Based on historical data tracked by analysts bitcoin We can reach six-digit numbers by recording a very strong rise in 2024. But is this rise really possible? Here are the details of the analysis.

Bitcoin, the king of the cryptocurrency world, didn’t spend much time building his own empire, so to speak. Despite initially having no value, the price peaked at $69,000. As a matter of fact, the price reached in November 2021 has dropped to lower levels such as $ 16,000 today.

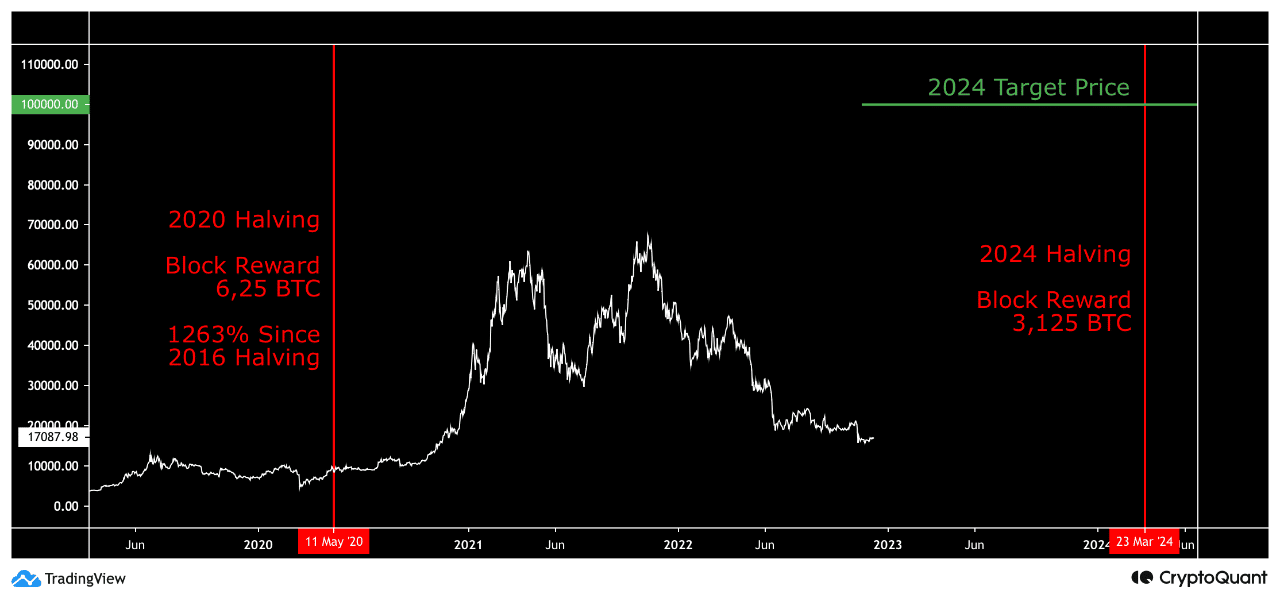

Looking at the historical data, the price has the power to exceed the $100,000 band in 2024. The reason for this rise is the Bitcoin halving or halving event.

Is Bitcoin Halving Really Effective?

Koinfinans.com As we reported, the price could reach $100,000 around March 2024, according to the data. The main reason for this rise is Bitcoin halving. The next halving event is scheduled for block 840K, which will take place in the spring of 2024. It is assumed that the block reward will be reduced from 6.25 to 3.125 per block after the next halving.

The leading cryptocurrency has been reducing its supply expansion rate over time due to its unique code structure. With a certain systematic, the decreasing reward rate reduces the expansion of the supply. This results in the price becoming more valuable.

Since the source code is public, simple calculations show that the reward of a Bitcoin block is halved every 210,000 blocks. This means that it decreases on average every 4 years.

Between the 2016 and 2020 halvings, the Bitcoin spot price increased by 1.263 percent. If current trends continue as they are, the price will reach $120,263 on March 23 of 2024.

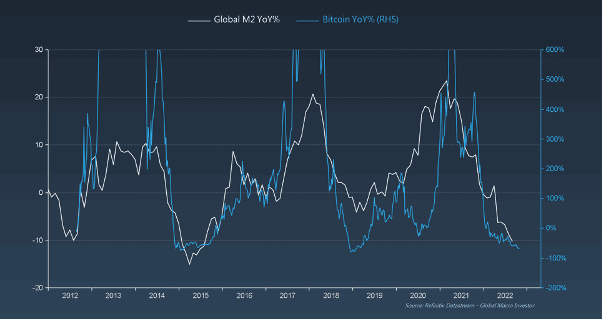

Raoul Pal reviewed the current state of the macro market in the latest issue of his newsletter. Pal shared the future price forecast in detail in this report.

According to Pal’s forecasts, the US Federal Reserve is moving away from a hawkish (QT) monetary policy and moving towards a more dovish monetary policy (QE).

Raoul Pal believes there is a strong correlation between Bitcoin’s spot price and the M2 Monetary Aggregate (i.e. money supply). The value of all higher assets, including Bitcoin, will likely increase with the reintroduction of quantitative easing (QE).

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.