The central bank is stepping up the fight against inflation.

(Photo: dpa)

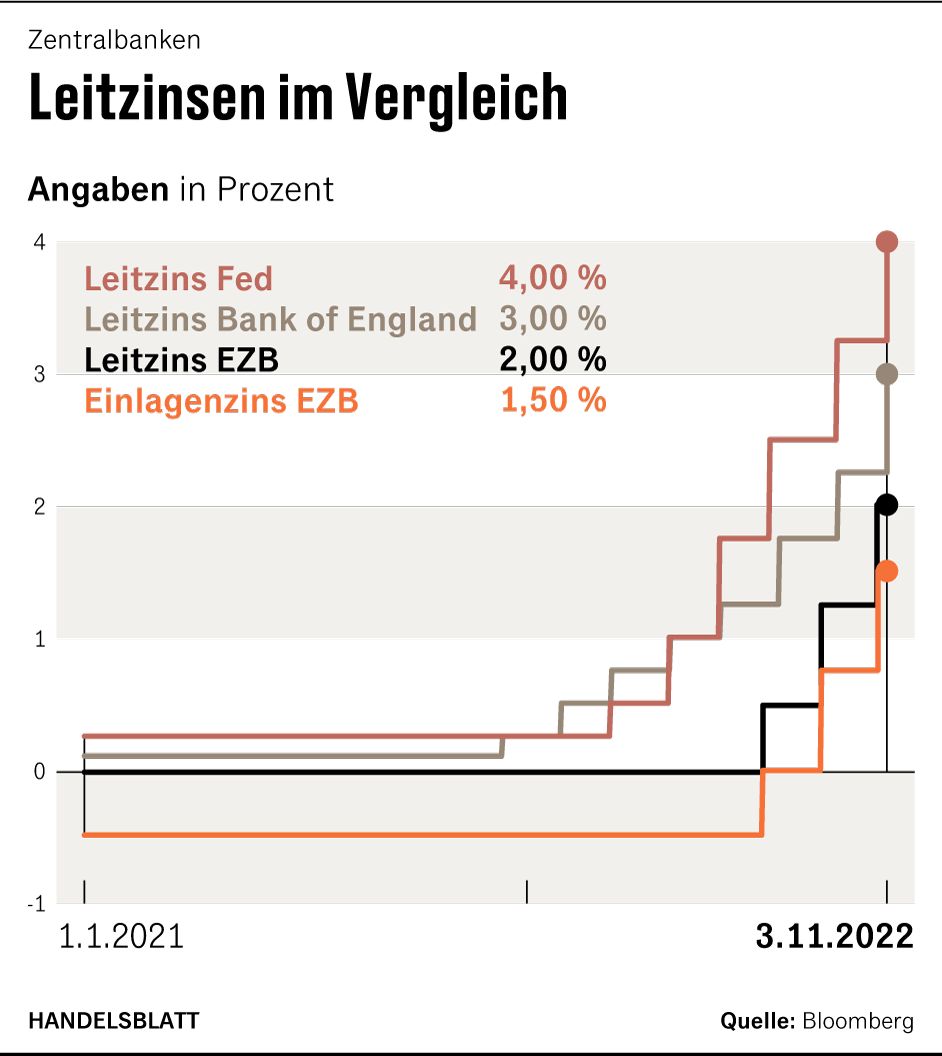

London As expected, the Bank of England (BoE) raised the key interest rate in Great Britain by 75 basis points to three percent. It is the eighth rate hike since December 2021 and the strongest in three decades. Key interest rates in the UK have not been this high since 2008.

The Monetary Policy Committee’s interest rate decision was passed by a majority of seven votes to two. At the same time, the central bank signaled that further rate hikes could be lower than expected on the markets.

With its decision, the British central bank follows the American Federal Reserve (Fed) and the European Central Bank (ECB), both of which also increased their interest rates by three-quarters of a percentage point on Wednesday and last week, respectively. “Inflation is too high and it is our job to bring it down,” said BoE Governor Andrew Bailey.

Most analysts had expected a rate hike of this magnitude. The BoE was under enormous pressure to act, since the inflation rate has been around ten percent for months and is therefore five times higher than the inflation target of the central bankers. Although the UK money watchdog has tightened interest rates massively, the cost of borrowing is still a full percentage point below US interest rates. The pound continued to weaken against the US dollar.

Top jobs of the day

Find the best jobs now and

be notified by email.

Economists predict more rate hikes in UK. “There is still work to be done,” said Karen Ward, market strategist at US bank JP Morgan in London. “I expect a further increase to at least four percent.”

Former British central banker Charlie Bean also expects the BoE to further tighten its monetary policy in order to counteract the risk of inflation, especially in the tight labor market in Great Britain.

BoE chief expects inflation to ease in mid-2023

The BoE itself stressed that further rate hikes may be needed to bring inflation back on target. However, it is unlikely that interest rates will have to rise to 5.25 percent, as expected on the financial markets.

Calculations by the central bank show that an interest rate level of just over three percent could be sufficient to sufficiently slow down the price surge. BoE boss Bailey expects inflation to fall as early as mid-2023.

Interest rate expectations on the markets have now fallen to 4.75 percent, and James Smith, an economist at the major Dutch bank ING in London, no longer expects interest rates in Great Britain to rise above four percent.

“Above all, the central bankers want to prevent price expectations from being fixed by so-called second-round effects in the form of higher wage demands in the economy,” said economist Bean of the BBC.

With an unemployment rate of just 3.5 percent and a record number of vacancies, the dangers of a wage-price spiral are particularly great. Without a decline in economic output, inflation will probably not be brought under control.

The Bank of England expects gross domestic product (GDP) to contract into 2024. It would be the longest recession since the end of World War II. The central bankers spoke of “very challenging prospects” for the British economy. Unemployment could rise to between five and six percent.

The real estate market in Great Britain has been particularly hard hit by the interest rate decision. Mortgage interest rates have already risen sharply, causing demand to collapse. In the worst-case scenario, building society Nationwide expects house prices to fall by up to a third in the coming year.

According to economists, much will depend on how strongly the British government supports the Bank of England in fighting inflation through a restrictive course in fiscal policy. The recently resigned Prime Minister Liz Truss shocked central bankers and financial markets with her plans for tax cuts on credit.

The new government under Rishi Sunak has since reversed most of the easing. British Chancellor of the Exchequer Jeremy Hunt plans to announce further tax increases and spending cuts on November 17 in order to plug a budget deficit of around £35 billion (around €40 billion).

Bailey emphasized that the central bank has not yet included the government’s future fiscal policy measures in its interest rate calculations. If the government announces tough austerity measures in November and thus drain purchasing power from the economy, this could ease the pressure on the Bank of England to take action. The key interest rates would then have to rise less sharply.

More: The US Federal Reserve raises interest rates by a further 75 basis points – signaling more flexibility