Recently, the Bitcoin price has become a matter of great curiosity for many investors and analysts. TechDev, one of the widely followed analysts, believes that Bitcoin (BTC) is poised for a parabolic rise despite recent price declines. According to TechDev’s analysis, conditions on Bitcoin’s two-month chart suggest that BTC is almost ready to witness a price explosion.

According to TechDev’s assessment, Bitcoin’s recent price chart bears similarities to previous major bullish periods. In particular, Bitcoin rose from $ 13,000 to over $ 29,000 in just two months towards the end of 2020, and the analyst points out that a similar explosion may occur. Accordingly, Bitcoin may increase by more than 120% and reach 140 thousand dollars.

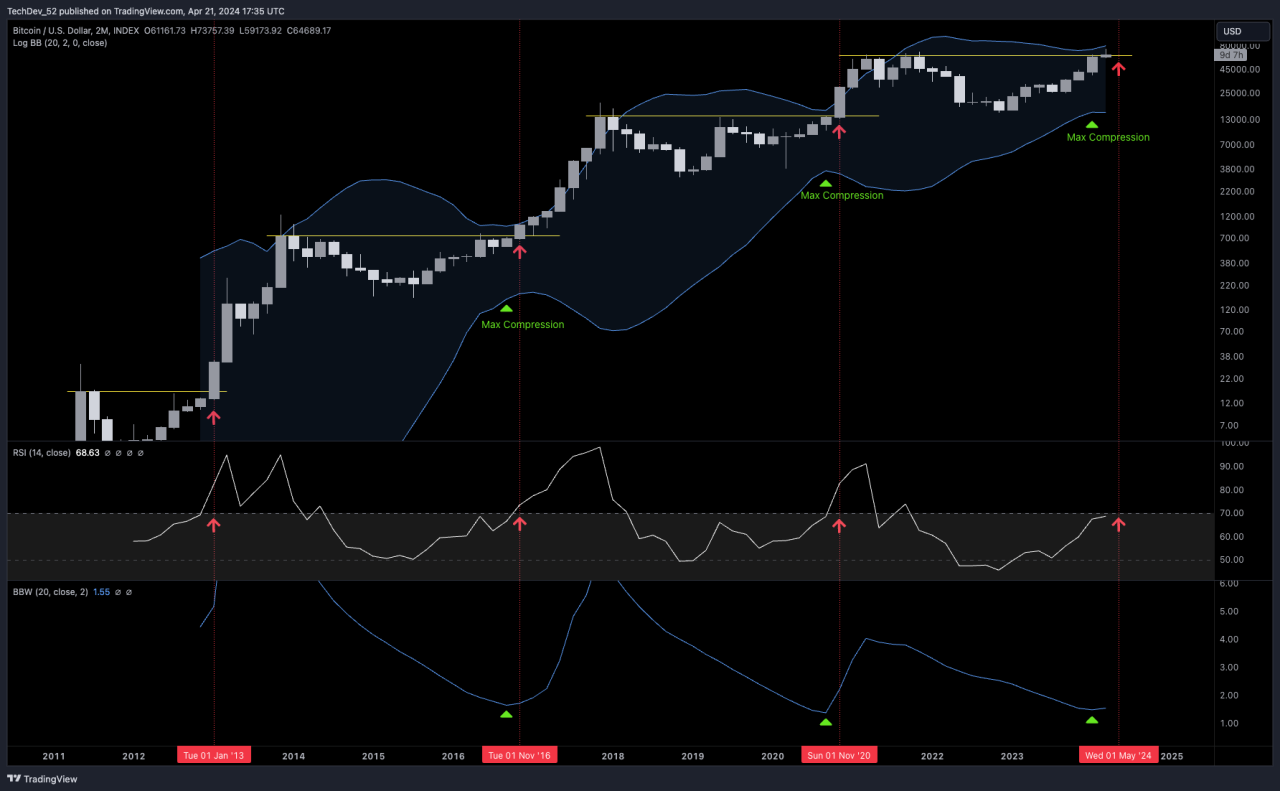

Indicators used in technical analysis evaluator TechDev noted that Bitcoin’s current state includes the conditions that led to the last three parabolic accelerations. In particular, the squeeze on Bitcoin’s two-month candle chart and the subsequent high trading volume support this view. In addition, the analyst states that indicators such as the relative strength index (RSI) tend to break the 70 level and emphasizes that this situation may support the rise of Bitcoin in the coming period.

He also points out that Bitcoin’s volatility indicator Bollinger Band Width (BBW) bottomed out in the same three instances, another indicator supporting the BTC price.

Since Bitcoin replicates the exact conditions, the analyst says it is unlikely that BTC will experience a price collapse.

“Please also pay attention to the ‘pullbacks/collapses/declines that many have feared over the past eight months.”

While TechDev is optimistic about the possibility of another parabolic rise for Bitcoin, fellow crypto analyst DonAlt disagrees. DonAlt warns that the $60,000 support looks vulnerable, causing some concern in the market.

In his statement on the subject, DonAlt said, “Let’s go back to the same old level. “The more frequently it is tested, the more likely it is to break,” he said. This is based on the idea that Bitcoin frequently tests the $60,000 level and that level becomes vulnerable. According to DonAlt, even the bulls may be looking for a breakout below this level at this point.

DonAlt advises investors to be careful and remain complacent up to a certain point. “In my opinion, one should remain complacent until a certain point (e.g. until $68,000 is reclaimed or the range is lost and then reclaimed again),” he says. This means that a key breakout point must be identified that determines the direction of the market.

This discussion increases uncertainty about future movements of Bitcoin price and encourages investors to be prepared for different scenarios. The different views of both analysts show that there are various perspectives on the market and should be carefully considered before making any investment decisions.

You can access current market movements here.