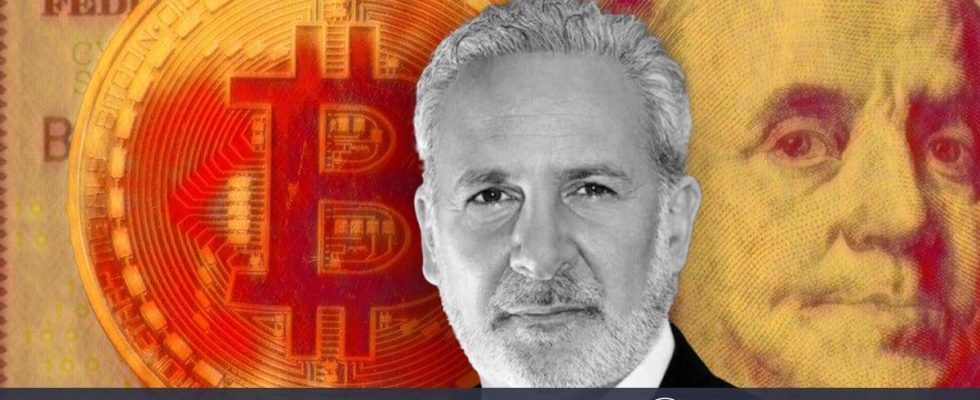

of Bitcoin Following its recent rise, experienced analyst Peter Schiff offered a new perspective on BTC’s role in the market. The price of Bitcoin rose above $64,000, approaching the record high of $69,000.

Schiff argues that Bitcoin is not “digital gold” as many believe. Instead, it claims to be “a digital way to invest against gold” or “digital anti-gold.” He says Bitcoin buyers are essentially hoping for a strong dollar against other fiat currencies, controlled inflation, and maintaining the credibility of the Fed.

According to Schiff, the recent weakness in gold stocks is likely due to investors selling them to buy Bitcoin ETFs. This means that Bitcoin has essentially become an investment against gold. Schiff claims that when gold inevitably rises, the funds to buy gold stocks will come from Bitcoin ETFs.

However, Schiff warns Bitcoin ETF buyers that less money will come out of Bitcoin ETFs than goes in, as the sales will, he claims, cause Bitcoin to crash. Therefore, most of the money needed to buy gold stocks will likely come from other sources.

Since February 2, GDX has lost 11.5% of its value. However, while the gold price did not change during the same period, Bitcoin increased by over 40%. Schiff argues that gold stocks are a major source of funds fueling inflows into new Bitcoin ETFs and that a rally in gold should burst the Bitcoin bubble.

*This is not investment advice.

For exclusive news, analysis and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android And iOS Start live price monitoring now by downloading our applications!