Investors need to be prepared for all possibilities when it comes to cryptocurrencies. While the Federal Reserve’s efforts to combat historically high inflation have been noble on some levels, it’s a nightmare for some of the top altcoin projects to watch. Crypto expert Josh Enomoto shares 5 altcoin projects to watch. Also, crypto analyst Milko Trajcevski analyzes Cardano (ADA), Ethereum (ETH), and Algorand (ALGO) on his list.

5 altcoin projects to watch

Tether (USDT)

Tether (USDT), a stablecoin pegged to the US dollar, seemingly offers stability compared to many other cryptos. Of course, Tether has provided many conveniences during bullish cycles. It is possible for investors to convert large chunks of their portfolios into stablecoins like USDT, rather than constantly converting from fiat to crypto. Then, when opportunities arise, market participants can react instantly.

However, under the cycle of decline, this narrative doesn’t work that well. Because opportunities are few and far between, it’s better to have cash in your portfolio. After all, auditing Tether has been a long and frustrating process. Moreover, the Fed probably has the biggest say in the viability of USDT. For example, the purchasing power of the dollar increased by about 0.3% between June and August of this year. Depending on Fed policy, this metric is likely to go much higher. If Tether can’t keep up, keeping your money in dollars is probably much better than digital alternatives that can evaporate overnight.

USD Coin (USDC)

Another popular stablecoin, USD Coin (USDC), is also pegged to the dollar on a 1:1 basis. That is, each unit of this cryptocurrency in circulation is backed by $1 held in reserve in a mix of cash and short-term US Treasury bills. The Center consortium behind this asset says USDC is issued by regulated financial institutions.

With traders currently liquidating their crypto over industry sustainability concerns, stablecoins have lost their primary reason for existence. Additionally, if the dollar’s purchasing power goes up, investing in USDC wouldn’t make much sense. I mean, who are you really going to trust? A blockchain project or the US federal government?

Dogecoin (DOGE)

Dogecoin (DOGE), which represents a class of crypto called meme coins, has sparked a craze. The emphasis here is on building community engagement rather than lofty goals like addressing global hunger. This way, DOGE sometimes walks to its own rhythm. Therefore, it may be of interest to those looking for digital assets that do not always correspond to Bitcoin’s fluctuations. But even Dogecoin couldn’t prevent the FTX drop.

Also, Dogecoin may face pressure from Elon Musk’s takeover of Twitter. According to The Washington Post, Musk is trying to tackle crypto-related scams while promoting Dogecoin. However, opening the doors to free speech absolutism also opens the door to fraud and fraud-like behavior. In other words, Musk is probably biting off more than he can chew. Also, it could negatively impact Dogecoin amid the FTX bankruptcy rumor.

Polygon (MATIC)

One of the new generation alternative altcoin projects is Polygon (MATIC). Ethereum is the first well-structured, easy-to-use platform for scaling and infrastructure development. Its core component is the Polygon SDK, a modular, flexible framework that supports building multiple application types.

Enthusiasm focuses on Polygon’s network expansion. In addition, the Blockchain project has seriously increased the portfolio of partnerships. Polygon’s partners already include mainstream giants like Disney, Starbucks, and Robinhood. While undoubtedly attractive, investors should still guard their minds about them. Even though MATIC has been popping out of the doors lately, it’s still down about 54% for the year. Therefore, I wouldn’t get too excited until MATIC decisively crosses the $1.50 resistance level.

Toncoin (TON)

Among the newer altcoin projects is Toncoin (TON). However, it currently ranks 31st in terms of market cap. It currently has a market cap of just under $2 billion. Recently, Toncoin has been on the move. Also, TON is up almost 12% in the last week and has moved against most other cryptocurrencies.

Toncoin’s mission is to provide ‘a next generation network to unify all Blockchains and the existing internet’. Since hitting bottom on June 18, TON has surpassed 106% of market cap. Still, TON has dropped by about 56% since the beginning of the year. The next upside target for risk takers is to break the $2 resistance level decisively.

ADA, ETH and ALGO analysis and forecasts

Cardano (ADA)

ADA hit an all-time high of $3.09 on September 2, 2021. Here, we can see the value of the token $2,7036 higher on its ATH. In other words, it’s 699% higher.

In terms of 7-day performance, its lowest point is $0.381090. Its highest point was $0.433695. Here we see a difference of $0.052605, or 14%. In terms of 24-hour performance, its lowest point was $0.377999 and its highest point was $0.415941. This marks an increase of $0.037942, or 10%. It is possible for ADA to climb to $0.42 by the end of November 2022.

Ethereum (ETH)

cryptocoin.comAs you follow, Ethereum (ETH) reached an all-time high of $4,878.26 on November 10, 2021. Here, we see ETH at $3,388.36 or 227% higher in value on its ATH. However, in its 7-day performance, the lowest point was at $1,470.10 and the highest point was at $1,659.61. Here is an increase of $189.51, or 13%.

The lowest point of the 24-hour performance of the altcoin price is at $1,454.95. However, its highest point is $1,606.76. There is a difference of $151.81, or 10%. With that in mind, it’s possible for it to hit $1,550 by the end of November 2022.

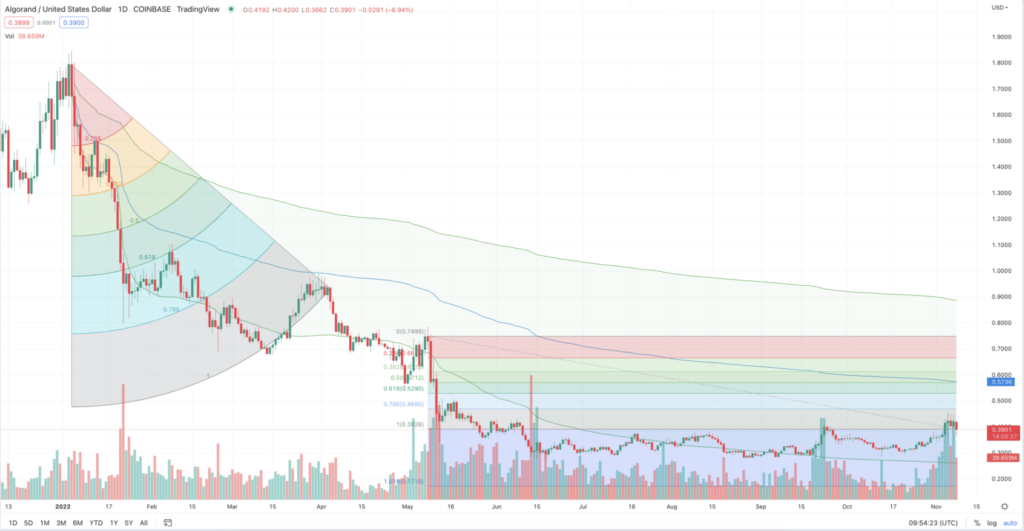

Algorand (ALGO)

Algorand (ALGO) hit an all-time high of $3.56 on June 20, 2019. Here, altcoin 3i was trading $1,1699 higher, or 812% higher. In terms of 7-day performance, the altcoin had a low of $0.346179 while the high was $0.445237. This marks a bullish outlook for the token, with an increase of $0.099058, or 28%.

In its 24-hour performance, Algorand had its lowest point at $0.375713 while its high point was at $0.446960. ALGO continued its growth of $0.071247, or 19%. There is potential to climb to $0.45 by the end of November 2022.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.