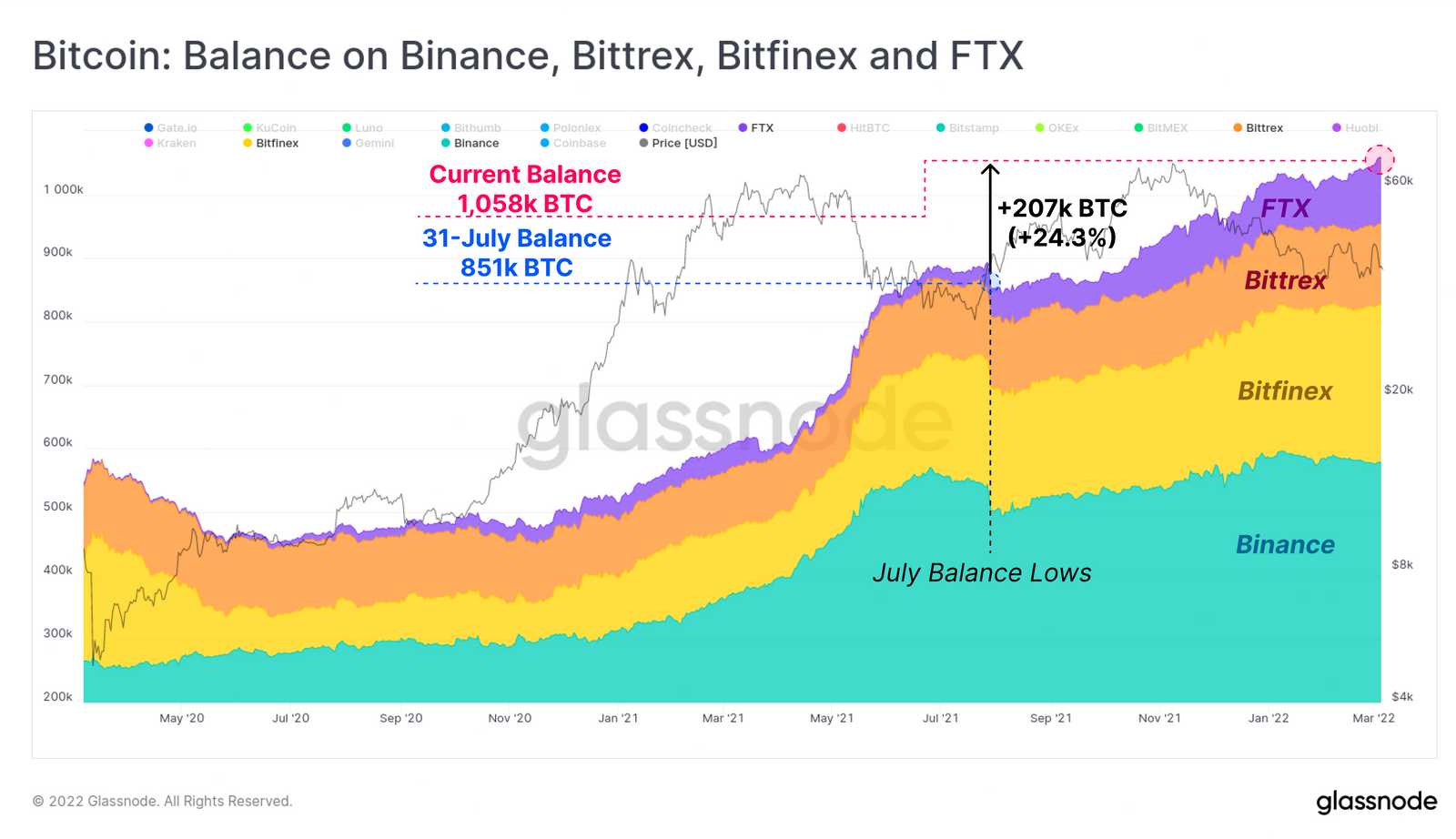

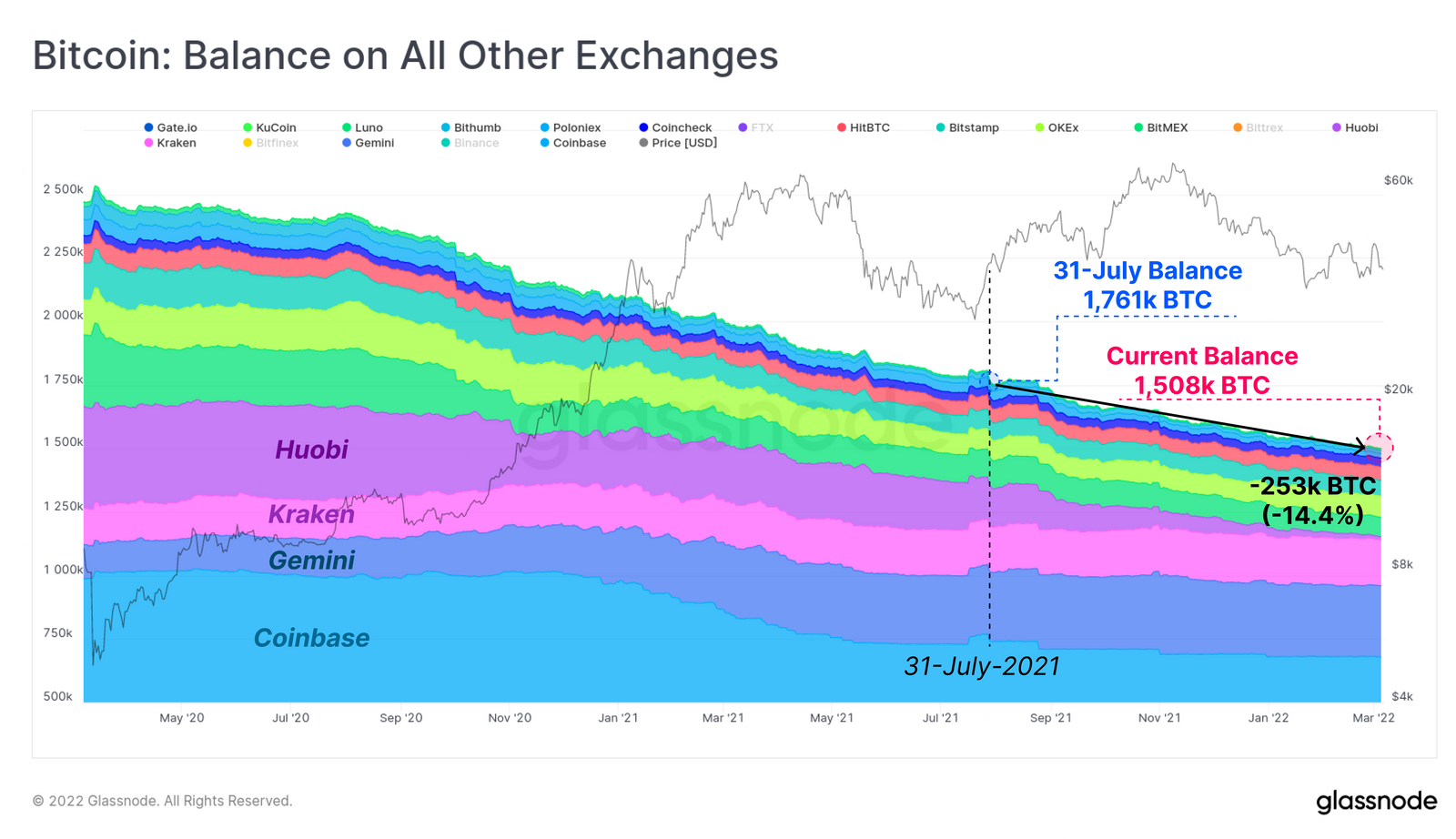

Since July 2021, there has been a lot of outflows from most exchanges except Binance, FTX, Bittrex, and Bitfinex. glassnode According to the data, it may be an indication that the sellers may run out.

Bitcoin inflows across all exchanges have been net negative since last July, but the four major exchanges are moving against this trend, with nearly equal amounts of net positive inflows. There has been a total net outflow of 46,000 BTC (worth about $1.8 billion at current prices) from all crypto exchanges since last July.

According to data from the March 7 newsletter of blockchain analytics firm Glassnode, only Binance, Bittrex, Bitfinex and FTX saw 207,000 Bitcoin (BTC) net positive entries. During the same period, net outflows from all other tracked exchanges totaled 253,000 BTC.

FTX and Huobi, Bitcoin (BTC) witnessed the most dramatic change in its assets since last July. FTX has more than tripled the amount of BTC it holds today to 103,200, while Huobi’s holdings have slumped from 400,000 BTC in March 2020 to just 12,300 BTC, or about 6% of what they hold.

Net outflows have been consistent since last year, with several large increases occurring in August and most recently on January 11.

However, Glassnode noted that he attributes the current relatively low inflows to “the scale of market uncertainty at the moment,” suggesting that the crypto trading market in general has shifted to derivatives trading over spot sales to hedge risk.

Stock market entries are measured to help better understand whether investors are preparing to liquidate or hold their coins. Net inflows cause incoming selling pressure, while net outflows indicate more accumulation.

The remaining on-chain coins maintain a real price of $24,100 per BTC, which indicates that most long-term investors have a 63% profit margin. The realized price represents the average price of all coins when they are carried on the chain.

The actual price contrasts with the implied price of $39,200. The implied price is an estimated fair value price per coin and is currently just below the breakeven point as BTC is trading at $38,346 at the time of writing, according to CoinGecko.

According to Glassnode, currently short-term holders have lost about 15%, as the average price of BTCs moving on-chain over the past 155 days has been $46,400.

In addition to the low-volume inflows and outflows, there is also the vendors profit and loss (PnL) ratio, which has been significantly self-balancing since the beginning of 2021. Glassnode explains the basis for these stats by suggesting that their long-term holders (LTH) are tired of selling. We have yet to see a major LTH capitulation event as seen in previous cyclic bottoms.”

The historically low magnitude of losses for both short-term investors (STH) and long-term investors may indicate increasing probabilities of total seller exhaustion.

The bulletin warns that the risk of “final and complete surrender of both STH and LTH” that occurred at the bottom of previous cycle bottoms still remains.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.