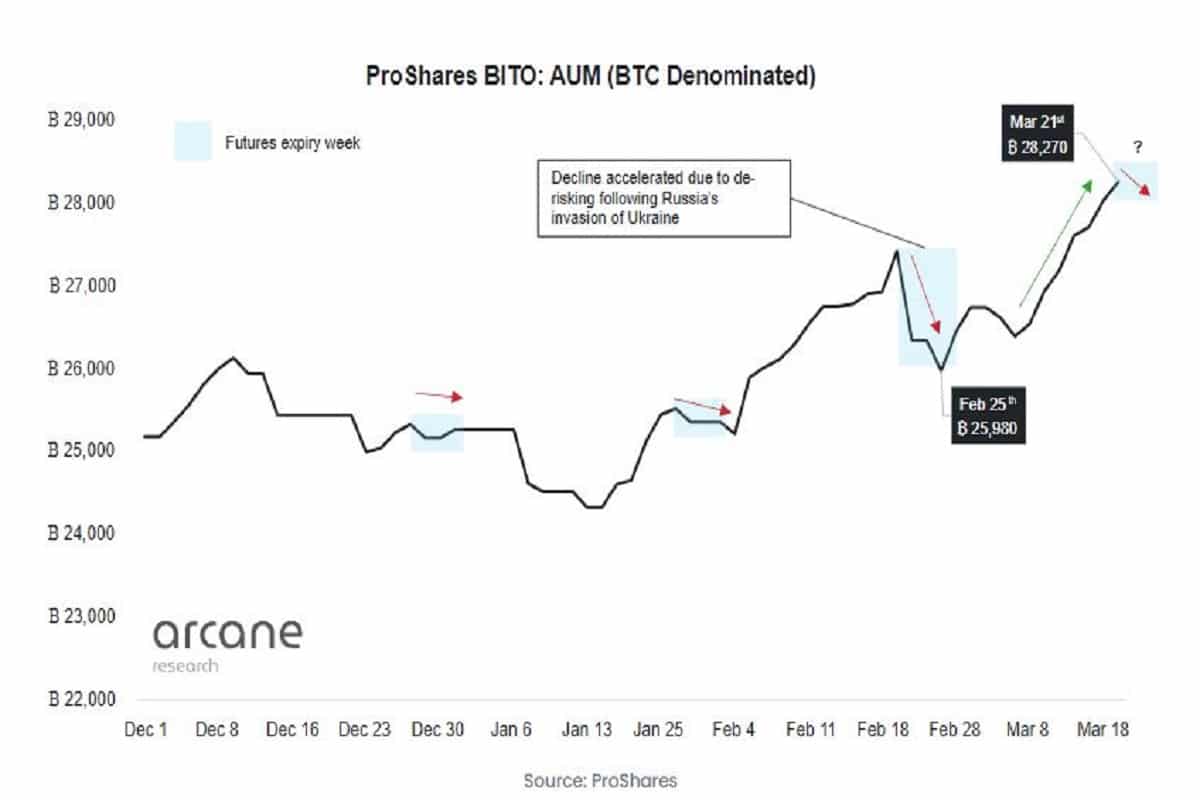

Bitcoin ETFs with large caps are breaking records for BTC inflows. USA’s first Bitcoin (BTC) linked ETF, traded on the New York Stock Exchange with the code BITO ProShares ETFhosted a new success. According to Arcane Research, the total amount of Bitcoin in the BITO ETF has created an all-time high of over 28,000 BTC. The heavy entries in the last two weeks contributed greatly to the emergence of this important number.

Arcane Research reports that such heavy inflows into futures ETFs over the weeks Bitcoin (BTC) price thinks it could have spillover effects. However, he also pointed out that as market makers chase delta-neutrality, they eventually rally more in the spot market to offset the net short-term risk.

Additionally, BITO has announced that it will launch 3846 futures contracts. After the conflicts between Russia and Ukraine, the last period was very difficult due to uncertain market conditions.

However, last Monday, BITO decided to open the March risk by shifting the 437 March contracts to April. The funds hosted an impressive entry of 225 BTC in one day.

As a result, the research claimed that strong inflows into the ETF indicate that investors’ desire for Bitcoin has increased with traditional investment methods.

According to Wu Blockchain reports, data from Glassnode revealed that Purpose Bitcoin ETF, the first ETF in North America, currently holds 36,271.8 BTC. This represents the highest number of Bitcoins held by the fund. Meanwhile, the ETF has added 2,473.5 BTC in just the past two weeks.

Bitcoin has delighted the crypto community by gaining something amidst uncertain market conditions. Wold’s largest cryptocurrency has increased by over 15% in the last 30 days. However, BTC has risen marginally by 1.8% in the last 24 hours and is trading at an average price of $43,825. The 24-hour trading volume of $31,476,745,321 also increased by 16%.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.