Grayscale Investments CEO Michael Sonnenshein came up with a bold claim about the spot Bitcoin ETF. Sonnenshein predicts a bleak future for some other spot Bitcoin exchange-traded funds. Grayscale’s CEO expressed doubts about the survival of its rivals.

Grayscale CEO challenged Bitcoin ETF!

cryptokoin.comAs you follow from , spot BTC ETF approval came after a long wait. Now the discussions are shifting to different points. Grayscale’s Bitcoin Trust ETF (GBTC) has over $25 billion in assets under management. This makes it the largest Bitcoin fund in the world.

According to Michael Sonnenshein, this importance is based on a ten-year history of successful operations and a diverse investor base. Unlike its competitors, Grayscale Bitcoin ETF charges a 1.5% fee. This is significantly higher than most approved ETFs, which charge between 0.2% and 0.4%. According to Sonnenshein, the funds’ commitment and experience in the crypto space justifies the fees. In this context, Sonnenshein makes the following statement:

Investors weigh issues such as liquidity, past performance and who the real issuer behind the product is. Grayscale is a crypto expert. And it really paved the way for a lot of these products.

Why is it not possible for competitors to survive?

The crux of Michael Sonnenshein’s argument lies in the long-term sustainability of these competing ETFs. It assumes that only two to three of the spot Bitcoin ETF products can reach a critical mass of assets under management. Others, he says, risk exiting the market because they fail to garner significant interest or investment. “I don’t think ultimately the market will have these 11 spot products that we have,” Sonnenshein says.

Is Sonneshein’s Bitcoin ETF claim realistic?

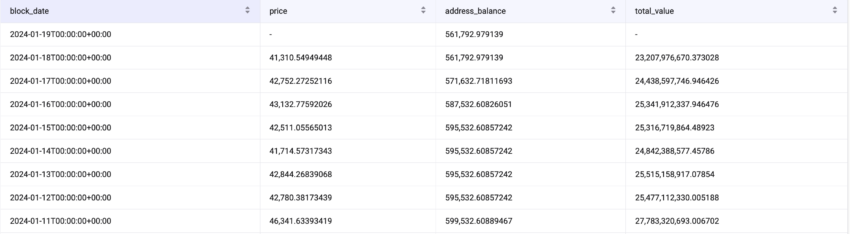

Despite Michael Sonneshein’s argument, the GBTC ETF is losing its market appeal due to its high fees. The screenshot below shows that Grayscale’s BTC reserves have decreased by over 37,740 since spot Bitcoin ETFs began trading.

Investors are likely redeeming their GBTC holdings to switch to Grayscale’s competing Bitcoin ETF products. Moreover, discounts to net asset value have decreased significantly, from 47% in February 2023 to approximately 1% in 2024. So some investors who bought GBTC shares at a discount are likely taking profits. Meanwhile, BlackRock’s iShares Bitcoin Trust reached the $1 billion milestone in assets under management (AUM).

Bit consolidation is inevitable!

Mati Greenspan, founder of Quantum Economics, does not rule out the possibility that most Bitcoin ETF issuers will fail in the long run. Because most investors will prefer to keep their assets or keep them to themselves. Greenspan comments:

For now, owning spot ETFs is a good way to gain exposure for some portfolio managers who might not otherwise be able to do so. But having 11 of these is pretty ridiculous. There will have to be consolidation and they all know it, which is why wages are flooring.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!