Bitcoin (BTC) has lost 3.74% in the last 24-hour period, falling to $ 21,930, and Ethereum (ETH) has lost close to 6% in this process.

Due to the fact that there is a short time left for the announcement of the FED interest rate decision and it is the weekend, the crypto money market has been dominated by a lack of volume for two days. For this reason, cryptocurrencies, which rose around 01.00 TSI last night, suddenly experienced a sharp decline.

Bitcoin Technical Analysis

24300 dollars Bitcoin, which started to decline after reaching the levels, has a falling trend. In last night’s decline, Bitcoin, which touched this trend, received previous support as current support. 21850 levels, which is the region, are located. With an interest rate above the expectations of the US Federal Reserve, a decline is expected in all markets. Therefore, it can be said that buying-oriented movements are quite voluminous.

20900 Bitcoin, which has a 200 candle moving average at dollar levels, will close monthly in 6 days. 19910 dollar level in case of closing 4 months in a row it will be closed.

Also as current resistance zones falling trend themes and $ 24,300 levels exists.

Ethereum Technical Analysis

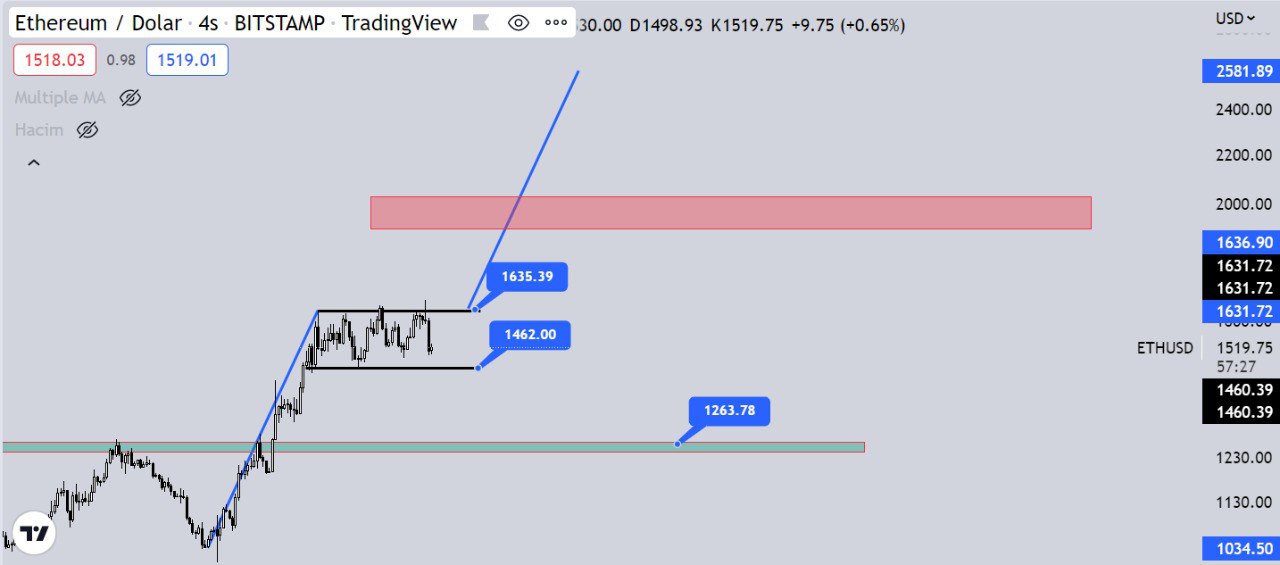

Performing better than Bitcoin in the last bullish wave, Ethereum is forming a flag formation. In case Ethereum breaks down the current supports and resistances while the upper and lower regions of this flag (Range) for 1260 dollars if it breaks up Reaching up to 2000 and 2500 dollars Waiting.

Despite the central bank’s announcement of a higher-than-expected interest rate, Ethereum $1460 levels If it maintains it, it may outperform Bitcoin in the next bullish wave.

- The information contained in the content is the author’s own thoughts. It certainly does not contain investment advice.