The global digital asset market has witnessed a major setback as more than $100 billion has been removed from the market. The world’s leading cryptocurrency bitcoin (BTC) has dropped nearly 9% in the last 7 days, losing the key $30,000 price level. While the market is trading in an environment of increased uncertainty, Bloomberg analyst points out that there will be a major pullback in the future.

Bitcoin Price Will Fall More In The Next Period

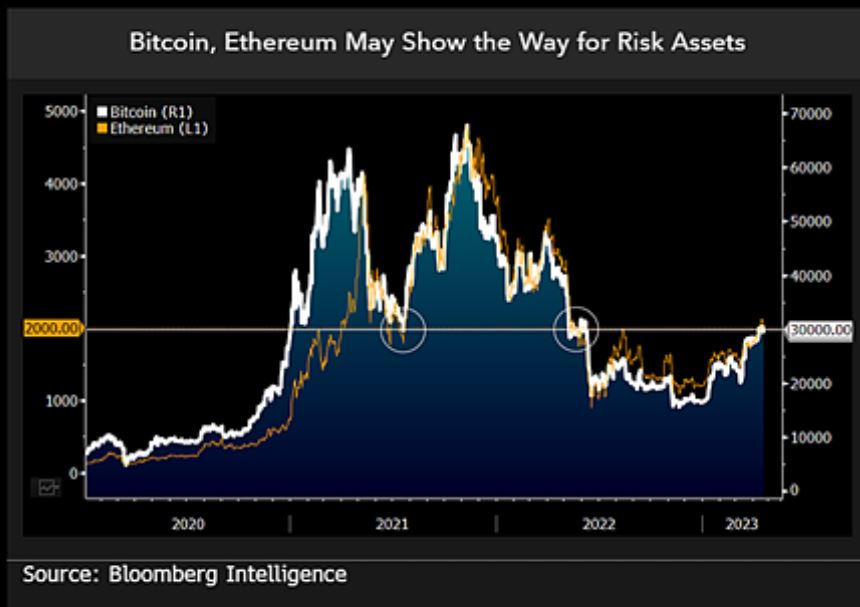

Bloomberg Intelligence Senior Macro Strategist Mike McGlone, Bitcoin (BTC) and EthereumHe stated that ETH (ETH) may face a wall of resistance in the future. However, Bitcoin price rallied above the $30,000 level to face multiple resistances. Same as ETH, second largest crypto- The price surpassed the $2,000 level but faced multiple resistances there.

Bloomberg Analyst is still bullish on the biggest in crypto in the long run. Meanwhile, a force generated by the falling stock market in line with the tightening Federal Reserve policies that led to the recession has the potential to turn the tide for all risk assets. It ranks Bitcoin and Ethereum among the riskiest assets.

According to the data, $30,000 and $2,000 were key points for Bitcoin and Ethereum, respectively. McGlone noted that dwindling supply and low and increased adoption make up the bullish case in the long run. However, growing consensus suggests that the worse is over before the recession in the US. This is illustrated by the yield curve with the highest probability since 1982.

Bitcoin price has dropped by about 8% in the last 7 days. BTC is trading at an average price of $28,127 at the time of writing. 24-hour trading volume fell more than 2% to $20 billion. Ethereum price has fallen by 9% in the last 7 days. ETH is trading at an average price of $1,910 at the time of writing.

You can find the current market movements here.