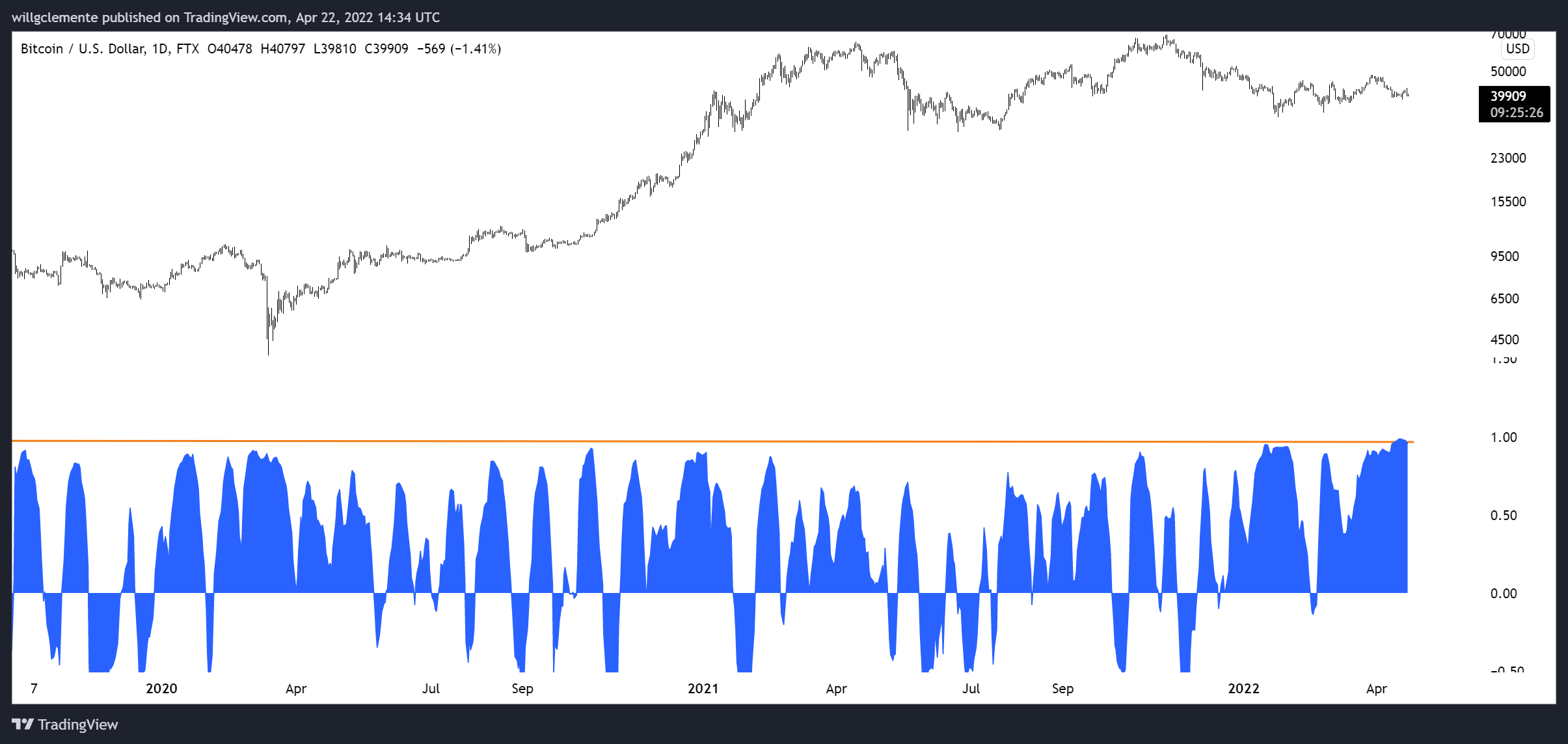

According to popular on-chain analyst Will Clemente, Bitcoin (BTC) supply dynamics will need to change for it to decouple from equities.

In a new Blockware Intelligence Bulletin, Clemente said that BTC has had an “extremely high” correlation with the Nasdaq 100 recently.

“With BTC below [Nasdaq] You can see that the daily correlation between Whether or not Bitcoin users see BTC that way, the reality is that the broader market sees BTC as a high beta asset and is merging it with technology.”

For the price of Bitcoin (BTC) to rise, Clemente says it either needs technology to recover or it needs to leave stocks.

