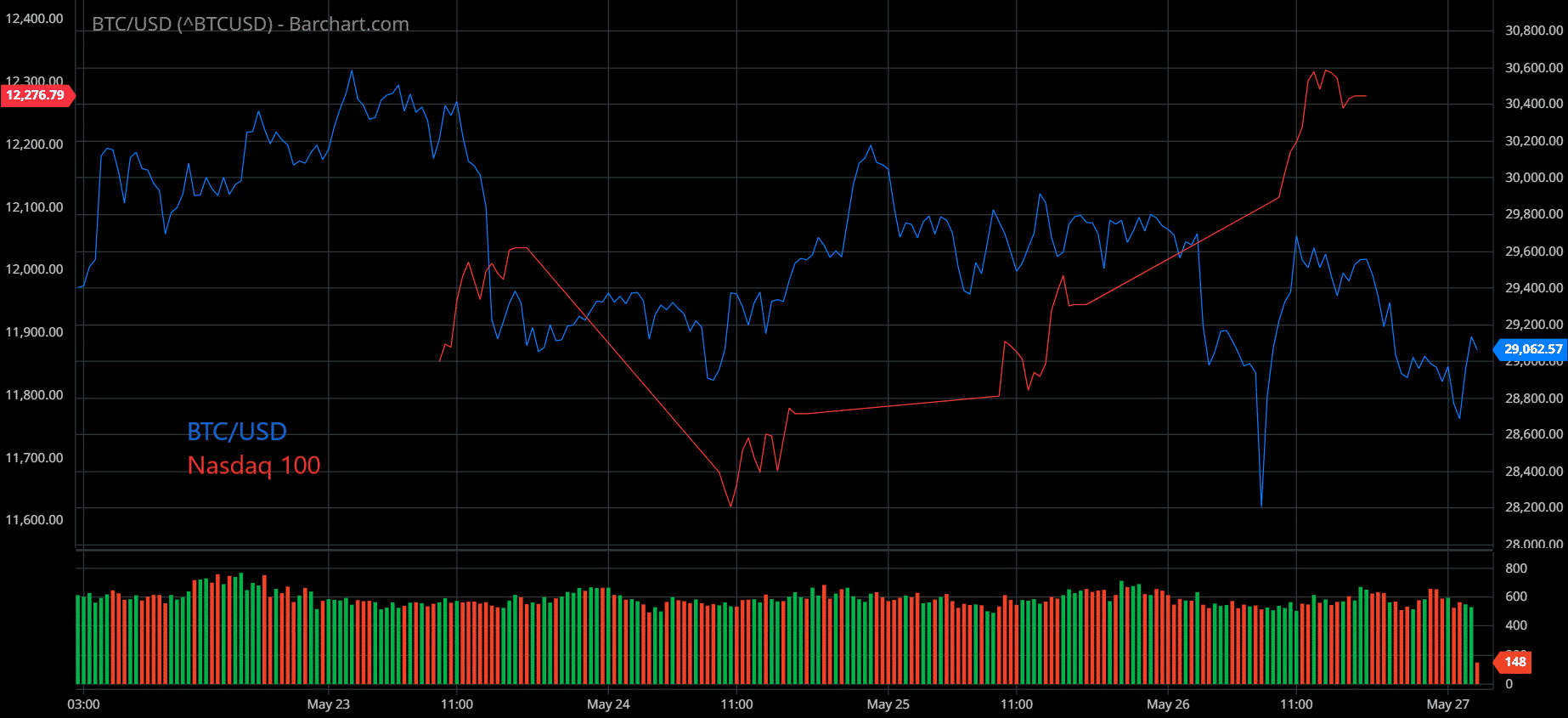

Leading crypto asset Bitcoin (BTC), has dropped 4.5% in the past seven days and is currently trading around $28,000. In response to this decline, the NASDAQ 100 gained 2% over the same period. While the correlation between Bitcoin and NASDAQ has been the subject of constant discussion, the current status of this correlation has been brought up for discussion again.

The gap to the S&P 500, on the other hand, appears to be even greater and the benchmark index has outperformed this week, up 3.3 percent.

While US stocks have managed to recover somewhat over the past few days, Bitcoin has lagged behind this performance. This was prominently visible in BTC’s Thursday session. Wall Street outperformed weak US GDP data, while BTC fell below $29,000, failing to perform as desired.

Bitcoin is currently trading around the last major support level of $28,000 and risks further losses afterward. BTC had dropped to $25,000 earlier this month.

Bitcoin Left Behind Stocks

With this week’s losses, the gap between BTC and the Nasdaq 100’s performance this year has widened significantly.

BTC is currently down around 40%, while the Nasdaq has trimmed some of its losses and is currently trading down around 25%. While the Nasdaq received some support from the positive institutional gains, BTC did not have such positive factors.

While preparing the news bitcoin price It’s set to wrap up its ninth consecutive week of declines and wraps up its worst weekly run ever. The mass expiration of BTC options on Friday could mean more losses for the token.

U.S. stock futures are also down slightly on Friday.

BTC has dropped sharply this year, consolidating most of its gains through 2021. Concerns about rising inflation and interest rates largely drove these losses.

While the collapse of Terra was another factor triggering the current low momentum in the markets; Recent data also showed that sentiment towards the crypto market is at its worst since the COVID-related crash in 2020.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.