“Inflation will come off its peak but will remain well above the Fed’s 2% target. The core rate of inflation is still well over five percent.”

(Photo: Hindustan Times/Getty Images)

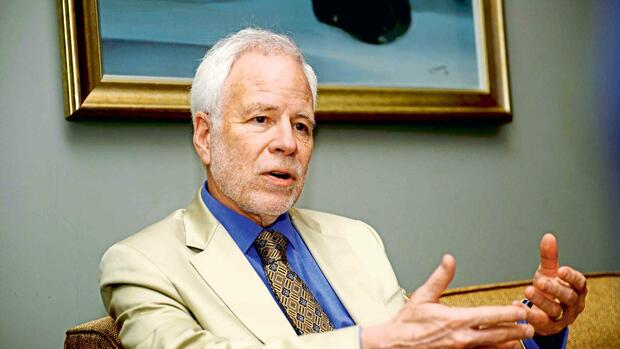

Frankfurt Investors are wrong in their assessment of the future interest rate policy of the US Federal Reserve. Barry Eichengreen, an economics professor and political scientist at the US University of California, Berkeley, believes so. Contrary to expectations, the Fed will keep interest rates high for longer.

In his opinion, this will exacerbate the problems in the banking sector, said Eichengreen on the sidelines of the “Institutional Money Congress” in Frankfurt. He expects restrictions on lending, sudden setbacks in bond prices and further loss-making bond positions at the institutes: “Bond prices can fall abruptly,” he says.

Eichengreen believes that the currently weakening dollar does not have to worry about its future as the world’s leading currency. Nevertheless, there are two acute risks for the US currency: domestic political wrangling over the debt ceiling and foreign policy tensions.

Read the whole interview here:

Read on now

Get access to this and every other article in the

Web and in our app free of charge for 4 weeks.

Further

Read on now

Get access to this and every other article in the

web and in our app.

Further