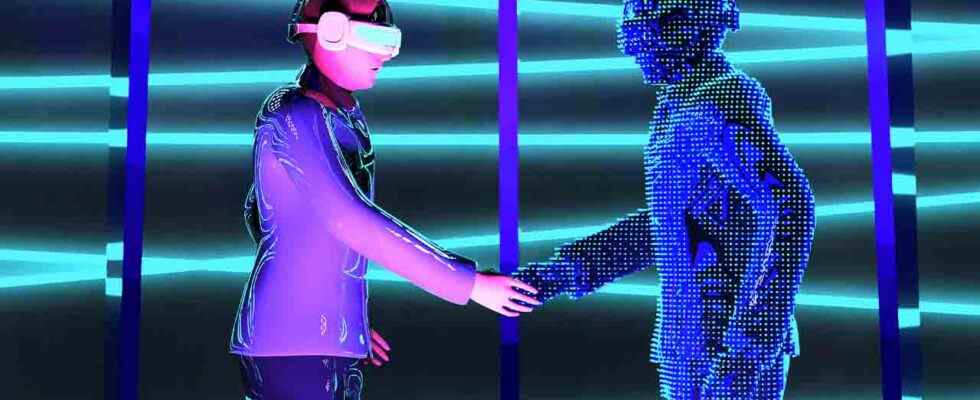

HSBC has become the latest corporate giant to enter the world of the metaverse through its collaboration with The Sandbox. As a result of this partnership, the bank will set up a virtual stadium in Sandbox and stay in touch with the community.

The Sandbox (SAND) According to a blog post published by the British bank, the British bank has purchased a plot of land that it will develop in the virtual world of the metaverse platform to interact with sports, e-sports and gaming fans and professionals. As a result of this partnership, HSBC has joined companies like Gucci, Warner Music and Ubisoft in creating sandboxes in Sandbox.

The partnership was announced by The Sandbox on Wednesday, but details of its development in the virtual plot and financial details of the deal were not disclosed. A promotional GIF found exclusively in the blog post featured an HSBC stadium next to a virtual body of water.

Speaking about the partnership, Suresh Balaji, marketing manager for HSBC’s Asia-Pacific region, said in a statement; He commented that “the metaverse will be the way people can experience Web3, the next generation of the internet” and continued his words as follows:

“At HSBC, we see tremendous potential to create new experiences through emerging platforms, opening up a world of opportunity for our current and future customers and the communities we serve.”

HSBC is no stranger to Web3

HSBC’s entry into the metaverse came soon after its increased blockchain adoption at the bank. Although the banking giant still maintains its strict anti-crypto stance, it has become more open to investing and even adopting blockchain technology.

Besides its support for blockchain, the bank is also known to be a big supporter of central bank digital currencies (CBDCs). Noting this issue, Chief Executive Officer Noel Quinn said in a statement last year that CBDCs have the potential to allow for cheaper and easier payments that can facilitate economic growth and that they should be regulated:

“If stable currencies and cryptocurrencies are to be relied upon alike, they will also need regulation commensurate with the risks they pose.”

The British bank was also among the investors in a $200 million funding round for blockchain technology firm ConsenSys in November.

Metaverse sees a surge in corporate interest

The crypto boom in 2021 also saw an increased interest in the blockchain and metaverse industry, which attracted the attention of several major financial institutions, and institutions competed with each other to enter the world of the metaverse.

Among these major institutions, Wall Street bank JPMorgan recently opened a lounge in Decentraland, while Thailand’s largest lending platform, Siam Commercial Bank, opened a sales point in Sandbox.

PwC Hong Kong, a subsidiary of PwC, one of the world’s four largest accounting firms, has also purchased virtual land from The Sandbox and announced that they think the virtual reality industry will be worth $1.5 trillion by 2030.

Other Partnerships

PwC Hong Kong is not the first major company to buy land from The Sandbox. Previously, Adidas also bought land in its VR game in late November.

The platform has also collaborated with many big names such as The Walking Dead, Atari, South China Morning Post and Snoop Dogg, as well as family brands The Care Bears and The Smurfs.

Sandbox’s native cryptocurrency SAND is trading at $2.91, up nearly 8 percent in the last 24 hours at the time of writing, according to data from CoinGecko.

You can check the price movements here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.