Bitcoin It triggered a sharp selling pressure in the market as the price corrected towards $40,000 earlier today. The latest decline occurred as the flow from Grayscale Bitcoin Trust (GBTC) began to move towards new BTC ETFs.

Ali Martinez pointed out that Bitcoin price movements depend on a parallel channel. According to Martinez, this indicator shows that BTC is facing resistance at the upper limit of the channel, at $48,000.

According to the analyst, BTC price risks correcting towards the lower limit and falling to $ 34,000. However, the analyst predicts that this correction may later repeat the upward movement and repeat the upper limit at $57,000.

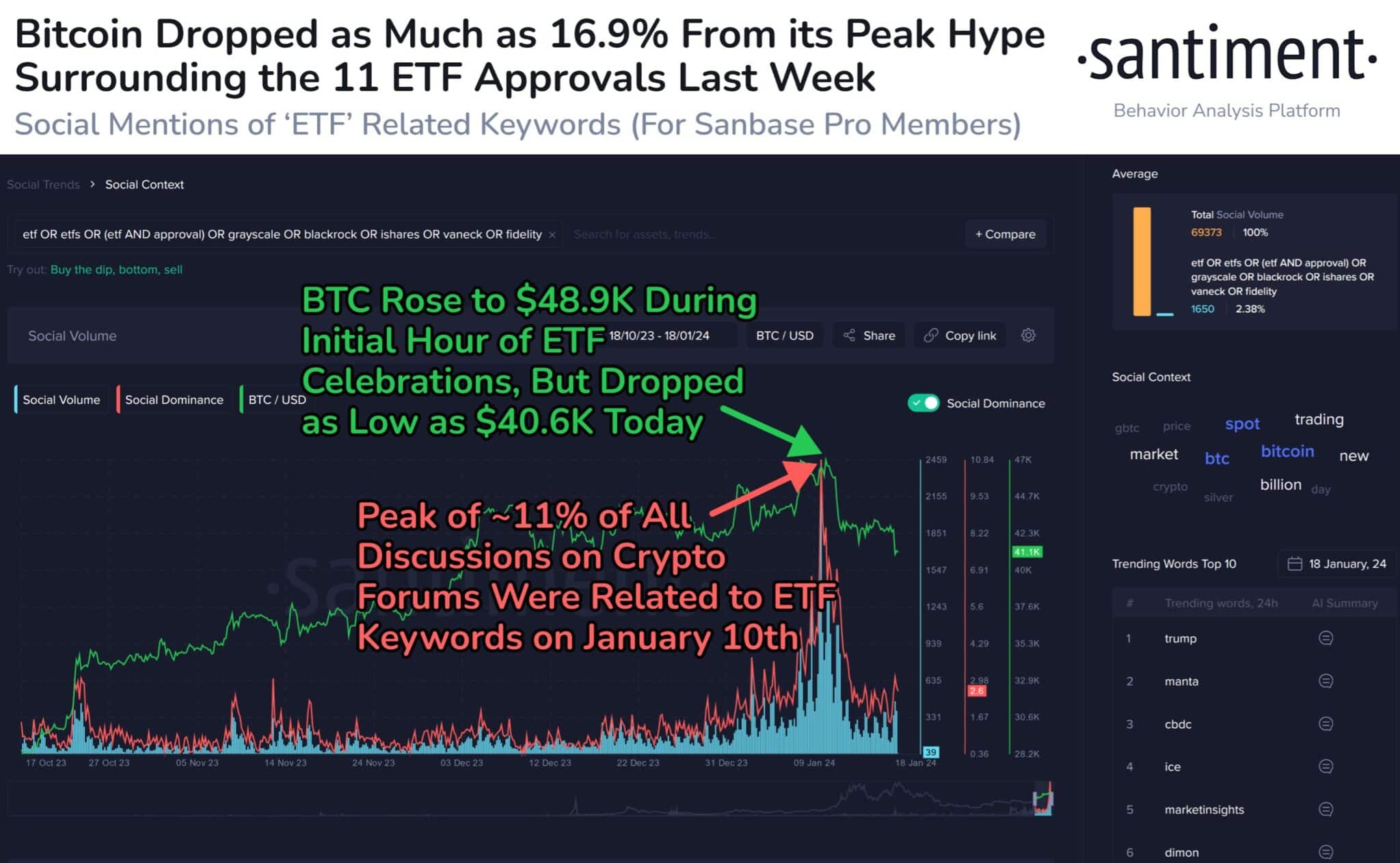

Santiment noted that existing investors are still optimistic following the approval of Bitcoin ETFs on January 10. However, sentiment may have started to change as current FOMO may have already recorded a peak price.

