Popular crypto analyst Justin Bennett Ethereum He said it may be preparing for a rally to liquidate bearish traders.

Sharing a new blog post Justin BennettHe noted that Friday’s rally of the S&P 500 (SPX) could signal the short-term performance of the crypto markets.

According to the analyst, crypto tends to follow in the footsteps of SPX, but there is a certain lag between the two asset classes. Bennett stated that if the crypto takes a cue from stocks, Ethereum could surpass the $1,840 resistance.

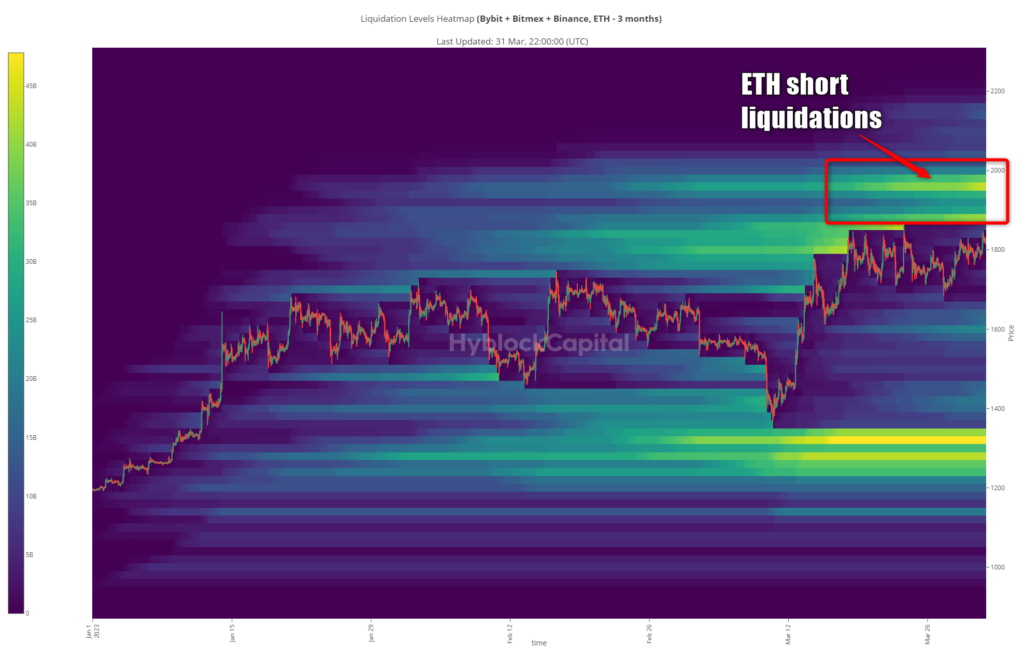

Bennett noted that an Ethereum breakout could trigger a short squeeze, as he noted that there is a “significant cluster” of short liquidations up to the $2,000 price level for ETH.

A short squeeze happens when a large number of traders who shorted an asset decide to cut their losses in response to an unexpected price increase. Jamming then helps trigger additional rallies.

“Cryptocurrency This could make sense as the market likes to target these areas and $2,030 is the August 2022 high. Many more long liquidations are below current levels, but closeness is important, so short liquidations up to $2,000 could impact ETH in the short term.”

However, Bennett noted that the time is ticking for crypto and Ethereum. According to the trader, the ETH short squeeze should happen in the coming days. Otherwise, he says, the rally may never happen.

“But if this is to happen, I would like to see crypto ‘catch up’ to equities sooner rather than later.

Unless we see ETH clearing these shorts over the next few days, that’s less likely to happen.”

At the time of this writing, Ethereum was trading at $1,818.

You can follow the current price action here.