Crypto analyst Jamie Coutts has suggested that gold will significantly underperform digital assets in the current market cycle. According to Coutts’ analysis, gold investors’ expectations may be overshadowed by the rise of cryptocurrency in the markets.

According to Coutts’ assessment, despite the rising expectations of gold, the influence of cryptocurrencies on the markets is gradually increasing. With the emergence of cryptocurrencies as a new asset class, interest in traditional investment instruments such as gold may wane.

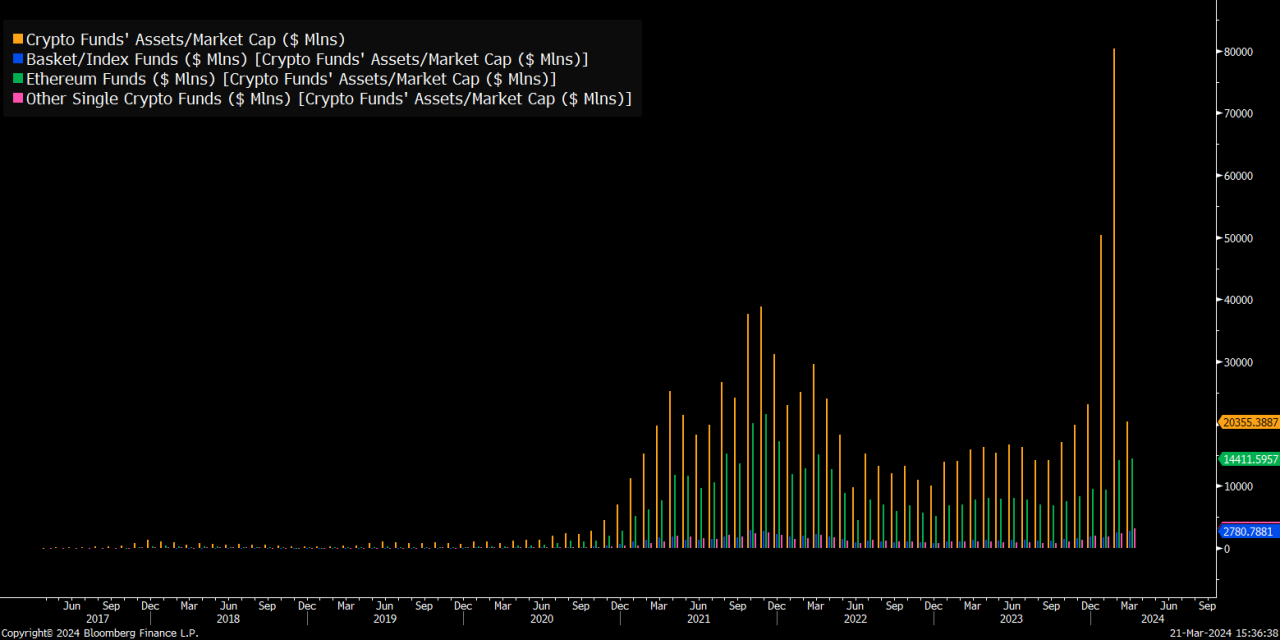

According to figures provided by Coutts, assets under management (AUM) of products (ETPs) traded on crypto exchanges are approximately $100 billion. The vast majority (80%) of this figure belongs to Bitcoin. On the other hand, the AUM of gold ETPs stands at approximately $190 billion. However, Coutts thinks that this is not a completely positive indicator for gold investors.

Although Coutts expects gold prices to rise, he thinks this cannot be compared to Bitcoin’s 2-3x rise this cycle. According to him, this signals the emergence of a new asset class.

Coutts associated Bitcoin (BTC) and cryptocurrencies with the stock market boom of the early 1980s. compared. According to the analyst, millennials will be able to outperform inflation with crypto, just as boomers have done with stock investments over the last 40 years.

“What 1982 was for the Boomer generation, 2009 is for the Y generation.

The great bull market in stocks began as Boomers fully entered the workforce.

The great bull market in Bitcoin (and blockchain assets in general) began with millennials entering the workforce at a time when governments and the boomers they represent decided to punish all subsequent generations for their mistakes.

No one was punished – rather rewarded – for the GFC (Great Financial Crisis), and regulatory capture by industry (where banks, big food, big pharma and big tech were too big to fail) got worse. The government has decided that the way forward is debt and debasement rather than restraint and decency.

Bitcoin is a purpose-built antidote for the age of debt; a new form of hard money synthesized with technology, finally a fair and transparent financial network. Moreover, it is an asset that can be entrusted to itself, from banks and governments that will seize it when needed, as has been the case throughout history and is done today through inflation.”

As a result, according to Coutts’ analysis, the rise of cryptocurrencies could surpass traditional investment instruments such as gold and usher in a new era in the markets. This may shift investors’ attention from traditional assets to digital assets and signal a period of increased importance of cryptocurrencies. However, Coutts notes that gold will still remain important as a store of value and will still be in demand under certain conditions.

Bitcoin was trading at $64,986 at press time.

You can access current market movements here.