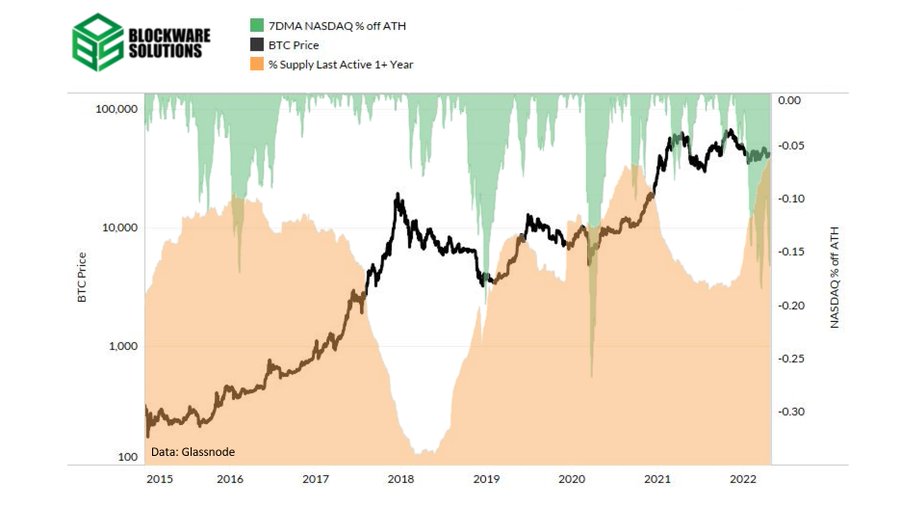

According to the analyst, a new type of buyer is accumulating BTC at current prices, which he predicts will lead to the divergence of Bitcoin and the stock market. As proof, analyst Clemente compared a chart showing the percentage of Bitcoin (BTC) that hasn’t moved in a year to a chart that tracks how far the Nasdaq is from its all-time high.

“What we’ve seen is that, despite the Nasdaq falling nearly 20% from its all-time high, about 64% of Bitcoin’s circulating supply has not moved. To me, this illustrates the fact that there is a convinced base of long-term Bitcoin believers/HODLers who use BTC as a store of value despite unprecedented uncertainty in global markets.”

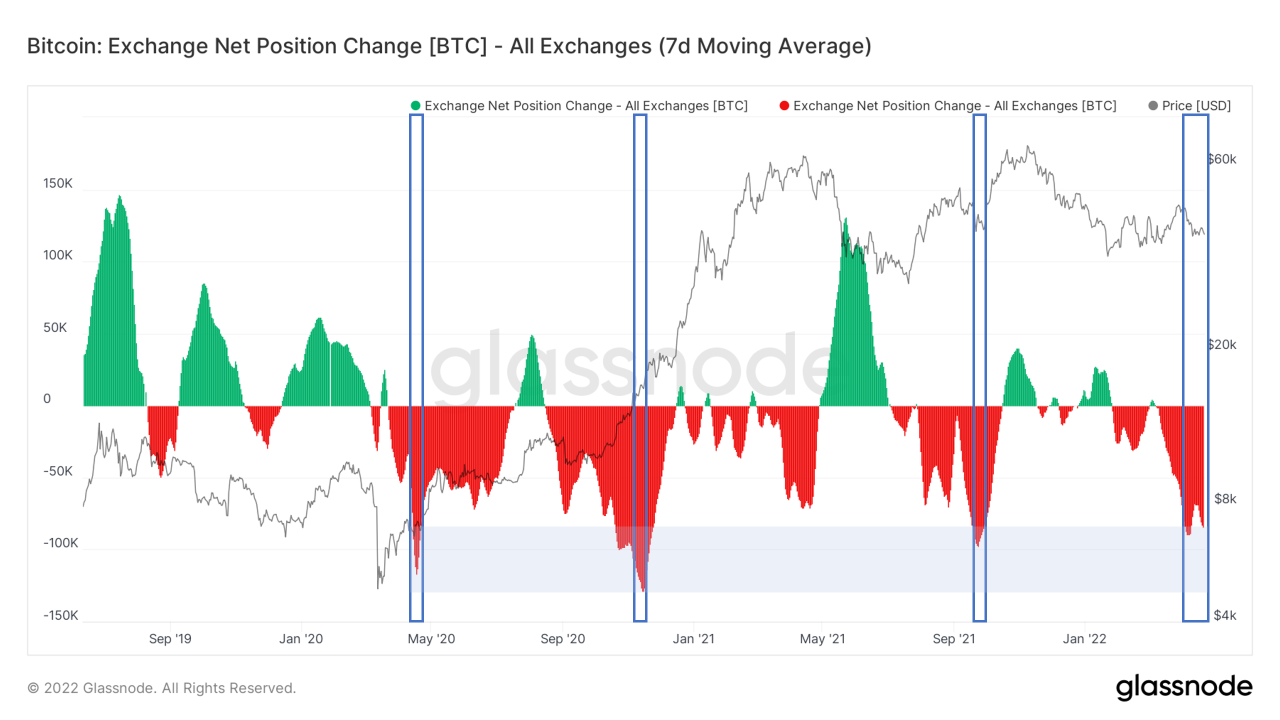

Clemente also added that Bitcoin stock market exits are emerging. Additionally, whales have been accumulating BTC for a month, according to the analyst.

“I think the story of this bear market is from traditional financial institutions trading correlations to long-term doomed crypto natives, [yüksek net değerli] It is a transfer of supply to individuals and prospective institutions. Once this supply transfer is complete, I suspect we may at least see a long-term multi-week correlation.”

You can check the price movements here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.