As Koinfinans.com reported, experts stated that the asset may have already been priced in anticipation of ETF approval.

Santiment also stated that it analyzed a number of words to gauge investors’ current sentiment. However, he stated that in general, more inexperienced investors may be fooled by FUDs and sell.

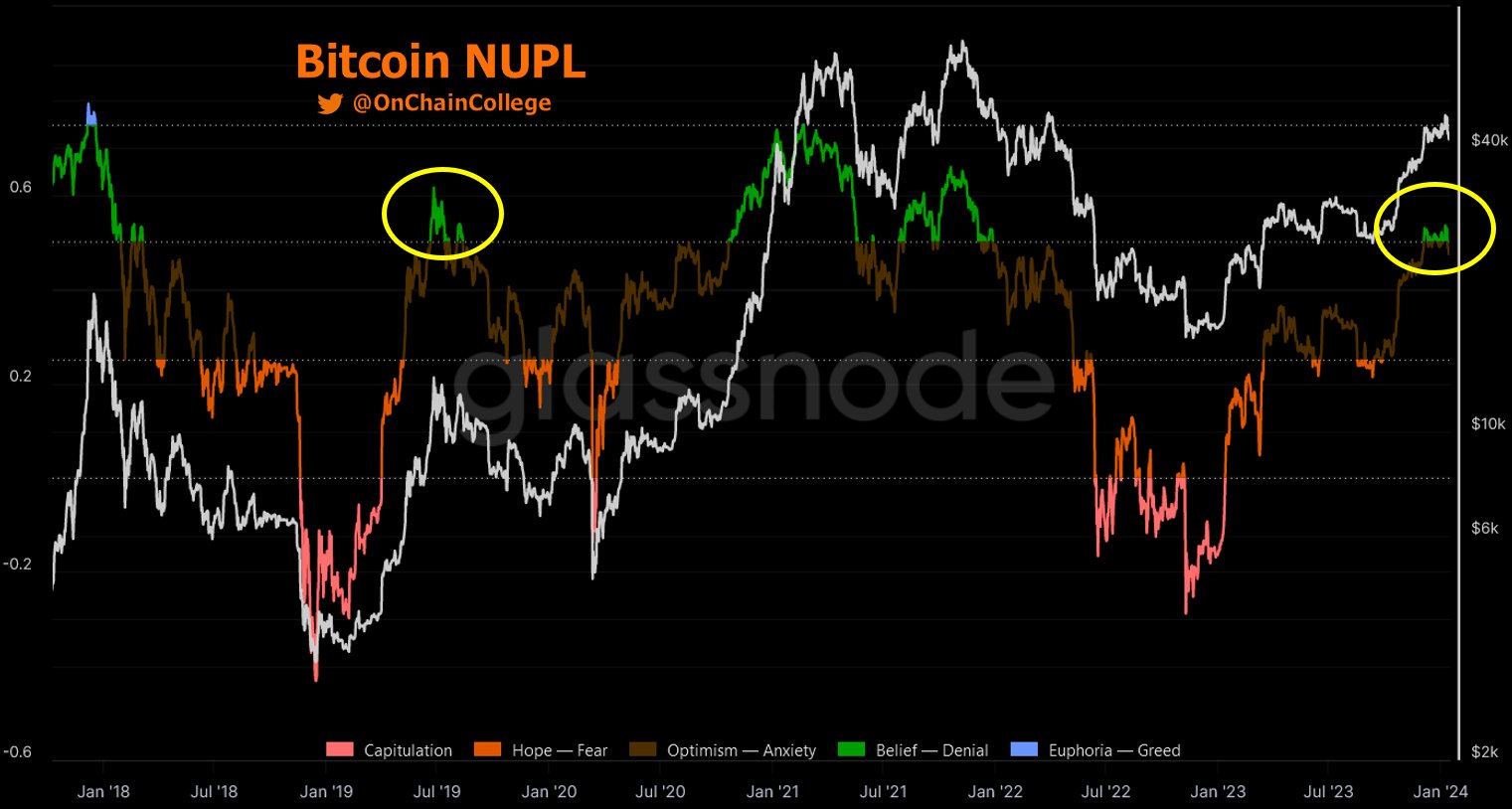

Bitcoin May Expect Multi-Month Recession

On-chain analytics platform College suggests there could be a multi-month correction or a recession in Bitcoin price. According to the analysis, such a trend does not indicate an impending bear market and could pave the way for a solid bull run in the future as the coins move into stronger hands in the market.

Considering the current conditions in the market, the “short-term cost” base of around $37,800 stands out. For Bitcoin, these levels serve as critical support/resistance levels for bulls and bears.