A senior analyst at crypto analysis firm Glassnode Bitcoin He believes that (BTC) is preparing for its next rise.

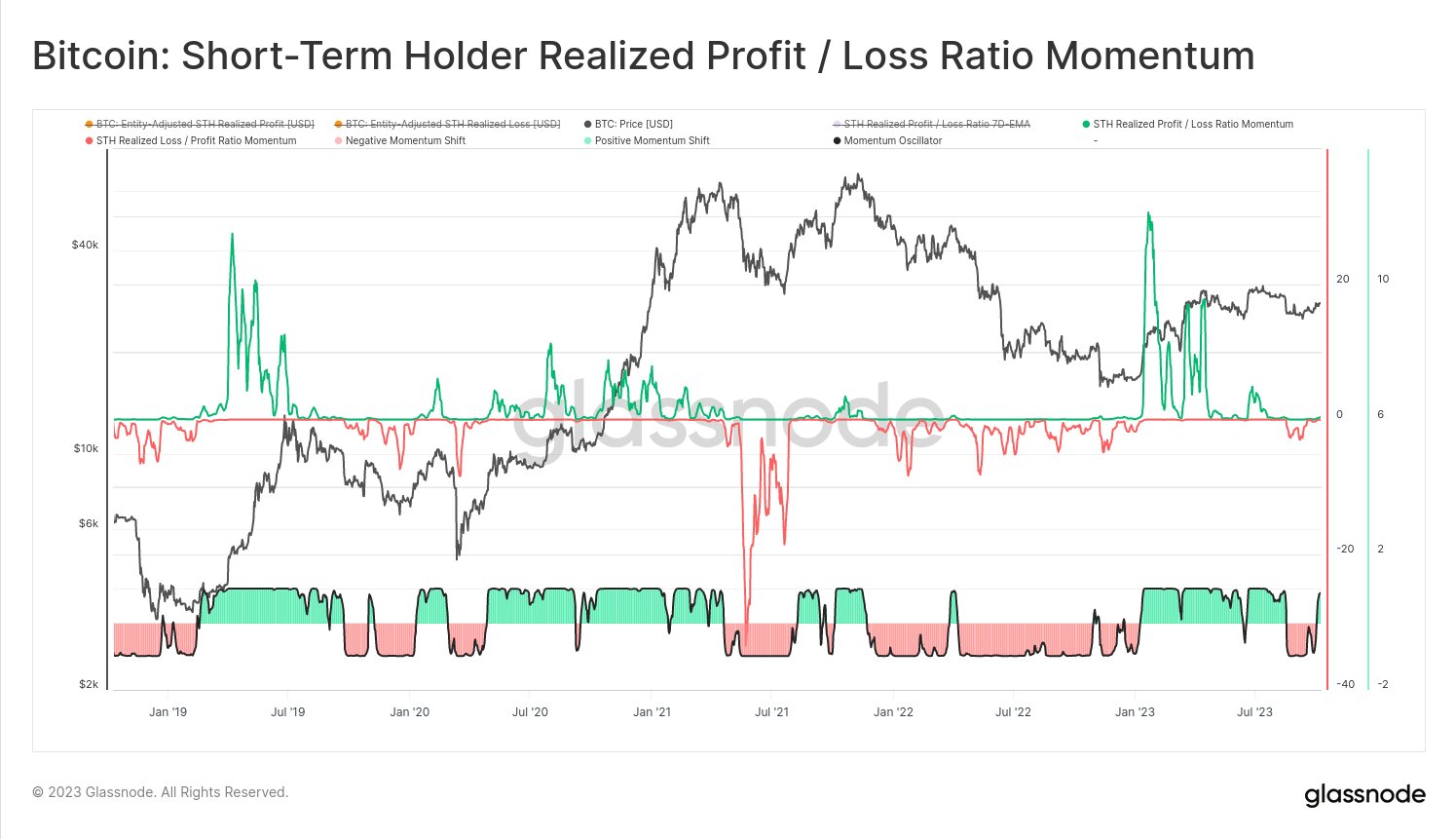

A trader with the pseudonym Checkmate, Glassnode’s chief on-chain analyst, wrote on media platform X that Bitcoin’s profit/loss momentum metric for short-term holders has recently recovered and turned green again. says.

According to Glassnode, the profit/loss momentum indicator aims to identify the current trend of an asset. The analytics firm defines short-term holders as traders who have held BTC for less than 155 days.

Checkmate says this metric is the “most responsive on-chain trend indicator” Glassnode has ever developed.

On-chain analyst says,

The bears negatively impacted the sell-off from $29,000 to $26,000. However, despite the market suffering significant losses (the market’s most bearish period since FTX), they failed to stem the decline.

NEWS CONTINUES BELOWThere are two interpretations for the green turn:

– Last profit taking before the apocalypse.

– Return of power.

The analyst says he is leaning towards the latter interpretation because of how well BTC has held up against the “turbulent” macro environment.

Checkmate also thinks Bitcoin is still in a “value zone.” Because crypto- The asset is trading below the real market average price of $29,700. According to Glassnode, the actual market average price is “a representative cost basis model for all coins acquired in the secondary markets.”

According to Checkmate, it is impossible to say what BTC may do in the short term. But he says value investors believe BTC bears are wrong on this point.

Bitcoin is trading at $27,629 at the time of writing. The top-ranked crypto asset by market cap has lost more than 1% in the last 24 hours.