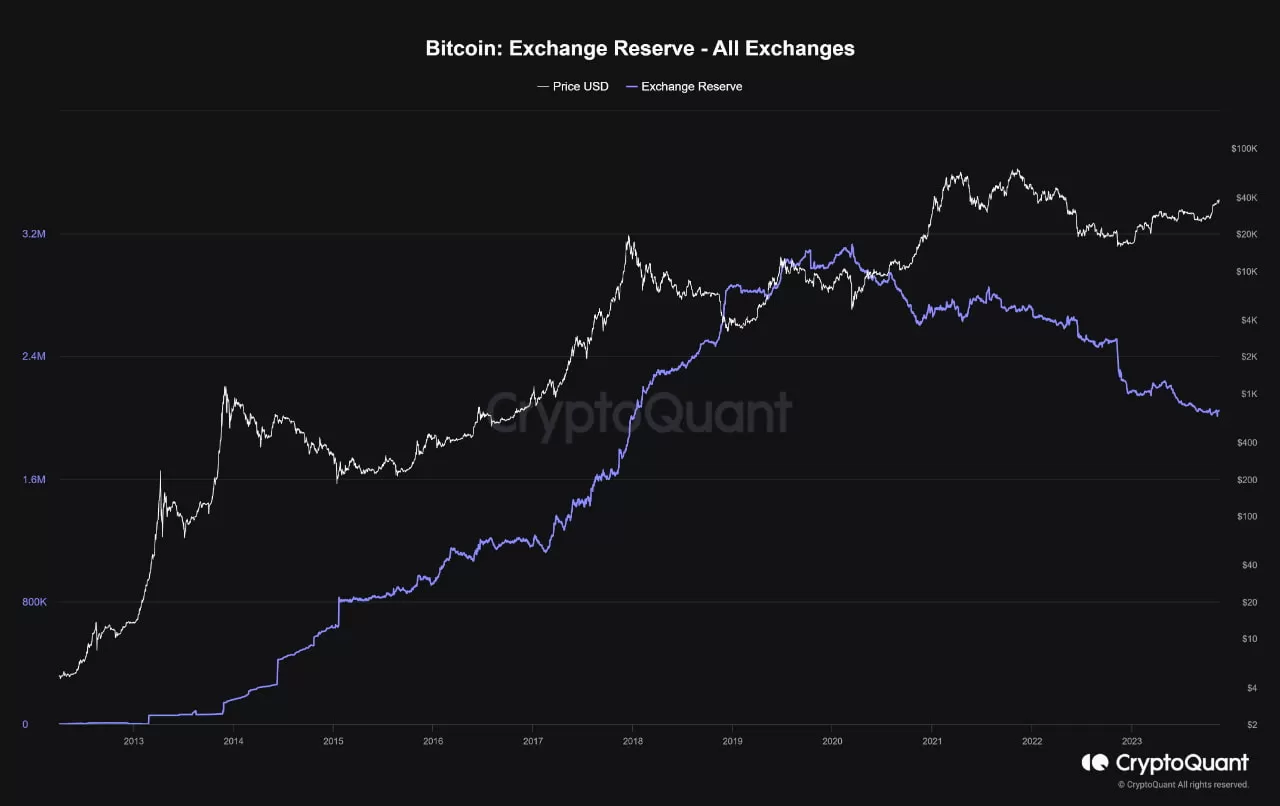

We can understand that the demand has increased from the change in Bitcoin reserves in the exchanges.

Although Bitcoin is still about 50% away from its ATH of $69,000 in November 2021, investors who believe in the future of BTC continue to accumulate BTC regardless of what is happening.

For CryptoQuant According to data, while Bitcoin foreign exchange reserves on exchanges increased steadily from 2013 to 2020, the approximately 10-year upward trend changed.

Accordingly, by 2020, investors and miners will be turning to exchanges more to trade or sell. BTC he was laying down.

However, since the end of 2020, this trend has changed, and the approximately 3 million BTC held on exchanges in 2020 has decreased by 32% in three years.

According to the data, there are currently approximately 2.04 million BTC in the exchange reserves.

The decrease in Bitcoin reserves in exchanges has led investors to transfer their BTCs to self-storage instead of keeping them on exchanges. Bitcoin While it indicates that you have withdrawn your BTC to your wallet and do not want to sell it in the short term, investors depositing their BTC into an exchange usually indicates the intention to sell.

At this point, stock markets BTC The decrease in reserves is interpreted by experts as investors prefer to hold their BTCs to evaluate potential future increases rather than selling their assets in the short term.

Experts also state that the decrease in BTC reserves means that investors’ expectations for a rise in the BTC price have increased.

*This is not investment advice.

For exclusive news, analysis and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android And iOS Start live price monitoring now by downloading our applications!