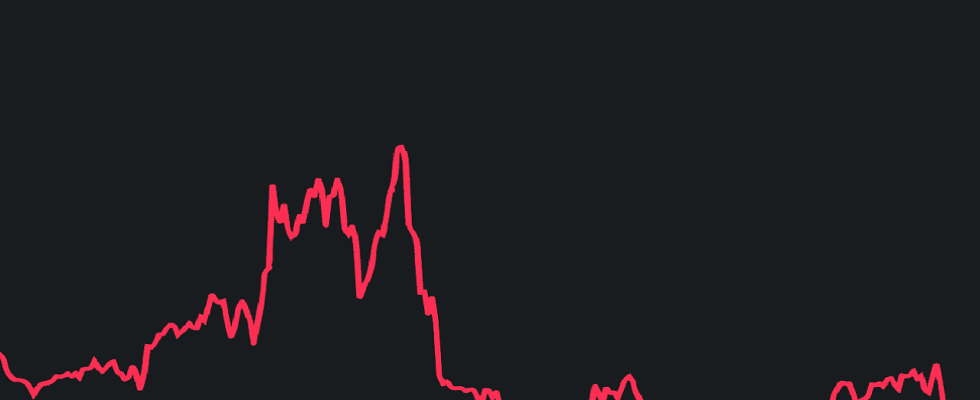

Altcoin project Balancer, in which Turkish crypto money investors also invest, has announced a critical plan. Accordingly, Balancer is on the agenda to self-arbitrage to recover the frozen crypto of reverse finance. After this announcement, the altcoin price started to fall.

With Balancer’s critical plan, altcoin price has fallen!

The plan in question envisions Balancer raiding their own trading pools before giving other arbitrageurs a chance. A team of decentralized finance (DeFi) protocols coordinates to recover nearly $300,000 in crypto that was frozen during the biggest hack of 2023. The owner of the cryptocurrency, Inverse Finance, is worried that arbitrageurs are preparing to seize this money when the freeze is over on June 8. After the latest developments, the altcoin price started to decline.

According to a forum post from Balancer’s management lead, under a plan outlined Tuesday, automated market maker Balancer will “permit arbitrage” of the “bb-e-USD” pool “before others reach it.” Balancer immediately froze the pool in March after credit platform Euler Finance lost $200 million to a hacker. Meanwhile, cryptocoin.com As we reported, the hacker later returned the funds.

Implementing your plan is not easy

The plan currently being discussed will need to change the mechanics of the DeFi protocol. That’s why Balancer needs community members’ approval. The organizers plan to hold a second vote for the distribution of the recovered tokens after the arbitrage is complete. DeFi’s lego bricks interlock in intricate ways. Also, the case of the Balancer is another example. It has already received the green light from the other three protocols. These are TempleDAO, which will lend Balancer the private stablecoins it needs to handle arbitrage, Euler, who patched the smart contract, and Inverse, which wants its money back.

“Inverse is clearly very worried about getting their coins back,” Tritium, a contributor to Balancer under the pseudonym, wrote in a forum post. Those familiar with the matter say that the months-long effort to save Inverse’s cryptocurrency has not been easy. Because there are many technical difficulties to overcome. The most important of these is the rigorous arbitrage smart contract itself. Add to this that Inverse has been hacked many times in the past. Because of this, the chances of recovery became quite low. According to the Inverse Finance Head of Growth, this was one of the most positive attack results of the past year. “First the Euler recovery, then this one,” the principal says.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.