An analyst known for accurately predicting the end of the crypto bull market last year, after nearly a year of downtrend Bitcoin (BTC) He thinks there will be a change in trend.

Koinfinans.com As we previously reported, the analyst known by the pentoshi alias, on his account with more than 612,000 followers, announced that the macro outlook has changed drastically since Bitcoin hit an all-time high in November 2021.

pentoshi, Federal ReserveHe said that the final interest rate, or expected endpoint for rate hikes, has tumbled wildly over the past year, pointing to a possible change in the macro backdrop.

“While terminal rates are at 4.6%, you could at least say that the rates section is priced after they finally go from 0% to 4.6%. It’s hard to expect more upside there, so risk could turn to the downside.

I continued to hold on to my macro bearish predictions until Bitcoin hit its lows on Sept. At this point, I started to be more neutral. The consumer price index is also potentially moving at maximum speed. For now, it’s a little difficult for me to sustain this sharp downward trend.”

Earlier this month, the Fed announced its intention to raise interest rates until they hit 4.6% in 2023. At the time of writing, the federal funds rate is between 3% and 3.25%.

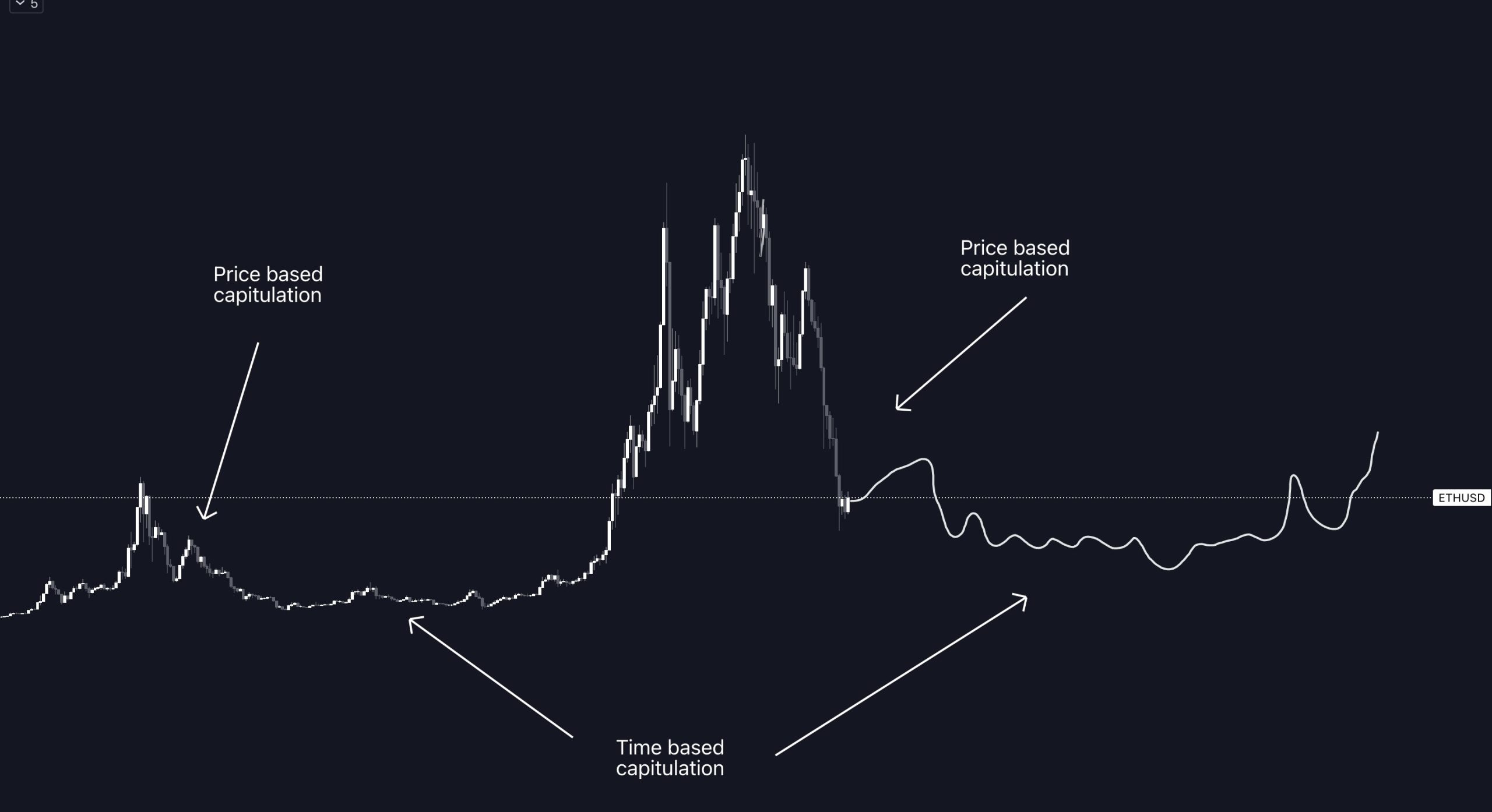

As interest rates approach the Fed’s end point, Pentoshi believes Bitcoin will make a short-term relief rally. After the rise, he predicts a final capitulation phase that will constitute the phase of Bitcoin’s transition to an expanded sideways trend.

“If I had to say the worst-case scenario, I would put it between $12,000 and $14,000 for BTC. It is currently close to $18,7000 and June lows. Don’t expect a bull market anytime soon. More real lateral movements will come.”

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.