Digital asset investment products saw a massive inflow in the second week. This shows that institutional and individual investors continue to rise in crypto. Also, the indicators for the leading cryptocurrency Bitcoin turned green. Are these the harbingers of a bull run for BTC?

Bullish sentiment continues in crypto

Crypto funds have recorded a total of $334 million in the last two weeks, including $199 million the previous week and $125 million last week. Bitcoin continues to be the favorite of investors. Accordingly, BTC investment products recorded an inflow of 123 million dollars.

According to CoinShares, the crypto asset inflow for the week ending July 2 was $125 million. Another weekly inflow brought the total inflow over the past two weeks to $334 million, almost 1% of total assets under management (AUM). Bitcoin again recorded the largest entry share with $123 million. However, short Bitcoin investment products saw $0.9 million outflows this week. Thus, despite the recent price increase, it has seen a 10th consecutive week.

Bitcoin has seen $123 million in inflows, continuing to be the main focus of investors. Thus, entries in the last 2 weeks represented 98% of all digital asset flows. Bitcoin investment products were in a net exit position of $171 million just 2 weeks ago. Now it’s back to net entry from year to date.

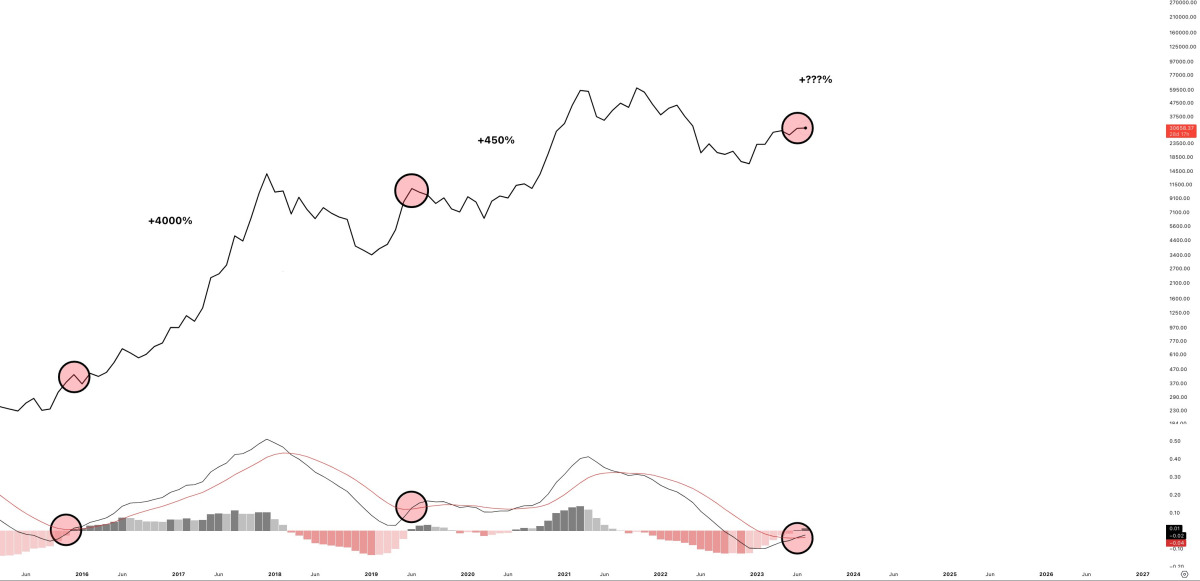

Bitcoin price rises as the monthly MACD turns green

The Bitcoin MACD indicator has turned green on the monthly chart. This points to major upward moves in the next few months. It also confirms the start of a bull market, according to experts. Historically, this signal has triggered bull markets in the last two events, with gains of 4,000% and 450%. Crypto experts and Bloomberg analysts are already bullish as the price of Bitcoin reaches $40,000.

cryptocoin.comAs you can follow, BTC price has moved sideways in the last few days. The leading crypto is currently trading at $30,637 and is up 0.5% in the last 24 hours. By the way, when we look at the last 5-year July returns of BTC, we see that it lost only in 2019. However, Bitcoin has managed to close July with gains of over 16% in other years.

Bitcoin shrimps are raising more BTC

According to Glassnode data, Bitcoin shrimp (addresses holding less than 1 BTC) have advanced aggressively. Shrimps has accumulated over 33.4K Bitcoin monthly. Glassnode added that this buildup is one of the biggest moves the Prawns have ever made. Thus, this move brings the total coins held by Shrimp to 1.33 million Bitcoins.

Meanwhile, on-chain data looks good for Bitcoin and the future crypto market. The current rate of profit for the circulating supply of Bitcoin (15,079 million) is over 79%. Bitcoin’s rise to $30,000 has helped many holders profit after a long time. However, the supply in the profit indicator plays a crucial role in defining the holders’ position in the market.

Glassnode reports that the realized capitalization of Bitcoin has consistently occupied a regime of net capital inflows, reaching a peak of $396 billion. This indicates that there is a substantial amount to broaden the asset class’s valuation. Meanwhile, the on-chain audience has kept the size of the expansion out of the bull market relationship.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.