After the FED’s decision to increase interest rates by 50 basis points, President Jerome Powell appeared on the screen. Here are the headlines from Powell’s statements:

- We are trying to bring inflation to our 2 percent target. We still have a lot to do.

- We will have to maintain our tight monetary policy for a while.

- The effects of this year’s rapid tightening have not yet been felt. More evidence is needed before we can be convinced that inflation is falling permanently.

- Fed members think that inflation risks are on the upside in the upcoming period.

- We cannot say with certainty that we will not raise the peak at the next meeting, it all depends on the data.

- In February, we will make a decision based on financial and economic conditions.

- If the data is bad, the peak value can move up, but if the inflation data is weak, it can also move down.

- Question: What will be the rate of interest rate hikes in the upcoming period? Powell: We’ve seen how persistent inflation is this year. We will make the February decision based on the data we have. For this reason, we cannot give an answer to the question of how far the interest rates will go.

Fed Chairman #powell: We are trying to bring inflation to our 2 percent target. We still have a lot to do.

— Bitcoin System (@bitcoinsystem) December 14, 2022

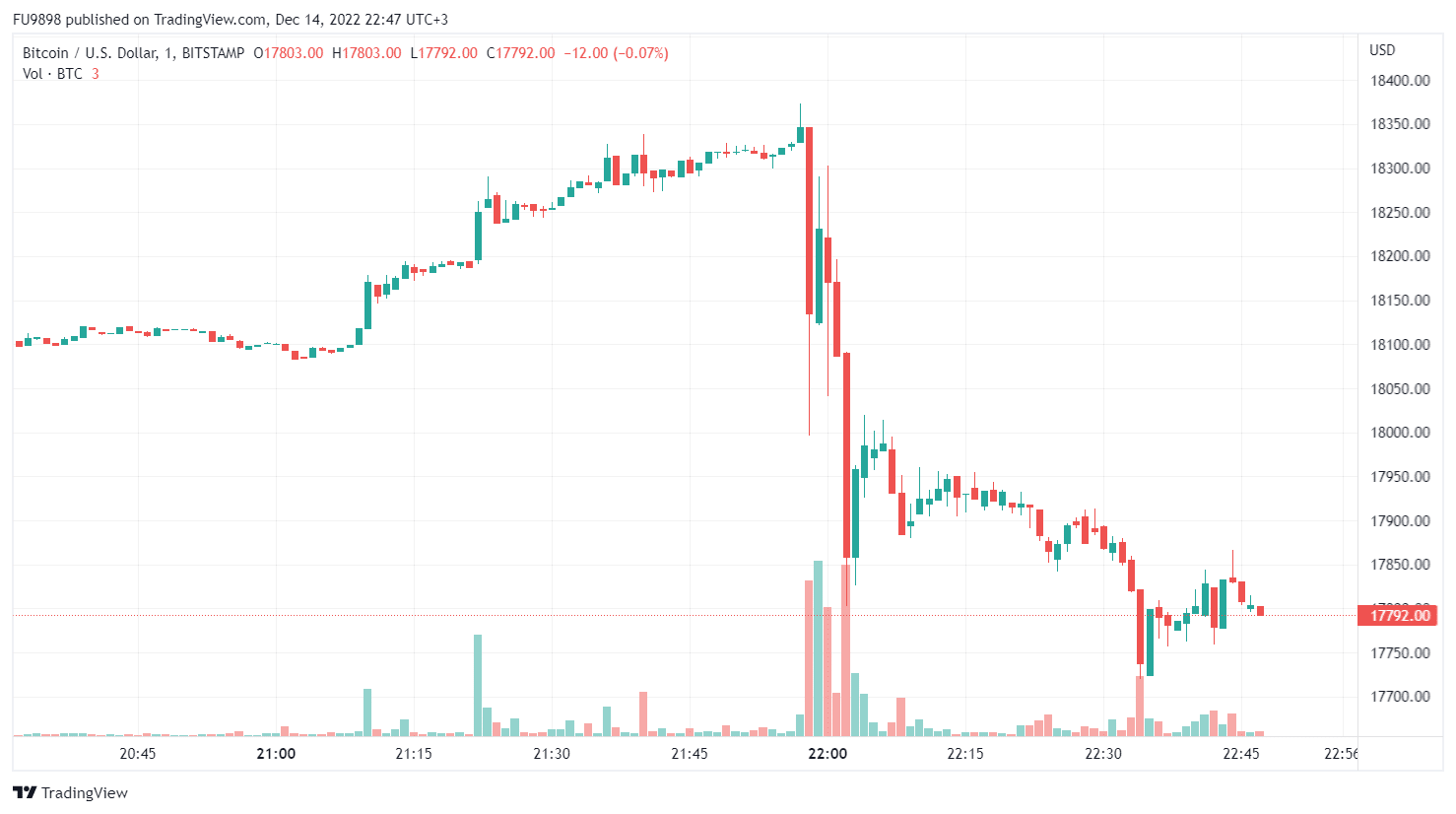

After the interest rate decision, it decreased and fell below $ 18,000. Bitcoin (BTC) Price moved as follows during Powell’s speech:

FEDThe median interest rate forecast for 2023 was 5.1% and for 2024 was 4.1%.

FED Made a 50 Base Points Rate Increase at 22:00

The FED announced the news of a 50 basis point rate hike with the following statements:

“The latest indicators point to a moderate growth in expenditure and production. Employment increases have been strong in recent months and the unemployment rate has remained low. Inflation remains high, reflecting the supply and demand imbalances associated with the pandemic, higher food and energy prices, and broader price pressures.

Russia’s war against Ukraine causes great human and economic problems. War and related events contribute to the upward pressure on inflation and put pressure on global economic activities.

The Committee targets maximum employment and 2 percent inflation in the long term. To support these goals, the Committee has decided to increase the target range for the federal funds rate to 4 1/4 to 4-1/2 percent.”

*Not investment advice.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android and iOS Start live price tracking right now by downloading our apps!