Chip factories cost billions. To ensure that they are reliably supplied, customers should participate in the investment.

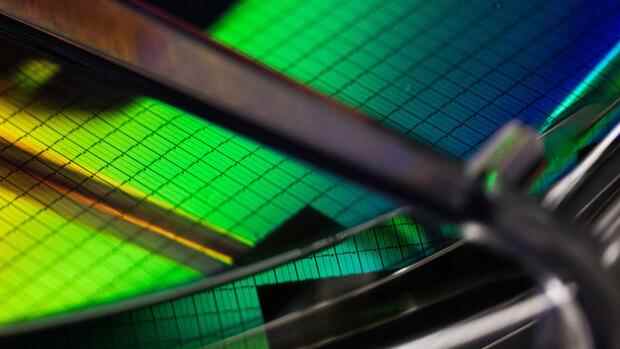

(Photo: Bloomberg)

The chip crisis never ends. In the meantime, even Apple is missing a lot of components. The largest customer in the semiconductor industry worldwide can therefore not sell nearly as many iPhones as planned during the Christmas season. The Californians are no better off than thousands of medium-sized companies worldwide.

Regardless of whether it is a billion-dollar company or a family business: Chips are and will remain in short supply. The whole of 2022 is expected to be tense, warned TSMC, the world’s largest contract manufacturer in the semiconductor industry, on Thursday. And this despite the fact that the Taiwanese are investing 30 billion dollars in factories and machines this year.

The shortages that have persisted for months should be a lesson to chip customers. You are well advised to reconsider some practices. It starts with product development. In the future, the engineers must by no means commit themselves to one chip supplier. This may be cheap, but it leads to dangerous addiction. Only designs that allow chips from different providers are sustainable.

It is just as risky to leave the exact order quantities open until the last moment. That worked in the past few years because there was overcapacity. Nobody can get past a properly stocked warehouse.

Top jobs of the day

Find the best jobs now and

be notified by email.

TSMC could also invest in Europe

If you want to ensure that the belts are always running, you also have to work more closely with the manufacturers. This also means: making advance payments so that producers invest enough. If things go worse, customers should be prepared to bear the vacancy costs together with the producers.

Customers should also insist that new plants are no longer built on the other side of the world, but closer to the market. That could make the chips more expensive, but should be worthwhile in view of the increasing geopolitical tensions.

TSMC as the industry leader seems ready to reach out to buyers. So far, the group has limited itself to its home country Taiwan. On Thursday, the Asians announced that they would be building a plant in Japan for the first time. In the USA too, TSMC is already spending billions on a factory. With binding commitments from European customers, it should be possible to convince TSMC to invest in our region.

In the short term, none of this helps, because building a new chip factory takes years. In the long term, however, there is no way around putting the relationships between customers and semiconductor manufacturers on a new footing.

More: “No postponement possible”: the electrical industry demands speed with chip subsidies