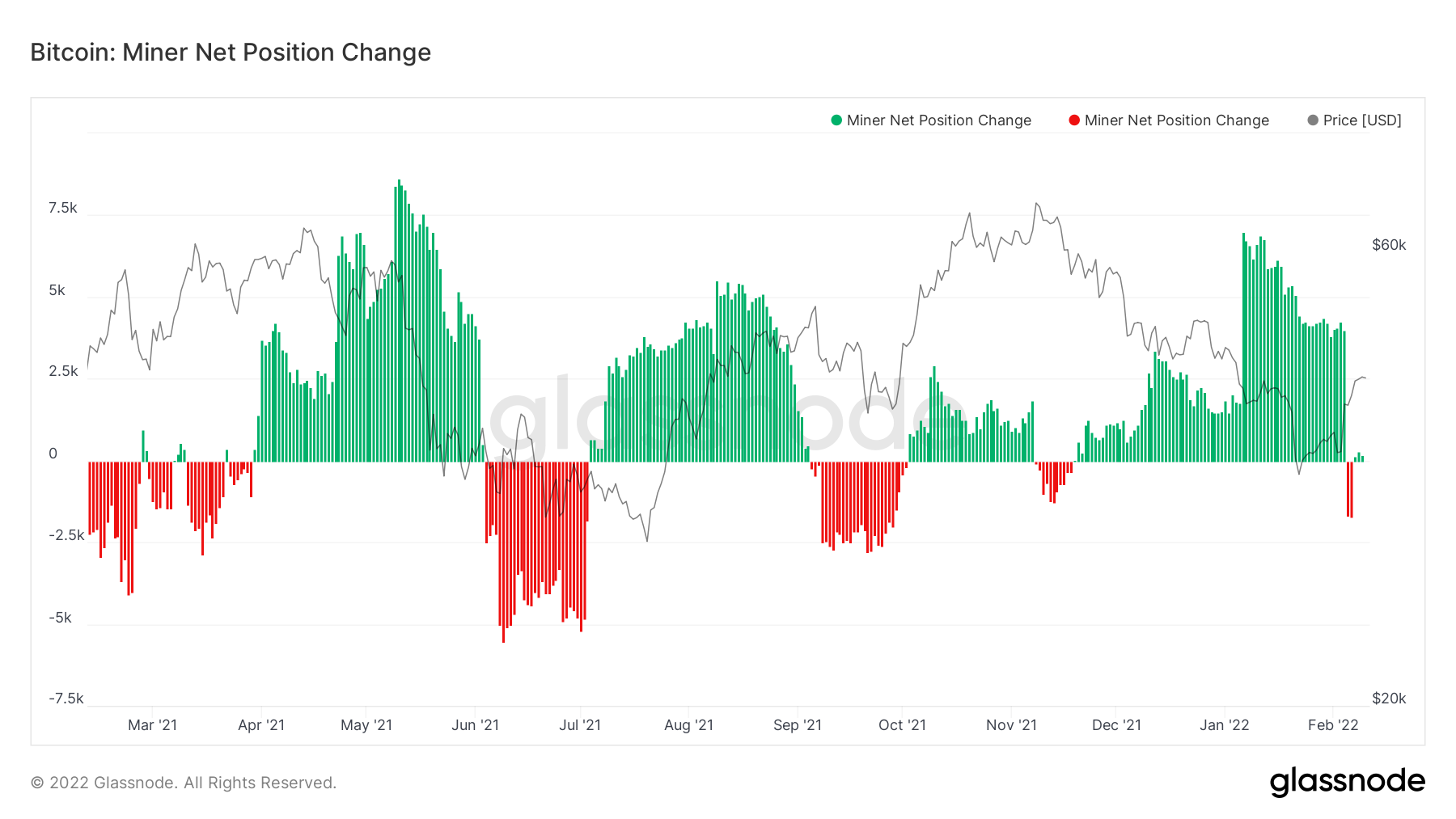

According to Glassnode data, bitcoin An indicator that tracks BTCs held by miners has entered negative territory for the first time since mid-November.

Net Amount of Bitcoin Exchanges Held by Miners Turned Negative on Feb. 5

The indicator, which scans a 30-day timeframe, turns negative from February 5th, Bitcoin miners gain crypto coins It means it’s starting to sell.

According to research firm Delphi Digital, Bitcoin miners continued to hold cryptocurrencies even when the BTC price dropped below $35,000. However, since the BTC price is still far from its peak in November, it is thought that miners are selling their coins in order to cover their costs and invest in more powerful equipment.

Major Mining Companies Remain in “HODL” Mode

The stock prices of the world’s largest mining companies, on the other hand, started to recover after their latest decline. Shares of Marathon Digital Holdings, Riot Blockchain, Stronghold Digital Mining and Hut 8 Mining are trading roughly 40% higher than in January.

The sale move by small-scale mining companies may have been the result of strategic thinking to buy more BTC equipment.

Marathon and Hut 8 said in a statement to Bloomberg that they did not sell any during the last drop. Charlie Schumacher, spokesperson for Marathon Digital, said:

“We’ve been in the ‘hodl’ position since October 2020, we haven’t sold a single satoshi.”

Sue Ennis, head of investment relations at Hut 8 Mining, explained their company’s policy as follows:

“We believe in Bitcoin. Some miners sell their BTC to cover their expenses. We will keep what we have.”

Riot and Stronghold mining companies did not make any statements on the subject.