A widely followed crypto analyst, leading digital asset Bitcoin (BTC) He shared what he needs to do to get on the rise.

The crypto strategist, known by the alias Rekt Capital, told his 319,000 Twitter followers that Bitcoin will likely continue to struggle until the volume on the buy side starts to rise.

“Bitcoin’s buy-side volume is below average, so until that changes, the upside chances are also below average.”

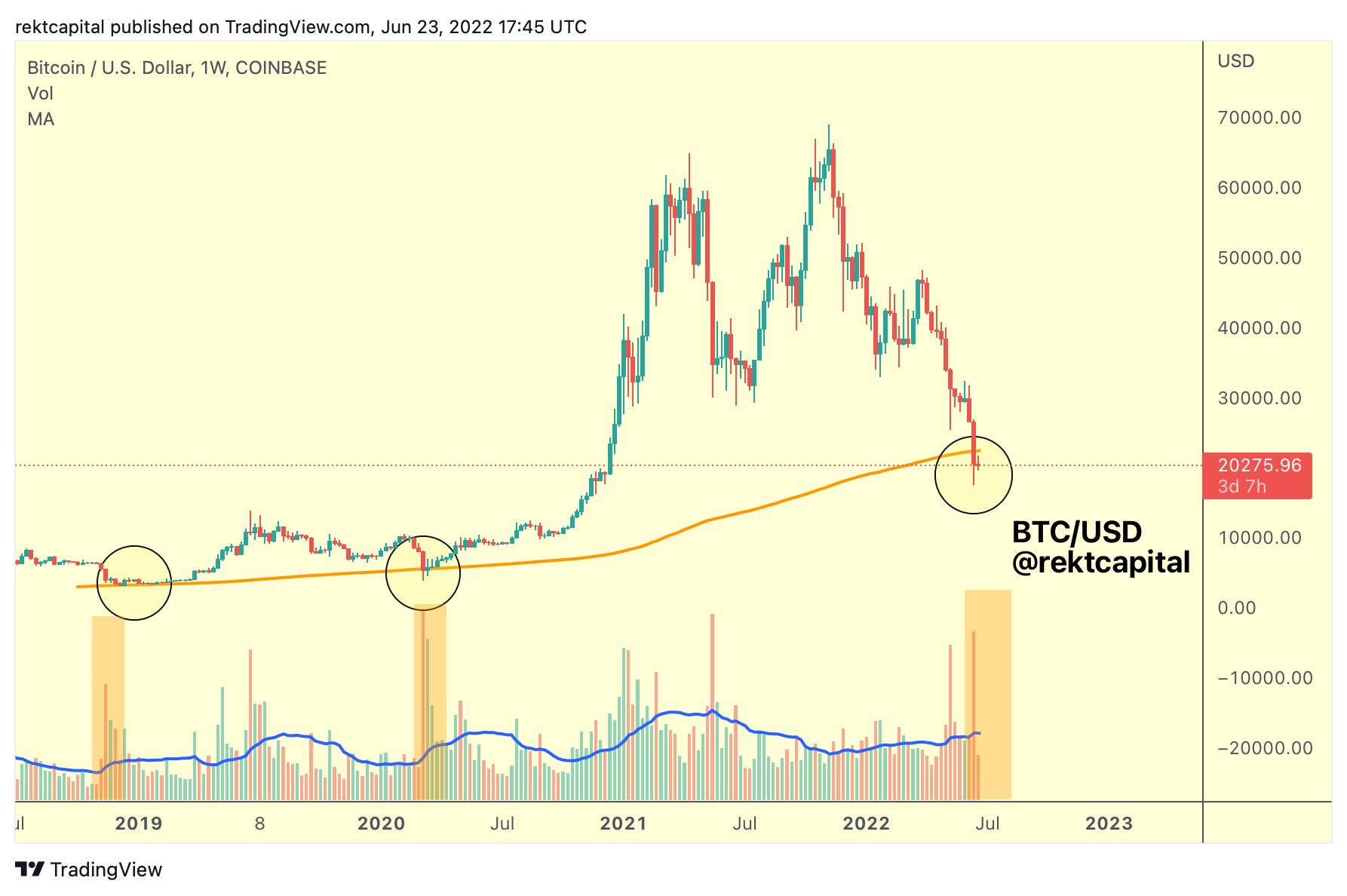

Rekt Capital also noted that BTC’s buying volume this week pales in comparison to previous bear market lows formed around the 200-week moving average. added.

“We are approaching the end of the week and the oversold volume of BTC over the last week is still very low compared to the buyer volume from the previous Bear Market Lows formed around the 200-week moving average.”

Koinfinans.com As we mentioned earlier, Rekt Capital later became involved in the FOMO (Fear of Missing Out) also noted that FOMO is psychologically known as the worry/fear of missing out on opportunities. Not being able to catch any innovation and opportunity is also defined as overlook.. The trader made the following warning for Bitcoin regarding this issue:

“If you FOMO on a green day… you won’t have enough ammo to FOMO on a red day. If you need to FOMO – pick a red day. Especially a red day when BTC is below $20,000.”

He also states that the best crypto asset by market cap will bottom out when investors least expect it.

“BTC bottoming won’t just happen when you least expect it. But in general it will show up at a time when you spend less time/thought on crypto. Consolidation causes boredom, and downtrends lead to the ostrich effect. Both take away from opportunity.”

At the time of writing, Bitcoin is trading at $ 21,250, an increase of 2.17% compared to the previous day.

You can check the price movements here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.